Research Note Summary

Deep in the heart of Tennessee, there is a company with roots dating to 1938 and known for a chain of retail stores across America that sell items such as lawn and garden care, agricultural supplies, and work/recreational clothing, among other things.

Today, I’ll be saddling up and covering Tractor Supply Company (NASDAQ:TSCO), which had its Q3 earnings release about a month ago, and is gearing up for the holiday shopping season.

Tractor Supply got a modest buy rating from me today, driven by recent YoY growth in both the top and bottom lines, equity, and cashflow growth, in addition to a 3 year dividend growth and cheap share price relative to the moving average.

Some headwinds to this stock include overvaluation and underperformance vs the S&P500 index.

The risks of rising debt and interest expense were offset by a plan to grow new stores in the near future.

Methodology Used

My WholeScore Rating methodology looks at this stock holistically across multiple categories including key risks, and assigns a rating score. I exclusively cover stocks and foreign ADRs that are dividend-paying and trade on major US exchanges only (NYSE, Nasdaq).

Some of the data comes from the most recent FY23 Q3 results from Oct. 26th, while the forward-looking sentiment relates to the upcoming FY23 Q4 earnings results expected on Jan. 31st.

Growth vs Industry Peers

Within the other specialty retail segment, I put together the following peer group of 5 stocks that happen to be major retail chains in the US and targeting a specific type of shopper that may be looking for supplies, farm and sporting goods.

Within this peer group, the good news is that Tractor Supply has come out on top with a 10.2% YoY revenue growth, exceeding the peer group average and beating my goal.

TSC – growth vs peers (author analysis)

Because, as I have talked about in prior articles, this is a capital-intensive industry with high overhead needed to operate all of those physical stores, and sometimes the need to take on a lot of debt financing to do so, it is also dependent on a good volume of sales to occur and inventory to move off the shelves quickly.

This is why a focus on top-line sales growth is such a big part of my analysis.

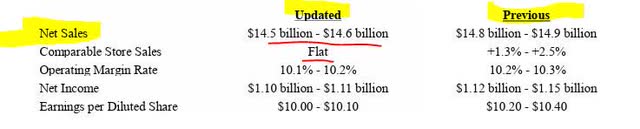

Based on the company’s outlook, I remain cautiously positive about this stock since the updated sales forecast is only slightly lower than previously thought:

TSC – updated sales outlook 2023 (company Q3 earnings release)

Financial Statements

When it comes to the financial statements as of the end of Q3 results, they tell the following story.

From the income statement, we see that revenue grew 4.3% on a YoY basis, while net income grew almost 9% in that period. Revenue came just short of my goal of a 5% YoY growth, so lost a rating point there.

TSC – financial statements (author analysis)

Another plus is that although the free cash flow per share was negative, it improved 88% on a YoY basis, beating my goal and earning another point there. In addition, positive equity improved nearly 9% on a YoY basis.

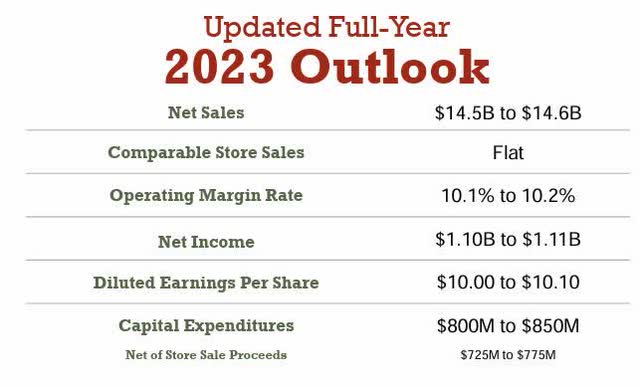

Looking forward to Q4 and the end of year results due in January, my sentiment is positive on net income results since the company’s full year outlook calls for profitability of around $1.1B.

TSC – 2023 outlook (company q3 results)

Dividends

I include a section on dividends since I am a dividend-income investor myself, but many of my readers may also be, though not all of course.

