Note:

I have covered Borr Drilling Limited (NYSE:BORR) previously, so investors should view this as an update to my earlier articles on the company.

Debt Refinancing Terms Disappoint

Two weeks ago, leading shallow water offshore driller Borr Drilling Limited or “Borr Drilling” successfully refinanced the majority of its debt obligations:

(…) Borr Drilling Limited (…) announced today that its wholly-owned subsidiary Borr IHC Limited has priced its previously announced offering of $1,540,000,000 in aggregate principal amount of senior secured notes, consisting of $1,025,000,000 aggregate principal amount of senior secured notes due 2028 at a price equal to 97.750%, bearing a coupon of 10.000% per annum and $515,000,000 aggregate principal amount of senior secured notes due 2030 at a price equal to 97.000%, bearing a coupon of 10.375% per annum.

The proceeds from the offering are intended to be used, together with the proceeds from the Company’s previously announced $50 million private placement of shares in Norway, to repay all of the Company’s outstanding secured borrowings, being the Company’s DNB Facility, Hayfin Facility, shipyard delivery financing arrangements with OPPL and PPL, the Company’s $150 million principal amount of Norwegian law Senior Secured Bonds, and to pay related premiums, fees, accrued interest and expenses, in connection with the foregoing, and the remainder, if any, for general corporate purposes. The notes will be guaranteed by the Company and certain of its subsidiaries and will be secured on a senior basis on substantially all of the assets of the Company and certain subsidiary guarantors.

Settlement of the notes offering is expected on or about November 7, 2023, and is subject to customary closing conditions.

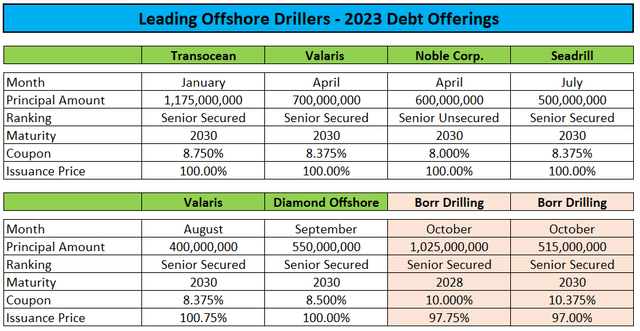

However, in contrast to its U.S. exchange-listed peers, the company missed out on the opportunity to raise new debt at lower rates earlier this year.

CNBC

With the 5-year U.S. treasury yield hovering just below 5% at the time of the announcement, the company had to offer double-digit coupons in combination with issuance discounts to attract a sufficient number of investors.

Press Releases

Please note that terms might have been even worse without the company raising $50 million in new equity at a price of approximately $6.65 per common share.

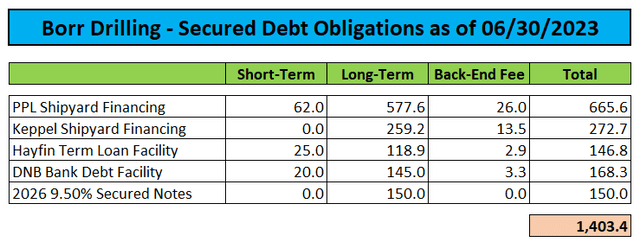

In combination, I would estimate net proceeds of approximately $1.52 billion which will be utilized to repay the company’s existing secured debt facilities including related premiums, fees, accrued interest and expenses:

Regulatory Filings

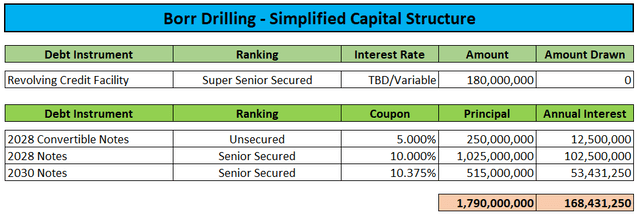

In addition, the company will enter into a $180 million super senior revolving credit facility.

As a result, Borr Drilling’s new capital structure will look as follows:

Press Releases

While less-than-stellar refinancing terms will result in annual cash interest obligations increasing by almost $20 million, the company managed to extend debt maturities until at least 2028 and will no longer be precluded from returning capital to shareholders in the form of share buybacks and/or dividends.

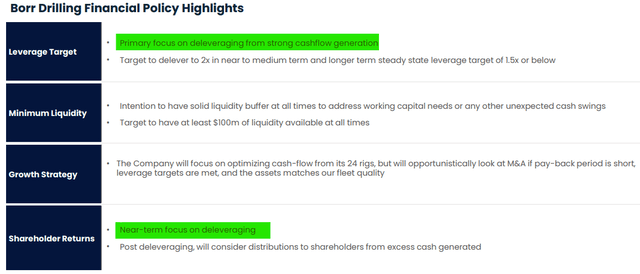

New Focus On Deleveraging

However, based on Borr Drilling’s most recent investor presentation, the company’s near-term focus appears to have shifted to debt reduction:

