Yields in the midstream/MLP space have been attractive to investors looking for income. Importantly, generous yields get bolstered by strong dividend growth trends, as midstream/MLPs prioritize returning excess cash flow to investors. Dividend growth continued for 3Q23, mostly driven by MLPs, though a corporation had the largest sequential increase. Importantly, there has not been a dividend cut for the broad Alerian Midstream Energy Index (AMNA) since July 2021. Today’s note recaps 3Q23 dividend announcements, examines current yields, and discusses the constructive outlook for growing payouts.

3Q23 Dividends: MLPs Again Drive Quarterly Growth

With a handful of MLPs growing their payouts each quarter, MLPs dominated sequential dividend growth for 3Q23. However, C-Corp Cheniere Energy (LNG) saw the highest dividend growth for 3Q23, announcing a 10.1% increase to $0.435 per share per quarter consistent, with its “20/20 Vision” long-term capital allocation plan.

Among MLPs, MPLX (MPLX) saw the greatest distribution growth, having increased its quarterly payout by 9.7% to $0.85 per unit in a widely anticipated hike. Western Midstream (WES) increased its base distribution by 2.2% in 3Q23 to $0.5750 in conjunction with its acquisition of Meritage Midstream. This follows a 12.5% increase in WES’ distribution for the previous quarter (read more).

The remaining names grew distributions more modestly, which aligns with their pattern of growing payouts each quarter. Hess Midstream (HESM) grew its distribution by 2.7%, while Global Partners (GLP) raised its distribution by 1.5%. Delek Logistics (DKL) grew its payout by 1%, and Energy Transfer (ET) raised its distribution by 0.8% as it continues to target 3-5% annual distribution growth.