What I typically look for is dividend growth and whether the yield is competitive.

In my table below, comparing the dividend from Aug 2023 with Aug 2020, you can see that it went up 157.5% in that 3 year period, beating my goal easily.

TSC – dividends (author analysis)

However, when it came to forward dividend yield, this stock is slightly below its sector average of 2.48%, missing my goal. Although, a 2.07% yield is not terrible, either, along with a $1.03 quarterly dividend per share, this stock could be worthy of being added to my dividend “quick picks” of the week.

Share Price vs Moving Average

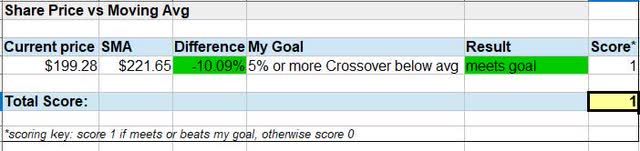

While the share price is only a single factor in the larger holistic rating, and alone should not determine a buy or sell, I think that my readers who are value-driven would be interested in whether I think the current share price is a dip-buying opportunity or not.

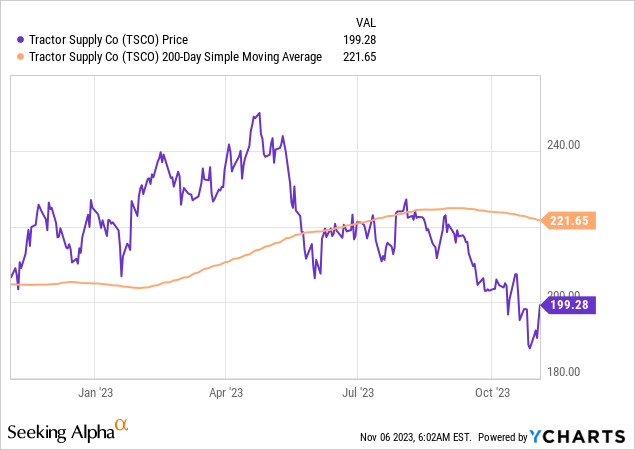

From the chart below which tracks the share price (as of the writing of this article) vs the 200-day simple moving average, over the last year, we can see that the share price of $199.28 has dipped about 10% below the moving average.

As a dip-buying opportunist, I like this price and it earns another rating point from me.

TSC – share price vs moving avg (author analysis)

From a larger view, though, it would fit nicely into a buy rating if the stock also shows profitability, revenue growth potential, and a good grip on its debt and equity situation.

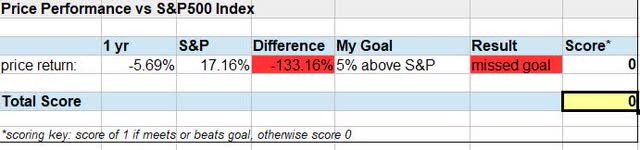

Performance vs S&P 500 Index

The market momentum of this stock has shown that its 1 year price return has been negative, while that of the S&P500 index was just over 17% as of this article, so it came short of the index by a lot, in fact lower by 133%.

TSC – performance vs S&P500 (author analysis)

I think that the market has perhaps been a bit unfair to retail, fueled by media stories over high inflation / prices combined with high cost of financing, and uncertainty of potential recession that can hit consumer-driven companies like this.

I also think that we have to look at the resilience of the US consumer in particular, and the fact that enough people are still spending.

According to a recent AP story on Oct. 30th:

Spending by consumers rose by a brisk 0.4% in September the government said Friday — even after adjusting for inflation and even as Americans face ever-higher borrowing costs.

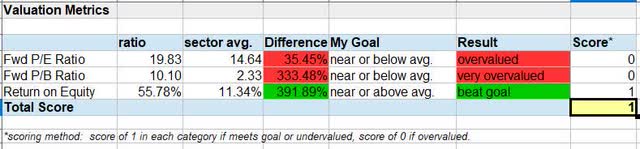

Valuation and ROE

The valuation picture shows the forward P/E ratio of 19.83 being much higher than the sector average, showing overvaluation. In addition, the P/B ratio is a stunning 333% above the sector average, being extremely overvalued.

