Investment Thesis

Diageo (NYSE:DEO) is a global beverage company focusing on alcoholic beverages with 80% in spirits. 200 brands across 180 countries with big brands like Guinness, Johnnie Walker, Smirnoff, Captain Morgan, and Don Julio. DEO plans to grow its 4.7% market share to 6% by 2030.

DEO is embarking on a strategy that emphasizes premiumization to help boost its 5-7% net sales increase target. Consumers are shifting their consumption habits higher quality which is also higher price, adding significant tailwinds to revenue growth given DEO’s revenue is 80% spirit.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $9.20 X 21.6 = $199

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

4.1 |

3.8 |

3.6 |

|

Price-to-Earnings |

18.2 |

16.6 |

13.9 |

Market Conditions and Market Share

In our article on Molson-Coors, we briefly discussed the market conditions in the adult beverage market. According to Grand View Research, the global alcoholic beverage market is expected to grow with a CAGR of 10.3% to 2028.

Gen Z is on track to consume much less alcohol than previous generations, spending 40% less on alcohol on average than millennials. While this can partially be explained by age, it is part of a broader trend present in the market. Lower or non-alcoholic beverages are growing in popularity, with consumption expected to increase by 70% by 2024. Approximately 20% of consumers state that they are actively decreasing their alcohol consumption for health reasons. While this shift does represent a risk to volume growth, DEO’s premium and super-premium brands may mitigate this risk by catering to consumers’ quality over-quantity drinking trends.

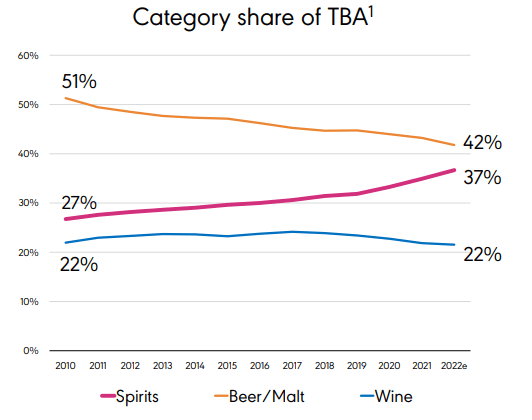

US Alcohol Consumption by Type (DEO)

In the US, spirit consumption has increased with a 10-year CAGR of 6%. In the last 4 years, this has been particularly driven by “super-premium” brands like DEO’s Johnnie Walker. These “super-premium” brands have grown by an 11% 4-year CAGR, according to Nielsen, with strength coming from the increased home consumption of alcohol.

|

Price Point |

Volume 5-year CAGR |

Net Sales as a % of Total (FY23) |

|

Value (<$10) |

0% |

8% |

|

Standard ($10-22.50) |

3% |

29% |

|

Premium ($22.50-$30) |

3% |

36% |

|

Super Premium (>$30) |

11% |

27% |

The fastest evolving trend is RTD (ready-to-drink canned cocktail). Currently, 47% of alcohol consumers are purchasing some form of RTD. Spirit-derived RTDs are the fastest-growing RTD channel, with 57.6% growth according to Nielsen, despite currently only making up 11.6% of the market. RTD drinkers are disproportionately younger and wealthier.

Brands and Portfolio

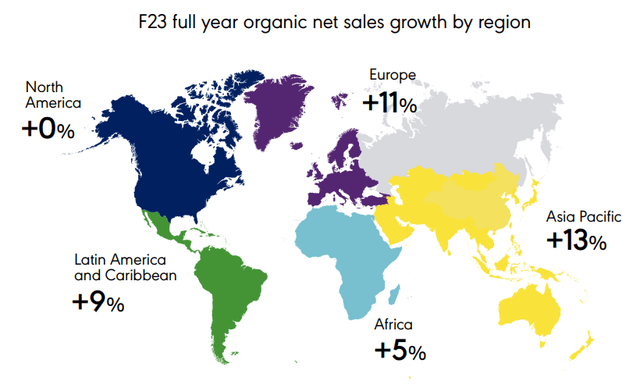

DEO delivered blockbusting results for its biggest brands, with double-digit growth in its top 3 categories. Johnnie Walker was the star of the portfolio, with a 239bps increase in market share and a 29% increase in net sales. The others were scotch growth in Asia-Pacific of 139bps market share and 26% net sales, US tequila at 121bps market share and 15% net sales growth, and global malt growth at 87bps market share growth and 16% net sales growth.

