Amid renewed optimism in the markets, I continue to believe that the best way to beat the major indices throughout the end of this year and into next year is to focus our portfolios on “growth at a reasonable price” stocks. In my view, valuation will continue to be a contentious argument – even if the Fed pauses its rate hikes, the fact that most investors expect yields to stay in the ~5% range is a strong argument against paying premium valuation multiples for growth stocks.

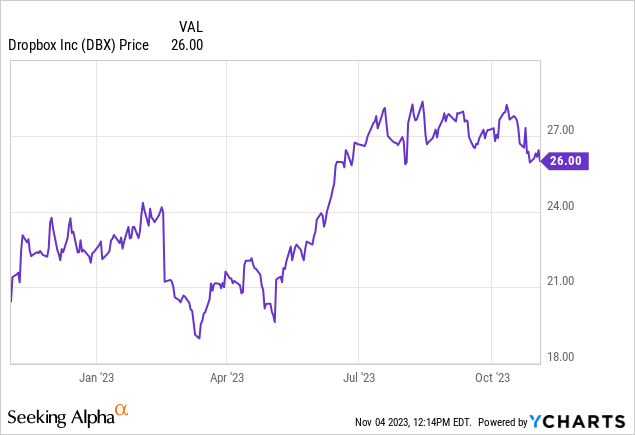

Dropbox (NASDAQ:DBX), in my view, fits the bill perfectly in this macro. Investors have largely moved on from both Box and Dropbox as their growth rates have stalled. Year to date, the stock is up ~15%, roughly matching the performance of the S&P 500.

Dropbox Dash and the bull case for Dropbox

I last wrote on Dropbox in August, giving the stock a bullish rating and citing its strong free cash flow as a primary reason. With Q3 earnings now out, I am retaining my bullish view on Dropbox and recommend holding on for further gains.

It’s easy to forget that Dropbox remains a “Rule of 40” software company (where the sum of revenue growth plus pro forma operating margins exceeds 40%, which few software companies can attain). It’s rare for a company to get the majority of its 40 points from operating margin and not growth, but this is the case for Dropbox, a business that has matured and leveraged its massive 80%+ pro forma gross margins to generate a strong bottom line.

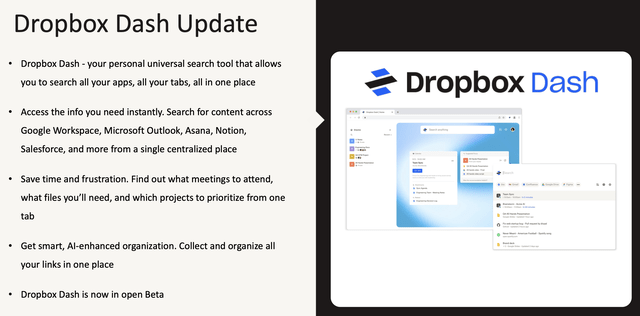

But that’s not to say that Dropbox isn’t still continuing to grow and innovate, either – in spite of making cuts to its R&D organization, which is a major source of margin tailwinds (which we’ll discuss in the next section). The company’s biggest feature release is Dropbox Dash, a feature that allows users to search content across applications:

Dropbox Dash (Dropbox Q3 earnings deck)

As a reminder to investors who are following this stock for the first time, here is my full long-term bull case on Dropbox:

- Sticky subscription business. In this macro environment, subscription revenue streams have become even more desirable due to the ease of planning cash flow and the reliability of low-churn customers. On top of high gross margins, Dropbox has a powerful formula for success.

- Dropbox isn’t just trading on a pie-in-the-sky future projection, but on real free cash flow today, singling out from other SaaS stocks in this risk-averse environment. Growth and paying premiums for growth stocks are out; value is in. The fact that Dropbox has routinely dangled a target of hitting $1 billion in annual FCF by FY24 while continuously raising operating margins quarter after quarter is a big draw for investors.

- Consumer upsells. More and more freelancers have emerged from the pandemic, untethering themselves from a corporate lifestyle and building brands and businesses of their own. Tools like Dropbox have become necessary infrastructure, and one with very low barriers to entry and ease of setup. Accordingly, Dropbox has differentiated itself from Box by appealing to these professional solo acts and small businesses, which is reflected by Dropbox’s greater upsells to premium paid plans.

- Enterprise market opportunity. Dropbox’s traditional strength has always been in smaller/consumer users, though it has started ramping up its enterprise efforts lately (products like Capture add to the company’s enterprise resume). There are still plenty of opportunities for Dropbox to take market share from Box here.

Stay long here, especially after the generous margin gains we’ve seen in Dropbox’s Q3 results.

Q3 download

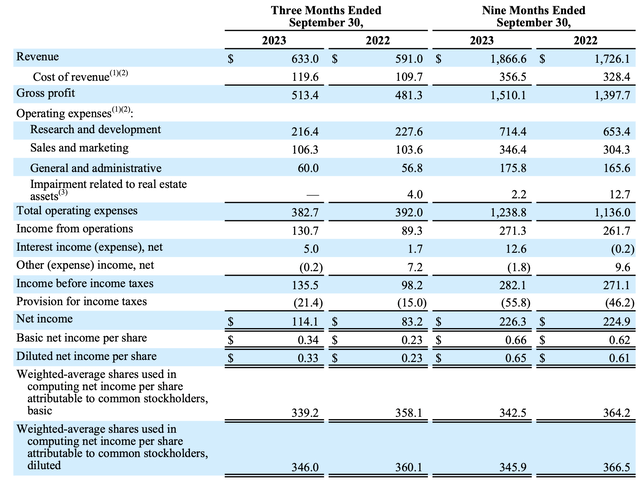

Let’s now go through Dropbox’s latest Q3 results in greater detail. The Q3 earnings summary is shown below:

Dropbox Q3 earnings results (Dropbox Q3 earnings release)

Revenue grew 7% y/y to $633.0 million, ahead of Wall Street’s expectations of $628.3 million (+6% y/y) but decelerating two points from Q2’s 9% y/y growth rate. FX was a one-point headwind to the quarter; growth would have been 8% y/y on a constant currency basis.