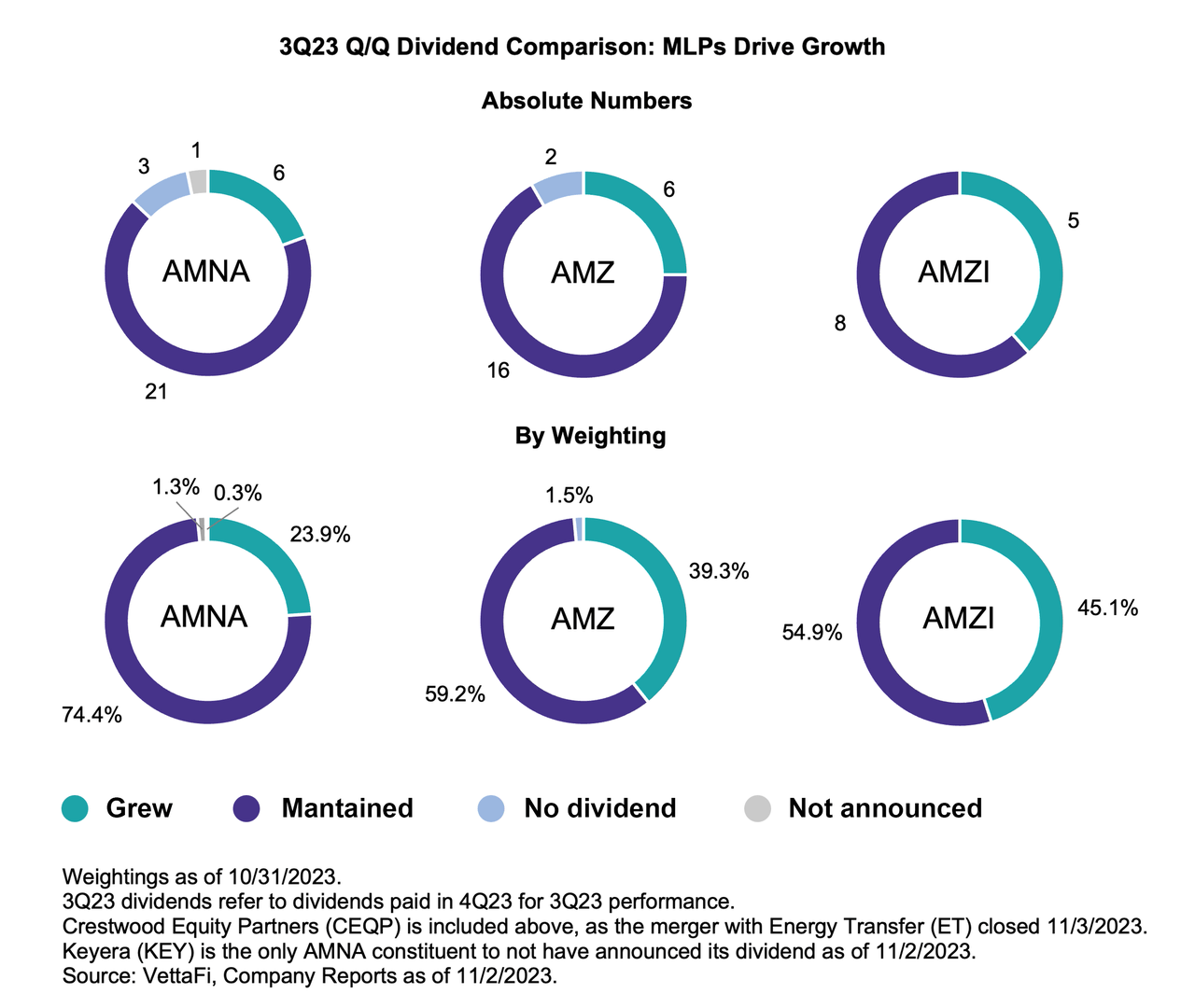

The pie charts below show quarter-over-quarter changes to dividends for AMNA, the Alerian MLP Index (AMZ), and the Alerian MLP Infrastructure Index (AMZI) by comparing 3Q23 payouts to those made for 2Q23. To be clear, 3Q23 dividends refer to dividends paid in 4Q23 based on operational performance in 3Q23.