DEO

Currently, DEO’s sales is comprised of 80% spirits, 15% Beer and 5% ready-to-drink. Within its portfolio of over 200 brands, two highlight areas are the market dominance in Tequila, and owning the #1 value and #2 in volume global spirit brand in Johnnie Walker.

DEO wants to take Tequila global. Currently, around 80% of tequila consumption is North American and is a $6 billion industry. Tequila will be the #1 spirit in North America by the end of 2023, but remains underrepresented abroad. Since 2021, tequila consumption in Europe more than doubled every year, causing a global shortage of agave. Tequila has serious potential to be a disrupter in the European spirits market, traditionally dominated by grain alcohols.

|

FY19-FY23 CAGR |

||

|

Category |

Net Sales Increase |

Volume |

|

Scotch |

8% |

4% |

|

Tequila |

43% |

32% |

|

Beer |

5% |

-1% |

|

Gin |

8% |

5% |

|

Other Whiskey |

4% |

2% |

|

Chinese Spirits |

7% |

6% |

|

Total |

8% |

2% |

Capex and Expansion

The capital allocation plan emphasizes a net debt to EBITDA target of 2.5-3.0x. The second priority is a dividend with a 1.8x and 2.2x dividend coverage ratio, along with M&A or portfolio actions. Any remaining cash is returned to shareholders, usually in the form of buybacks. The current buyback authorization is $1 billion for fiscal 2024 which started in June 2023.

Productivity initiatives delivered $545.7 million in savings, which increased the marketing budget by 6% year over year, allowing for organic margin expansion of 15bps.

M&A focus is on high-growth brands with margins that support premiumization. In September, it completed the sale of Windsor Global, a premium whisky brand, for $163 million. In March, it purchased Don Papa, a super-premium rum from the Philippines. Currently, Don Papa is available in 30 countries. In October, it purchased the Premium Mr Black, a cold-brew coffee liqueur. Mr Black is available in 22 countries and is at the top of the coffee liqueur category for growth.

Risk

Net Debt to EBITDA has increased to 2.6x from 2.5x, which by itself is not concerning, but the effective interest rate has increased 120bps year over year to 3.9%. Free cash flow did decrease by 35% year over year; however, this can be explained mostly by an increase in working capital usage – which includes alcoholic spirits that require aging.

Though we are not in a classic recession as measured by GDP, which is being driven by a massive expansion of Government expenditures, consumer behavior is drifting toward recessionary patterns. During a recession, consumers typically exhibit caution. Consumers prioritize essential goods, gravitating to value-oriented products while reducing discretionary spending on premium alcohol. While not usually considered as resilient as other consumer staples, alcoholic beverages – aside from wine – are considered just as recession-resistant. While consumers may become more price-sensitive during economic downturns, sales increases in lower-value products may help offset losses in the Premium categories.

Outlook

DEO

The long-term market goal for DEO is to have 6% global market share by 2030 compared to 4.7% today. This market share growth target is ambitious, but DEO has historically demonstrated superior execution. During FY23 it increased its EBITDA by 14.3%, and DEO gained or maintained market share in 70% of its markets. To continue this trend, DEO is targeting 5-7% organic sales growth, with market share acquisition remaining at the top of the priority list for fiscal 2024.

Organic volume was down 1% for fiscal 2023, with pricing actions offsetting this by 6%. This is lower but still in line with the trailing 5 years. Despite the aggregate decrease in volume, some of the highest margin brands like Johnnie Walker, saw significant volume momentum, with 18% year-over-year volume growth.

To keep the 5-7% yearly sales growth figure more weighted toward volume rather than pricing actions, we expect further repositioning of the portfolio. In particular, shedding value brands and entering the RTD (ready-to-drink) market. Given the trend towards spirit derived RTDs, it could provide a new growth avenue and appeal to the lucrative demographic of younger, wealthy consumers.

Diageo is strategically positioned to grow within the expanding global alcoholic beverage market, particularly through its emphasis on premium and super-premium brands. The company’s strong brand portfolio and balanced capital allocation strategy make it an attractive stock holding in our opinion.

Read the full article here