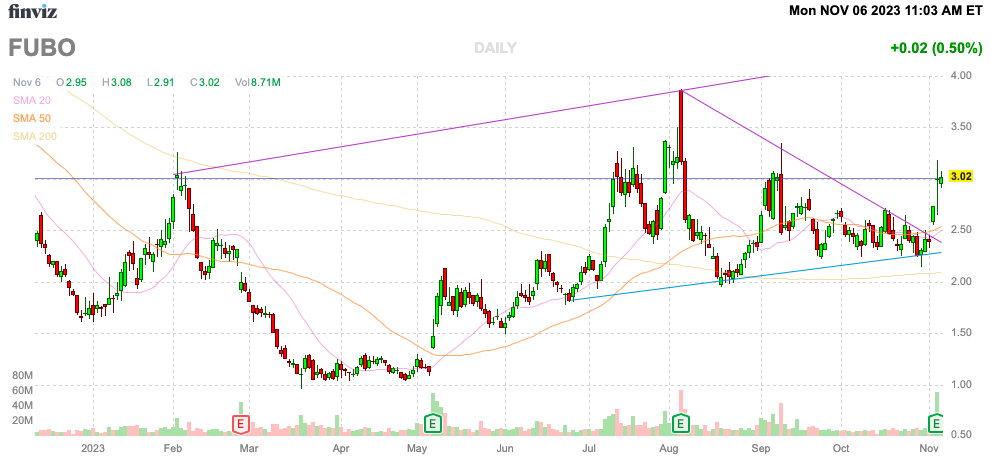

fuboTV Inc. (NYSE:FUBO) was nearly left for dead and now the company is still reporting strong growth in the face of a supposedly tough advertising and streaming market. The video streaming platform continues to make progress towards being cash flow positive, but the company has a long way to go. My investment thesis remains Neutral on the stock due to the limited margin of safety requiring solid improvements in the financials through 2025.

Source: Finviz

Great Rebundling

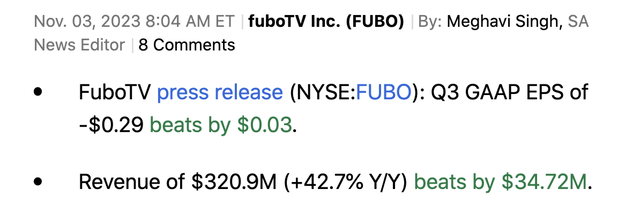

fuboTV reported Q3 ’23 results with a strong revenue beat as follows:

Source: Seeking Alpha

The video streaming platform has a sports-first content focus leading to stronger growth than the overall video streaming sector. The biggest concern going into the year is the lack of proprietary content due to the move away from sports betting and this issue hasn’t been resolved.

The prime reason revenues jumped 43% in the quarter was the North American ARPU boost to $83.51 in Q3 to a record high, up from $71.51. The Rest of the World ARPU remains a meager $6.98.

fuboTV has improved the results during the year. The company continues to grow subscribers due to the sports-first content, especially the move to work with Bally Sports on local sports options via 19 regional sports networks sets fuboTV apart from other platforms and even cable/satellite services.

The company grew North American ad revenues by 34%, but the revenue total only reached $30.3 million in Q3’23. fuboTV is still far more reliant on selling subscriptions.

The company offers a streaming distribution platform and the video streaming market is heading back towards the bundling of services. Consumers are increasingly running into frustrations with having a bunch of streaming apps on top of a bundle of premium channels making finding shows and sports events much more complicated than the past.

In addition, fuboTV is working on proprietary AI video technology to aggregate content delivered through a personalized streaming experience. The more the company can provide unique software-like services, the more valuable the distribution platform will become.

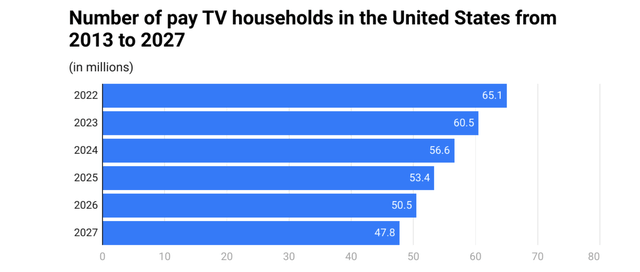

The company plans to end 2023 just shy of 1.6 million North American subscribers. The U.S. pay TV market still has an estimated 60 million households that could ultimately shift to a streaming distribution platform like fuboTV providing the growth path in the years ahead.

Source: Enterprise Apps Today

Cloudy Profit Picture

The major reason fuboTV remains difficult to turn bullish on is the ongoing losses and the limited cash balance. The company burned $173 million this year from operating cash flows with $24 million during Q3’23 alone while only having a current cash balance of $266 million.

The company boosted the gross margin by nearly 9 percentage points, but the amount is still only 6%. The adjusted EBITDA loss remained a lofty $62 million, an improvement of $21 million from Q3’22.

fuboTV remains far away from being cash flow positive with adjusted EBITDA losses at 19% of revenues. The problem is that a lot of companies struggle to move beyond just reaching breakeven levels after spending years overcoming large losses.

The subscriber content costs remain a large portion of the issue. fuboTV grew revenues by $95 million while SRE grew by $72 million offering an ~24% margin on additional revenues. The company has to boost quarterly revenue by around $250 million in order to provide the gross margins to cover the current operating expenses.

Current analyst revenue targets are only $371 million in Q3’24, which wouldn’t provide the type of revenue growth needed to generate positive cash flows.

The stock currently has a market cap of $900 million. The large losses and limited cash balance doesn’t provide the level of certainty that fuboTV will avoid dilutive financing during a recession in the U.S. to make the stock worth the risk here. Though, fuboTV could have substantial upside on becoming cash flow positive in 2025.

Takeaway

The key investor takeaway is that fuboTV Inc. is making great progress in cutting losses. The biggest question is whether the business actually can go from large losses to generating massive profits in 2025 as the typical business path is to stall out at breakeven levels.

Investors should look for better risk/reward options in beaten down small caps.

Read the full article here