Thesis

I believe WEX Inc. (NYSE:WEX) is well positioned in its target markets, and the company’s management has a strong track record of achieving robust revenue and earnings per share growth, which I expect to continue over the next two years. Fleet cards offer significant cost savings and advantages to local fleets, such as enhanced purchase controls, reduced fraud, and specialized reporting. I appreciate the diversification strategy employed by WEX’s management and expect strong execution over the next two years. I believe that WEX’s rapid revenue growth, expanding operating margins, and robust EPS growth will contribute to an increase in the value of its shares. I remain optimistic on the prospects of the company and assign a buy rating to the stock.

Post Q3 Review and Outlook

WEX has continued to perform well YTD, surpassing expectations in terms of both revenue and earnings. The company recently made its second consecutive acquisition, this time acquiring Payzer, a venture-backed field service management software provider, for $250 million. This purchase was funded through a revolving credit facility and cash reserves. While the Mobility segment revenue fell slightly short of expectations, mainly due to softer finance fee revenue, there were some positive aspects, such as a lower credit loss rate and improved late-fee rates, which are encouraging given the uncertainties faced by WEX’s customers in the current economic climate. On the bright side, the travel/corporate payments and benefits segments more than made up for this, driving better-than-expected guidance. Robust global travel volumes, coupled with accelerated revenue from Benefits SaaS accounts, contributed to this.

Looking ahead, WEX seems well-positioned to achieve its increased 2023 revenue growth guidance of 8%, especially considering the stronger-than-expected results in the third quarter. The potential negative impact of lower fuel prices on the fleet segment may be balanced out by increased corporate payments and benefits, which showed substantial growth in the third quarter, up 19% and 34%, respectively. WEX’s payments business has benefited from the post-pandemic surge in air travel and hotel stays, while the benefits segment has added to its base of 19.9 million Software-as-a-Service account holders. Furthermore, WEX’s acquisition of Payzer in the field service management software sector could provide a boost to their mobility segment and create opportunities for cross-selling through a new SaaS solution.

WEX Seeks Diversification With Business Payments

WEX, with its dominant position in fuel payments that contribute to over 60% of its revenue, is using this advantage to diversify into other digital business-to-business transactions, such as travel, health, and benefits. While the mobility segment might face some short-term challenges in earnings due to lower fuel prices, this will likely be partially offset by stronger growth in benefits and corporate payments driven by the travel industry. WEX enjoys a high client retention rate and generates recurring revenue of over 80%, indicating that clients tend to stay with the company. This factor supports management’s strategy of cross-selling new products and services to existing customers. After a relatively quiet 2022 in terms of deal-making, the company may resume its expansion efforts, especially if fintech and software valuations decline. Additionally, I believe there might be further acquisitions in 2023 following WEX’s announcement of its intention to acquire Payzer to strengthen its mobility segment.

Company Presentation

Scale and Distribution Provide Competitive Edge

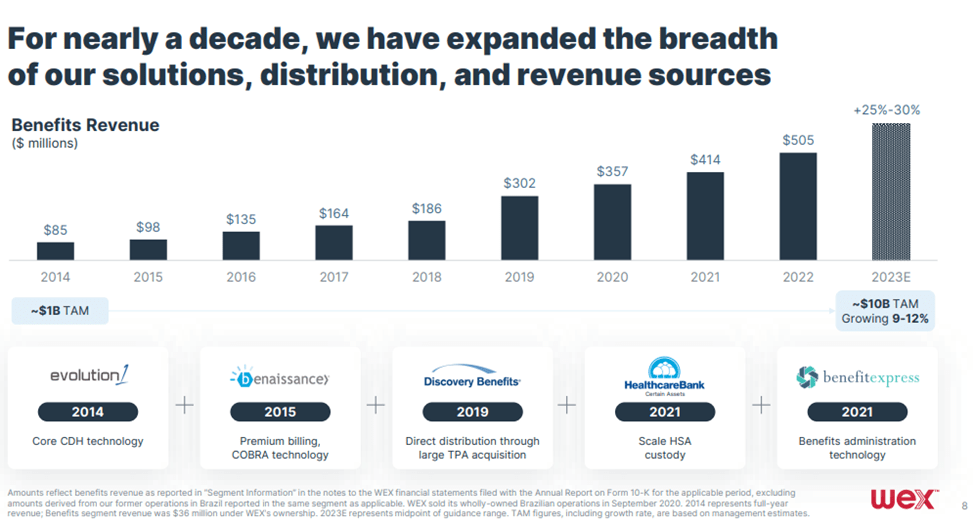

WEX gains a competitive advantage through its longstanding customer relationships and efficient distribution model, which also allows for operational efficiency when introducing new products. In its rapidly growing benefits sector, which faces competition from companies like HealthEquity and Alegeus, WEX has been enhancing its offerings through acquisitions, adding new features and capabilities. WEX’s flexible technology platform accommodates various types of customer accounts within a single tech infrastructure, while its multichannel distribution strategy broadens its market reach. In the travel-payment sector, where it competes with banks and financial institutions, WEX stands out with its technology-driven, embedded-finance solutions and well-established client connections. Although new fintechs are emerging with point solutions, management remains confident due to the breadth of WEX’s offerings.

Financial Outlook and Valuation

WEX’s benefits and payments businesses have the potential to partially offset the impact of declining fuel prices on its mobility segment and contribute to a projected 7% growth in revenue this year. Over the next 3-5 years, double-digit growth in these two units may drive annual revenue expansion of 10-15%, and the scaling of the recently acquired Ascensus health business could help counter any declines.