TSC – valuation and ROE (author analysis)

In terms of return on equity, specifically the trailing-twelve-month return on common equity, the ROE is nearly 56%, or 392% above the sector average.

To try and understand why it is so overvalued on price to earnings and price to book, considering that earnings and book value have risen and price has dropped, the plausible explanation is that the book value itself could be low.

If you look at this company’s balance sheet on a quarterly basis, you can see that total liabilities are 77% of total assets, and 41% of total liabilities come from capital leases.

Fellow retail peer MarineMax (HZO) has a similar balance sheet situation though somewhat better, with total liabilities being 62% of total assets.

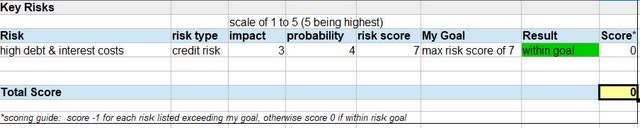

Key Risks

As mentioned in some other recent articles of mine, a key concern during this environment of high interest rates, particularly with the Fed continuing to keep its policy rate intact at a 22-year high after its November meeting, is the debt level of a company impacting the balance sheet with the interest costs impacting the income statement.

We can see from this company’s income statement and balance sheet that long-term debt of $1.72B has gone up about 60% on a YoY basis, which is no small number. At the same time, interest expense has gone up 53%.

TSC – rise in long term debt (Seeking Alpha)

TSC – rise in interest expenses (Seeking Alpha)

At the same time, one must also look at this in the context of this particular industry which relies on hundreds of brick-and-mortar retail stores, a very capital-intensive type of business, and growth plans.

For example, Tractor Supply is deploying its capital towards opening of many new stores and distribution centers, which should increase its retail footprint and market penetration.

According to their Q3 earnings release:

Capital plans for 2023 include opening a total of approximately 70 Tractor Supply stores, completing the conversion of Orscheln Farm and Home stores to Tractor Supply, continuing Project Fusion remodels and garden center transformations, building its 10th distribution center and opening a total of 10 to 15 new Petsense by Tractor Supply stores.

Within this context, I determined that although the probability of debt and interest risk is medium to high, the business impact is just medium because the company is on a growth and expansion trajectory right now and more stores should lead to more sales.

TSC – key risks (author analysis)

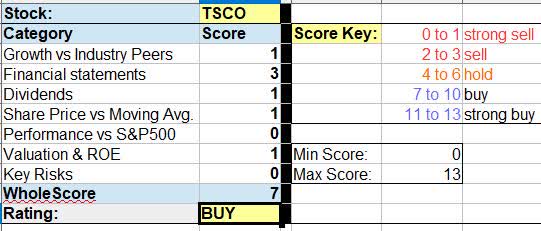

WholeScore Rating

In my note today this stock got a WholeScore of 7, earning a buy rating from me.

TSC – WholeScore (author analysis)

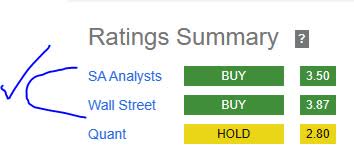

To compare my rating with that of the consensus from analysts and the SA quant system, I am agreeing with the bullish sentiment from Wall Street and analysts, and I think the quant system is being slightly more cautious than me on this stock.

TSC – rating consensus (Seeking Alpha)

My Forward-Looking Sentiment

I remain positive about this stock ahead of its next Q4 and end-of-year results in a few months, and the evidence I laid out in this note justifies it.

At its current price, combined with its revenue growth and profitability, I like it as a “buy” right now to add some shares to a retail / consumer goods portfolio. I also like it as a dividend “quick pick” due to its nice 3 year dividend growth and 2% yield.

To quote a common University of Texas-Austin saying: “boots up, horns down..”

With that said, bullish on Tractor Supply Company!

Read the full article here