Note that consensus is calling for Dropbox to continue decelerating to a 5% growth pace next year, but this is also roughly similar to its more enterprise-oriented competitor Box, for which Wall Street is citing only a slightly stronger growth expectation of 8% y/y for FY24.

ARR also continued to grow 4% y/y (7% y/y constant currency) to $2.55 billion. While this does represent a decelerated pace from Q2’s 11% y/y constant-currency ARR growth pace, the good news is that this ARR level almost completely covers Wall Street’s $2.61 billion revenue expectation for FY24, potentially leaving upside room to the Street’s 5% growth target.

The company is banking on new product releases to continue driving growth going forward, especially with Dropbox Dash, which the company believes has opened up a $7 billion market opportunity. Per founder and CEO Drew Houston’s remarks on the Q3 earnings call:

As a reminder, in June we introduced our first generation of products, including Dropbox Dash and Dropbox AI. I’ll focus on Dropbox Dash as this represents our first major product launch within our next generation of AI powered products. And we see this opening a new market opportunity of universal search. Drew has talked for a while about the growing challenge of fragmented content in this new world of distributed work. Last month, we met with hundreds of customers in New York, and many echoed the same pain points around organizing their work. And we believe we’re in a good position to solve these new problems with our scale and platform neutrality.

We also see the shift from files and folders, along with recent advancements in AI, giving way to new market opportunities. In particular, the search and knowledge discovery software market. IDC sizes this as a $7 billion market today that’s expected to triple over the next four years. And we believe we’re well positioned to take part in this secular wave with Dropbox Dash. As a reminder, Dropbox Dash leverages AI, while connecting your cloud tools, apps, and content into a single search bar. It allows users to quickly find everything in one place, whether that content is pulled from Microsoft Outlook or Google Workspace or Asana. And because Dash is powered by machine learning, it learns about you and your priorities the more you use it.”

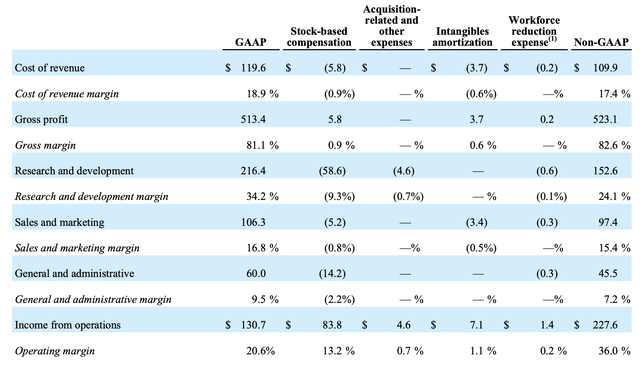

On the margin front, Dropbox hit a 36.0% pro forma operating margin this quarter (which stacked on top of a 7% growth rate yields a Rule of 40 score of 43):

Dropbox margins (Dropbox Q3 earnings release)

This was a 440bps improvement versus 31.6% in the year-ago quarter, driven primarily by a 4-point reduction in R&D costs as a percentage of revenue (in fact on a nominal basis, pro forma R&D expense fell -8% y/y to $152.6 million).

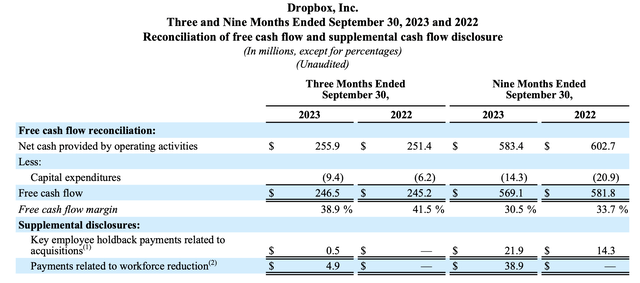

The company also generated $569.1 million in FCF in the first three quarters of the year, roughly flat to last year but held back by one-time payments made in connection to its layoffs. Management is still expecting to hit a 32.5% FCF margin for the full year.

Dropbox Q3 FCF (Dropbox Q3 earnings release)

Valuation and key takeaways

At current share prices near $26, Dropbox trades at a market cap of $9.04 billion. After we net off the $1.31 billion of cash and $1.38 billion of convertible debt on Dropbox’s most recent balance sheet, the company’s resulting enterprise value is $8.97 billion.

As previously mentioned, consensus is expecting Dropbox to grow 5% y/y to $2.61 billion in revenue next year (data from Yahoo Finance). Given Dropbox is a mature company, we think FCF is the best way to value it – the company has continued to project $1 billion in “natural” FCF next year, but given uncertainty around R&D tax legislation has reduced that figure by a placeholder of $36 million until it finalizes guidance targets in the February Q4 earnings release. Against ~$964 million of FCF (a 36.9% FCF margin on consensus revenue, versus 32.5% FCF margins this year), Dropbox trades at 9.3x EV/FY24 FCF.

That single-digit FCF multiple is rare in this market and the biggest appeal to investing in Dropbox, despite the risks of slowing growth and a saturated market. Stay long here.

Read the full article here