I expect WEX’s strategic focus on benefits as a more robust driver of revenue growth to mitigate the mobility segment’s vulnerability to fluctuations in gasoline prices, which is its largest segment. The company appears well-positioned to achieve 8-12% organic sales growth over the next few years, with the potential for an additional 2-3% from complementary acquisitions. In 2023, the corporate payments business is likely to be led by U.S. travel. WEX’s customer base is well-diversified, consisting of two-thirds smaller clients and one-third larger clients, providing some resilience against potential economic downturns. WEX also aims to accelerate digital sales to mid-sized and smaller customers and transition from an interchange-based model to recurring subscription fees.

With nearly $900 million in cash reserves and an annual free cash flow ranging from $500 million to $700 million, WEX is well-equipped to fund growth investments. The management aims to generate 2-3% incremental revenue through acquisitions, and the company’s balance sheet has room for such activities. The current debt level is at the lower end of the 2.5-3.5x range, and WEX may consider exceeding those levels for more value-adding deals, given its healthy cash flow. While recent capital allocation has favored buybacks, this strategy could change if the pace of acquisitions accelerates. The company is also focusing on the transition to electric vehicle fleets and has announced a $100 million investment in early-stage companies related to the energy transition, which aims to position its mobility segment for long-term growth and market share expansion.

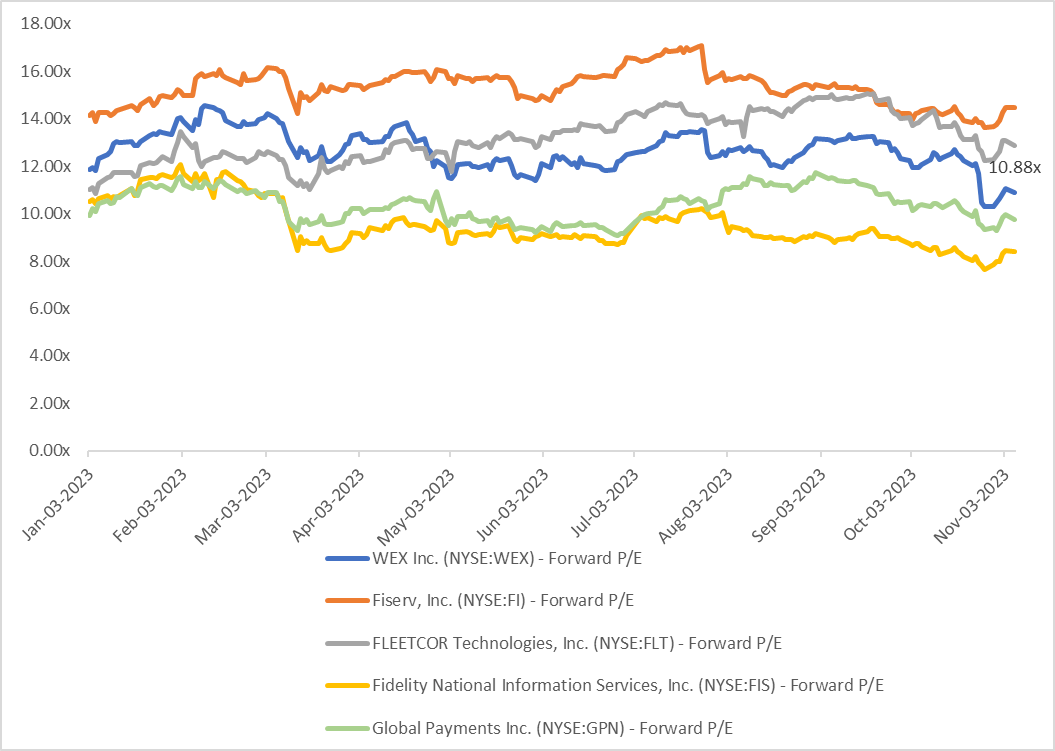

As per Capital IQ estimates, WEX is trading at a forward PE of 10.8x, consistent with the 8x-14x range at which the scale legacy processors (e.g. FI, FIS, FLT, GPN). I believe a higher multiple is warranted given the company’s strong positioning, high-quality mix of business, and strong growth profile. In conclusion, I am optimistic on the management’s diversification plan and anticipate effective implementation over the next two years. I believe that WEX’s revenue growth, expanding profit margins, and robust earnings per share growth will lead to an increase in the stock’s value. Hence, I assign a buy rating to the stock.

Capital IQ

Investment Risks

WEX’s fleet segment constitutes the largest portion of its business, accounting for 60% of its total revenue. A significant portion of its revenue is tied to fuel purchases made by customers directly or through fuel retail partners. The company estimates that for every one-cent decrease in the average domestic fuel price below the actual average prices. WEX faces substantial competition across its core industries, with increasing intensity and the entry of new competitors over the years. While WEX historically offered a wide range of services that helped it establish a leading position, competitors have been improving their own capabilities to compete more effectively in recent times. Additionally, there is a risk of clients not renewing their contracts with WEX if competitors offer more attractive terms, potentially impacting the company’s market share and revenue.

Conclusion

WEX is well positioned in its target markets, and I expect the company to continue posting healthy revenue growth, expanding operating margins, and robust EPS growth in the medium term. The company leverages its strong customer relationships and efficient distribution model to gain a competitive edge. The Payment-processing transactions and health-benefit accounts are the primary drivers of WEX’s revenue, fueling the mobility and benefits segments. About 80% of the top line is recurring, with a majority including payment-processing and account-servicing revenue tied to contracts. I remain optimistic on the company and assign a buy rating to the stock.

Read the full article here