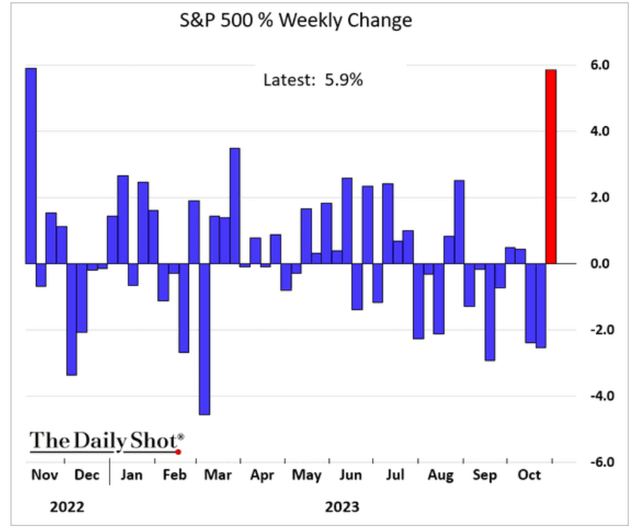

It was a heck of a week for stocks. It was the best week for U.S. stocks in a year.

Daily Shot

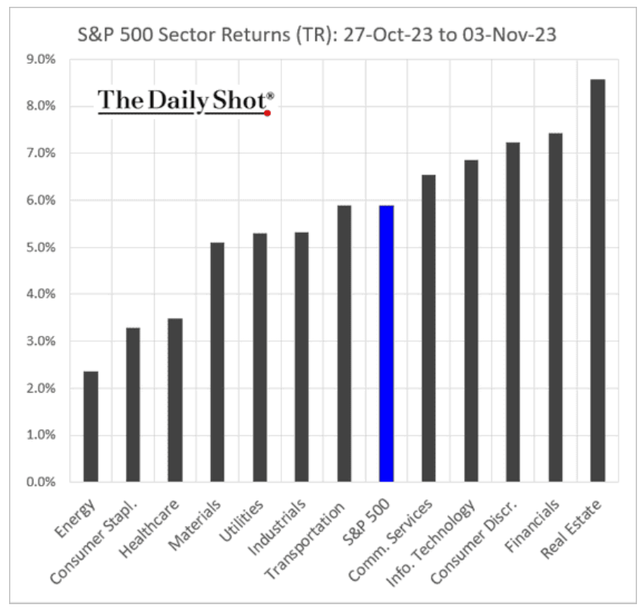

The S&P 500 (SP500) soared almost 6%, while tech soared over 7% and financials and real estate delivered even stronger returns.

Daily Shot

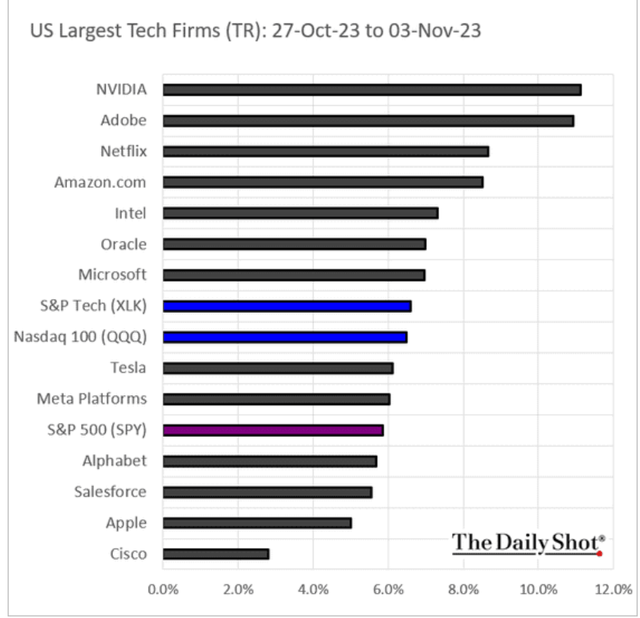

Not surprisingly, some big tech stocks delivered blockbuster 10+% returns in a week.

Daily Shot

So, what’s a smart investor to do? Chase the momentum? Just hope this continues so you can scalp a quick 5% or 10% gain from a greater fool?