Company Presentation

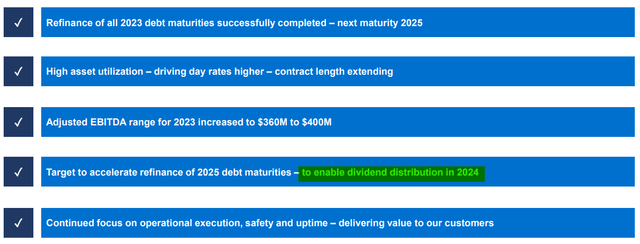

Previously, management had targeted a dividend initiation in 2024 as evidenced by this slide from the company’s Q4/2022 earnings presentation in February:

Company Presentation

Delivery Of Remaining Newbuilds Being Accelerated

While certainly disappointing for many shareholders, I consider the near-term focus on deleveraging a prudent financial decision due to a number of factors:

- A recent contract termination resulted in the requirement to reduce near-term profitability expectations quite meaningfully.

- The decision to accelerate deliveries of the company’s two remaining newbuilds Vale and Var to H2/2024.

- Substantially higher interest obligations as a result of disappointing refinancing terms and additional debt being required to pay for the newbuilds.

According to Fitch Ratings, the remaining $295 million in shipyard installments are expected to be financed by $260 million in committed long-term debt while $35 million will be paid from cash on hand.

In addition, I would estimate a required investment of up to $50 million to enable the activation of the rigs.

Reducing Estimates On Legacy Contract Impact

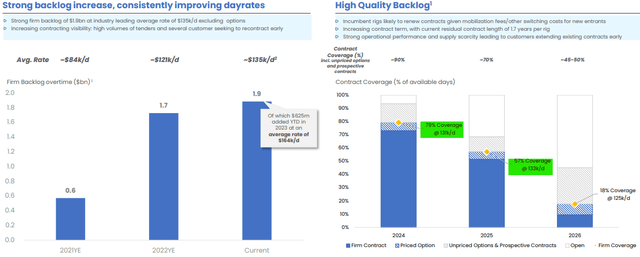

Moreover, both the company’s 2024 and 2025 results will be impacted by a meaningful number of lower-margin legacy contracts:

Company Presentation

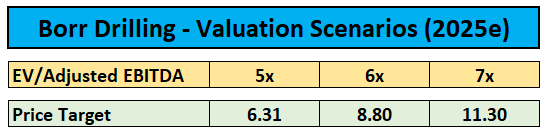

With 57% of available days for 2025 contracted substantially below prevailing market rates, my original expectation of 2025 Adjusted EBITDA reaching $800 million has been way too optimistic.

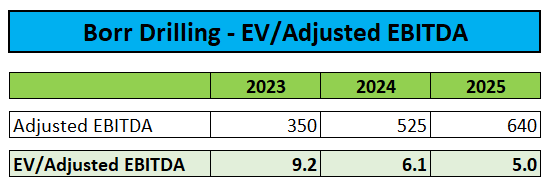

Consequently, I am lowering my 2025 Adjusted EBITDA estimate by 20%:

Company Projections / Author’s Estimates

However, assigning an EV/Adjusted EBITDA multiple of 6x would still yield a $8.80 price target for the shares thus providing for more than 40% upside from current levels:

Author’s Estimates

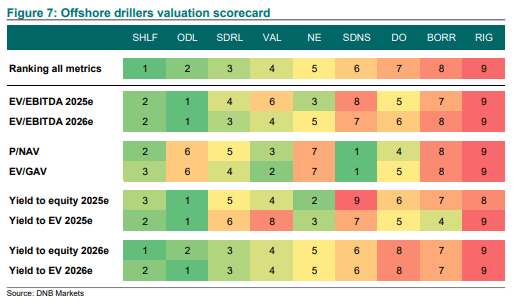

On the flip side, shares look expensive relative to peers based on a number of key metrics:

DNB Markets

Without the recent sell-off, I would have likely downgraded the company’s shares to “Hold” but with more than 40% upside to my revised price target, I still consider scaling into the stock on weakness an appropriate strategy.

Key Risk Factor – Oil Price Correlation

Please note that offshore drilling stocks remain heavily correlated to oil prices so any sustained down move in the commodity would almost certainly result in industry shares taking a further hit.

Bottom Line

Clearly, things haven’t played out as expected by Borr Drilling’s management earlier this year with a recent earnings warning in combination with surging interest rates having resulted in disappointing terms for the company’s eagerly-awaited debt refinancing.

In addition, the company’s decision to accelerate delivery of its remaining newbuilds is likely to negatively impact cash flows next year.

Moreover, with a substantial number of available days for 2025 contracted substantially below prevailing market rates, progress in profitability and cash generation will be more muted than originally expected by me.

Perhaps most disappointing for many investors, management has shifted the near-term focus from returning capital to shareholders to reducing leverage.

While I consider this a prudent decision, the move has eliminated a key near-term catalyst for the shares.

However, with the stock now down by more than 30% from recent multi-year highs and ongoing, solid industry fundamentals, I still consider scaling into the shares on weakness an appropriate strategy for investors with a medium-term investment horizon.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here