Kimco Realty Corporation (NYSE:KIM) executed well in the third quarter with FFO customarily exceeding the trust’s dividend pay-out by a very wide margin.

Though the REIT reported a QoQ decrease in occupancy, the fundamentals in the business align well and the trust enjoys same-store net operating income growth.

With the U.S. economy chugging along at a healthy clip in the third quarter (4.9% on an annualized basis), I think Kimco Realty offers passive income investors great value: The stock is cheap based on FFO, the trust bumped its guidance for FFO up and the dividend was raised by 4% in October, resulting in a 5.1% forward dividend yield.

My Rating History

When Kimco Realty acquired RPT Realty, another real estate investment trust focused on grocery-anchored shopping centers, my stock classification was Strong Buy.

Taking into account that Kimco Realty raised its dividend, managed to cover its dividend comfortably with FFO and same-store NOI kept growing in 3Q-23, the trust continues to represent great value for passive income investors.

A Grocery-Anchored, Diversified Shopping Center Portfolio

Kimco Realty is focused primarily on open-air shopping centers that lease space to grocers. Grocery companies ensure a steady stream of foot traffic and also generate stable cash flows from their operations which is something that landlords value highly.

By far the biggest property category in Kimco Realty’s portfolios are grocery stores and pharmacies which accounted for 31% of the trust’s annualized base rent at the end of the third quarter.

Portfolio Overview (Kimco Realty)

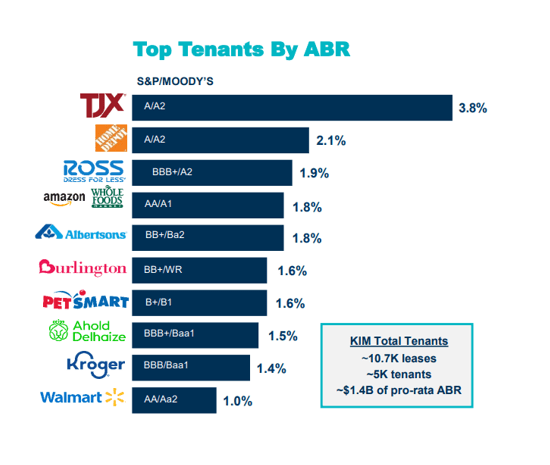

Kimco Realty’s top tenants include TJX, Home Depot, Whole Foods, Kroger and Walmart which are all nationally represented grocery-focused retail chains. The largest lease was held by TJX which accounted for close to 4% of the trust’s annualized base rent.

Top Tenants By ABR (Kimco Realty)

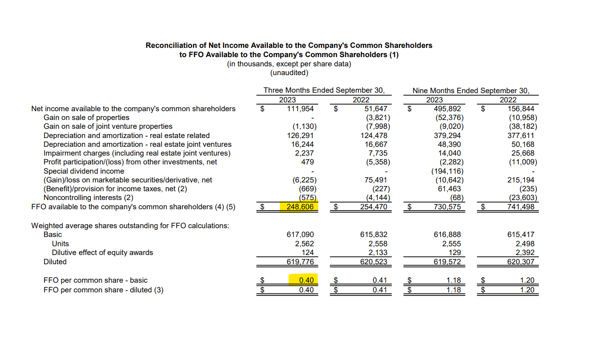

In the third quarter, Kimco Realty earned $248.6 million in FFO from its real estate and lease portfolio, reflecting a minor decline of 2.3% YoY. FFO per share was down $0.01 per share to $0.40 per share, but the trust’s cash flow was more than sufficient to finance a generous dividend for passive income investors.

FFO Per Share (Kimco Realty)

Occupancy Dipped In 3Q-23

Kimco Realty’s occupancy dipped in the third quarter. Portfolio occupancy fell from 95.8% in 2Q-23 to 95.5% in 3Q-23. Though the dip in portfolio occupancy was only 0.3 percentage points, it was a dip nonetheless.

Occupancy Trend (Kimco Realty)

On the other side, Kimco Realty continues to profit from strength in real estate markets in general as well as demand for lease space. Kimco Realty’s net operating income, for its same-store portfolio, continued to grow in the third quarter: The trust’s same-store net operating income increased by 2.6% which was the highest rate so far in 2023.

Same-Site NOI (Kimco Realty)

Dividend Coverage

Kimco Realty’s dividend coverage remained excellent in 3Q-23 with a payout ratio of only 58%, reflecting a 1 percentage point decrease compared to the prior quarter.

In total, the REIT earned $0.40 in FFO in the third quarter and paid out $0.23 per share. The LTM pay-out ratio was 59%, proving that the trust comfortably covered its dividend in the last year.

Due to the high degree of excess dividend coverage, Kimco Realty raised its dividend by 4% in October and the new forward dividend is $0.24 per share per quarter, leading to a forward yield of 5.1%.

Dividend (Author Created Table Using Trust Information)

Kimco Realty Bumps Its FFO Guidance

The REIT guided for FFO of $1.56 to $1.57 for 2023, reflecting a $0.01 per share FFO increase at the lower end of guidance. With the stock presently selling at $18.75, the implied valuation multiple is 12.0x.

Realty Income Corporation (O) expects $4.07 to $4.15 per share in FFO (normalized) in 2023, so Realty Income’s FFO costs passive income investors 12.4x. Realty Income recently acquired Spirit Realty Capital which I considered to be a reason to go all-in.

I use Realty Income as a benchmark for Kimco Realty as both trusts are large-cap, retail-focused REITs with big real estate portfolios concentrated in cities. Realty Income, as far as dividend safety is concerned, is regarded as somewhat of a benchmark in the industry. With that being said, though, Kimco Realty offers passive income investors an even safer dividend as the trust only pays out 58-60% of its FFO.

Why Kimco Realty Could See A Lower Or Higher Valuation Multiple

Kimco Realty might be vulnerable to a recession, even though the trust’s occupancy metrics didn’t deteriorate as badly as one might have expected during the Covid-19 pandemic.

With that being said, Kimco Realty should be expected to do well as long as consumer spending ramps up and job growth remains strong, which is presently still the case. A particularly severe recession in commercial real estate, however, is a potential headwind for Kimco Realty and its passive income investor base.

My Conclusion

Kimco Realty’s financial performance in 3Q-23 remained as robust as ever: the trust earned a stable $0.40 per share in FFO which comfortably covered Kimco Realty’s $0.23 per share per quarter dividend pay-out.

With a pay-out ratio of 58%, I think that the dividend is quite safe and the 4% dividend raise attests to the trust’s dividend growth potential.

Kimco Realty offers passive income investors a very strong margin of safety, in my view, in terms of both the dividend as well as the FFO multiple.

Read the full article here