Don’t Believe The Hype: We’re All Value Investors

Unless you’re a short-term momentum trader trying to score a quick profit, we’re all value investors. No one pays more for a company than they think it is worth because that would be speculation, not investing.

There are two times in a man’s life he should not speculative. When he can’t afford to, and when he can.” – Mark Twain.

People might have different opinions about a company’s value for several reasons, but it all comes down to cash flow in the end.

The present value of future cash flow is fundamentally the only thing that counts towards the value of a company.

- But what about dividends? They are paid out of cash flow

- But what about credit ratings? They determine the long-term sustainability of cash flow

- But what about “stories” (like EVs or AI) or sub-stories (like ESG)? That’s all about the long-term cash flow, due to the size of the addressable market and sustainability of the company to last for decades or even centuries (and thus make more cash flow).

A good analyst will have a valuation model that factors in things like the safety of a company.

- bankrupt companies don’t generate cash flow.

And the growth rate of a company.

- where the PEG rule of thumb comes from.

Why GARP Dividend Aristocrats Are So Amazing!

Dividend aristocrats are proven to be high-quality and dependable. In fact, Ben Graham considered a 20-year streak without a dividend cut a sign of quality and a 20-year dividend growth streak a sign of excellence.

Dividends are great because they are a kind of royalty to you. You own the company, but you don’t have to sell your ownership to get paid; you can get a cut of your profits every three months.

If you don’t need the cash? Just reinvest the dividends automatically via a DRIP (dividends reinvestment plan) such as most brokers offer for any stock.

If you need the cash to pay bills or prefer to reinvest the dividends manually, you can do that.

It’s all about the financial freedom to do what’s best for you. What’s more American than that?

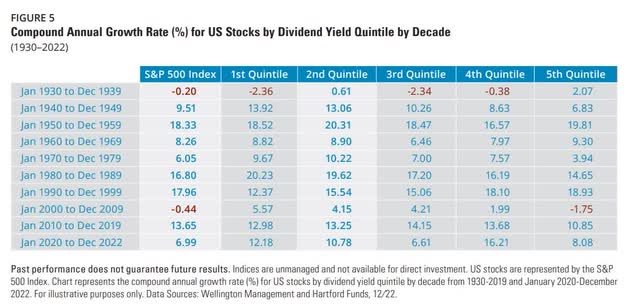

Why Dividend Growth Matters

Hartford Funds

Max safe yield is great, but there are always tradeoffs.

A company like British American Tobacco p.l.c. (BTI), paying a secure 10% yield, isn’t growing very fast because it has to send 65% of its earnings to investors each year.

A company like Mastercard (MA) keeps 83% of its earnings to reinvest in the business and can grow its dividends at 20% annually.

Marketwatch

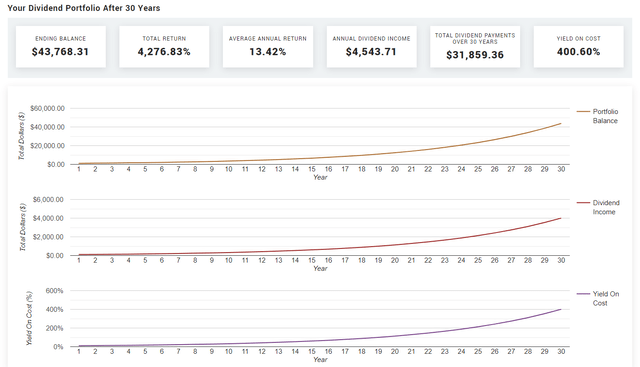

Over 30 years, analysts currently expect a $1,000 investment in BTI today to generate $32,000 per year in dividends.

Marketwatch

Mastercard is expected to generate $7,900 in dividends on a $1,000 investment.

So, if you’re already retired and are just planning for 30 years of income? Sure, dividend growth doesn’t matter to you.

But look what happens if you’re ten years from retirement, 20 years, or even 30 years.