Most Constituents by Weighting Have Grown Payouts Over the Last Year

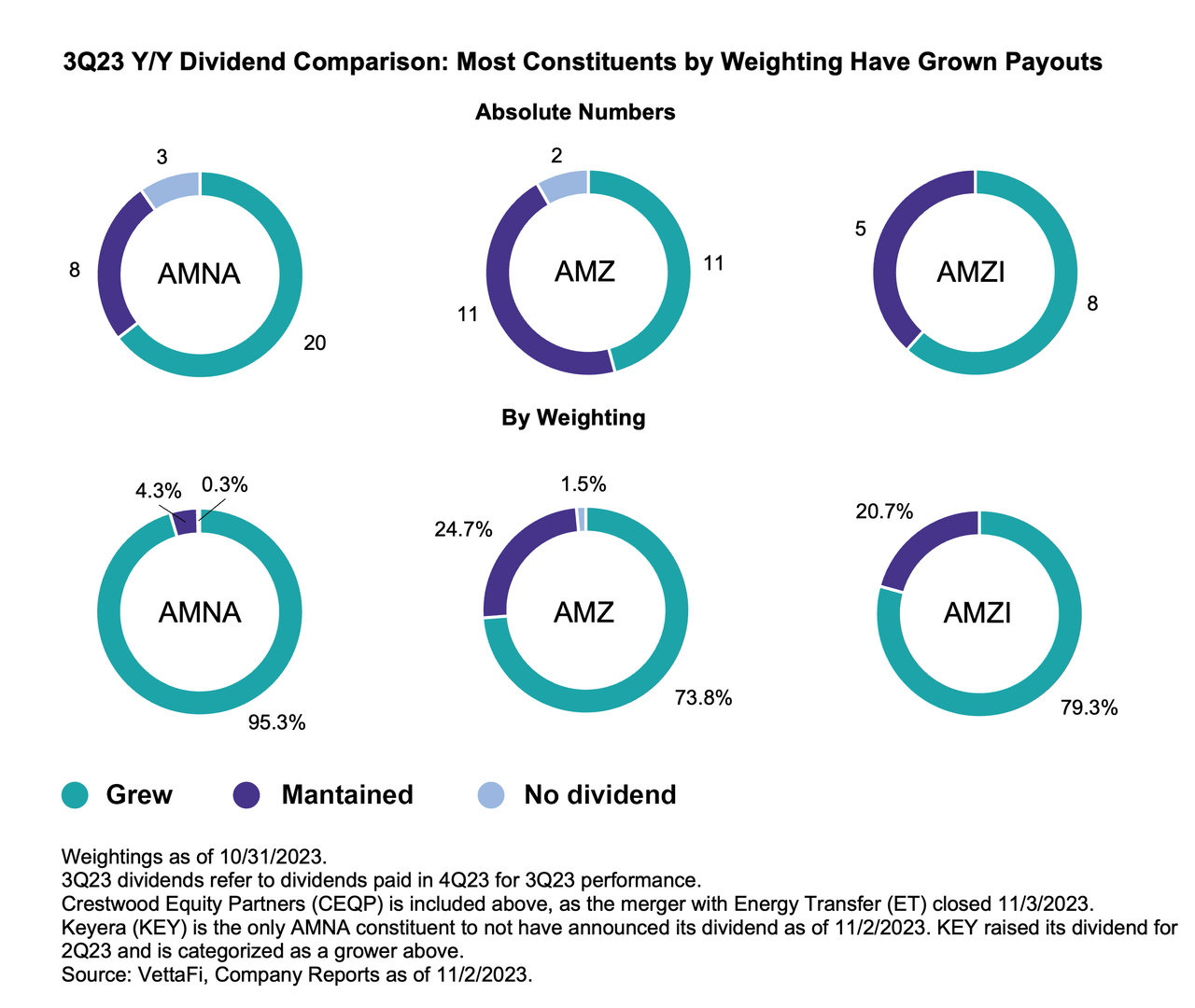

While a handful of constituents have increased their payouts sequentially, many companies evaluate dividend growth annually. Therefore, a comparison with dividends from the same quarter a year ago allows for a better view of midstream’s dividend growth trends. On a year-over-year basis, the majority of the indices by weighting have increased payouts, as shown in the chart below. Notably, dividend growth has generally outpaced inflation (read more).

For AMNA, which includes both corporations and MLPs, 95.3% of constituents by weighting have grown payouts over the past year. For the MLP indexes, AMZ and AMZI, 73.8% and 79.3% of constituents by weighting increased their payouts year-over-year, respectively.

Growing Payouts Enhance Yields and Total Return

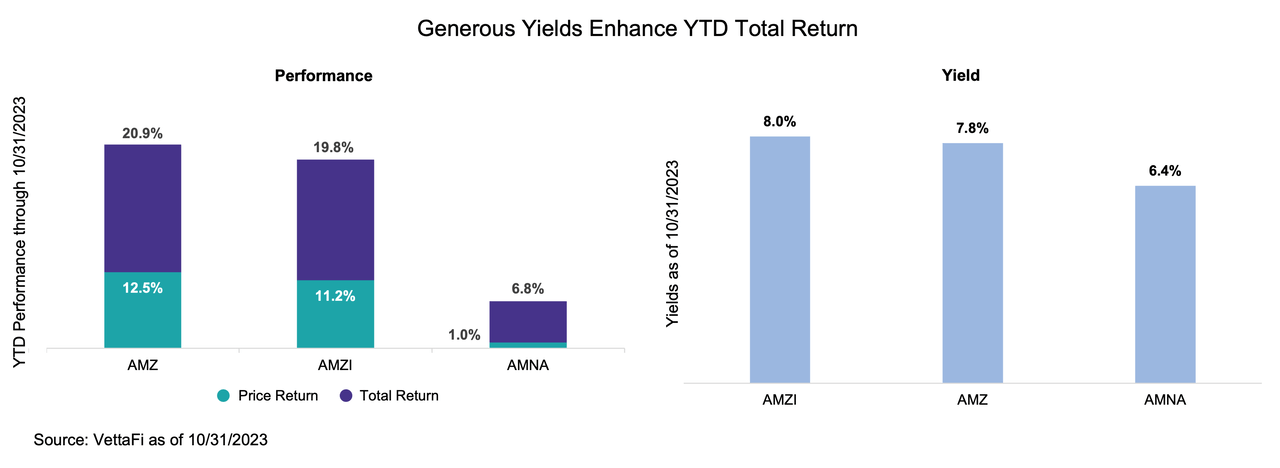

Strong dividend growth adds to midstream’s already healthy yields and enhances total return, as shown in the chart below. Notably, MLPs are handily outperforming the S&P 500, which is up 10.7% on a total-return basis this year through October (read more). As of October 31, AMZ and AMZI were yielding 7.8% and 8.0%, respectively, while AMNA was yielding 6.4%.

Importantly, dividend growth is expected to continue as companies generate free cash flow and return excess cash to investors. A handful of companies have provided multiyear dividend guidance in capital allocation plans (read more), and some provided dividend outlooks with 3Q results.

As announced last week, Targa Resources (TRGP) plans to recommend to its board of directors a 50% increase to its common dividend for 1Q24 (payable in May 2024). TRGP increased its dividend by 43% earlier this year, with growth coming off a lowered base after a 2020 cut. The corporation aims to provide meaningful annual dividend increases beyond next year.

Also announced with 3Q results, management of Plains All American (PAA/PAGP) intends to recommend that its board approve a $0.20 per unit, or 19%, increase for the next distribution, to be paid in February 2024. This is a step up from prior plans to grow the distribution by $0.15 per unit annually beyond 2023.

While these are just a few examples, the outlook for broader midstream/MLP dividend growth remains strong.

Bottom Line:

Midstream companies remain well-positioned to grow their payouts, enhancing already generous yields and supporting total return performance.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMZ is the underlying index for the JPMorgan Alerian MLP Index ETN (AMJ) and the ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN (MLPR). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Original Post

Read the full article here