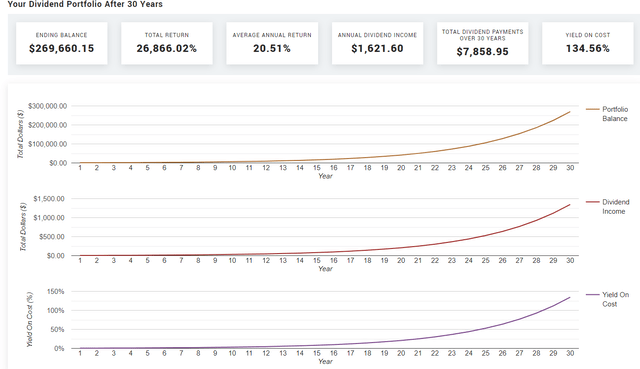

40-Year Time Frame On Mastercard (starts investing at 55)

Marketwatch

After 40 years of dividend compounding, $1,000 isn’t enough to live on alone. However, it would make an excellent supplement to Social Security.

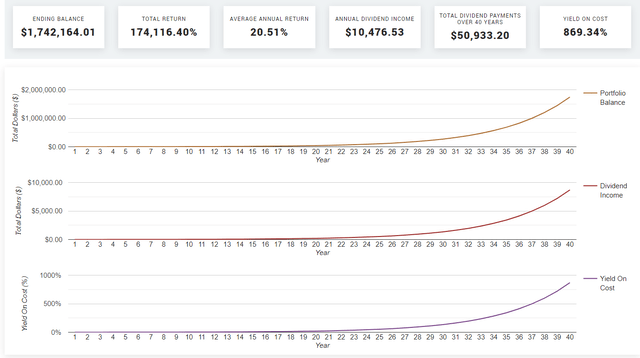

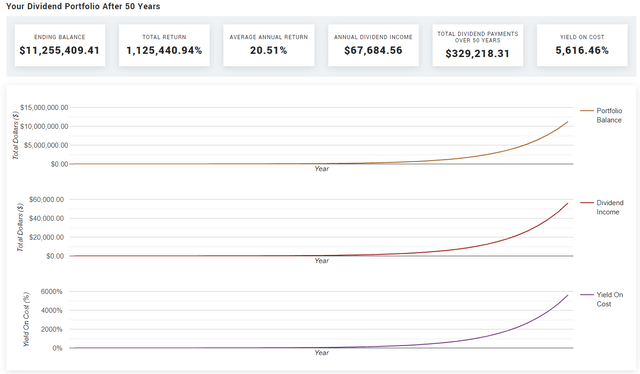

50-Year Time Frame On Mastercard (starts investing at 45)

Marketwatch

Fifty years of dividend hyper-compounding does create enough income to live on.

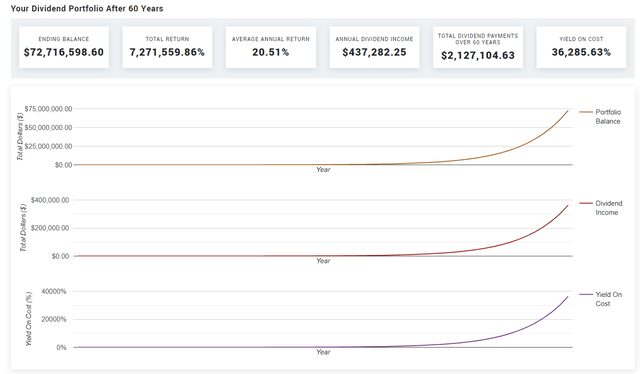

60-Year Time Frame On Mastercard (starts investing at 35)

Marketwatch

After 60 years, you can really start to see the effects of compounding work their magic.

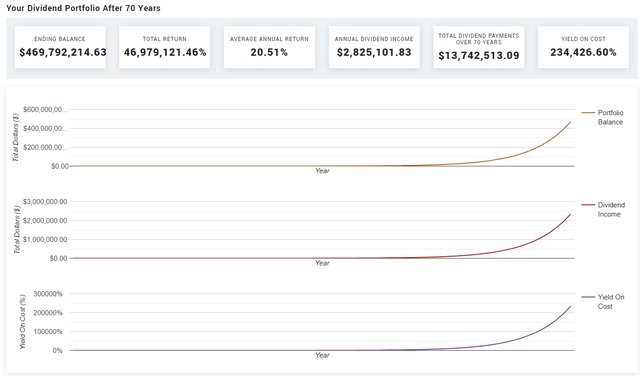

70-Year Time Frame on Mastercard (starts investing at 25, retirement plan through age 95 for themselves and spouse)

Marketwatch

Don’t you think it’s possible to grow 20% in 70 years? You’re right.

But dividend growth stocks have grown their income by 10% annually for 50 years.

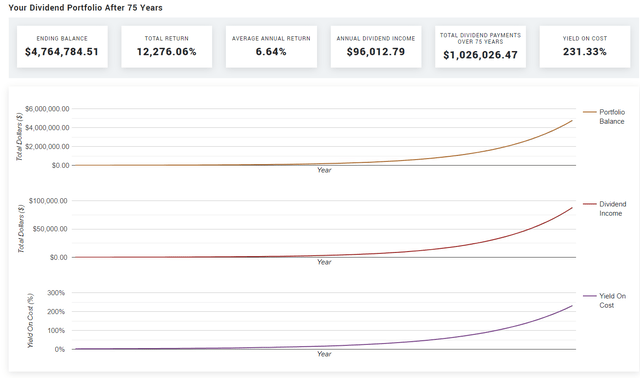

75-Year Time Frame on Dividend Stocks (starts investing at 25, retirement plan through age 100 for themselves and spouse) 10% income growth, adjusted for 2.5% inflation, $1,000 starting investment and $500 monthly contribution

Marketwatch

Adjusted for inflation, you can see how, with enough time anyone can harness the power of dividend growth stocks to generate life-changing financial freedom.

Finding The Best GARP Dividend Aristocrats

Here is how I have used our DK Zen Research Terminal to find the best GARP (low PEG) dividend aristocrat bargains you can safely buy today.

From 504 stocks in our Master List to the best blue-chip aristocrat bargains.

All in one minute, thanks to the DK Zen Research Terminal. This is how I find all my investment ideas.

| Screening Criteria | Companies Remaining | |

| 1 | Lists “Dividend Champions” | 135 |

| 2 | BHS Rating “reasonable buy, good buy, strong buy, very strong buy, ultra value buy” | 100 |

| 3 | Non-Speculative (No Turnaround Stocks, investment grade) | 83 |

| 4 | Sort By PEG Ratio | 89 |

| 5 |

Select Top 7 Lowest PEG and Include In The “Ticker” watchlist creator |

|

| Total Time | 1 minute |

So, let’s look at the best 7 GARP (growth at a reasonable price) dividend aristocrats you can buy today.

7 Dividend Aristocrats You Should Buy Before It’s Too Late

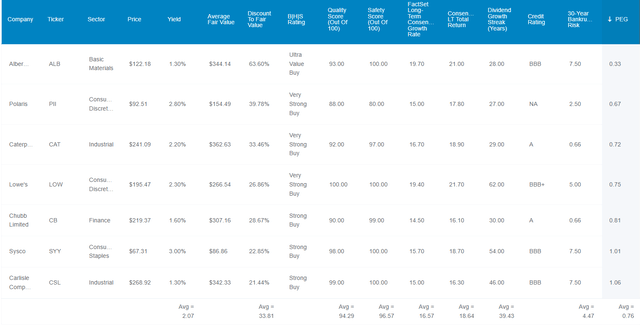

First, bottom line upfront, here’s the fundamental summary of these amazing GARP aristocrats.

Fundamental Summary

- yield: 2.1% (vs 1.7% S&P 500 and 2% Dividend Aristocrats)

- dividend safety: 97% very safe (1.15% dividend cut risk)

- overall quality: 94% low-risk Ultra SWAN dividend aristocrat

- credit rating: BBB+ stable (4.747% 30-year bankruptcy risk)

- long-term growth consensus: 16.6%

- long-term total return potential: 18.6% vs 10.2% S&P 500

- discount to fair value: 34% discount (potential very strong buy) vs 5% overvaluation on S&P

- 10-year valuation boost: 4.2% annually

- 10-year consensus total return potential: 2.1% yield + 16.6% growth + 4.2% valuation boost = 22.8% vs 10.0% S&P

- 10-year consensus total return potential: = 680% vs 160% S&P 500.

More than 4X the S&P 500’s consensus total return potential over the next decade.

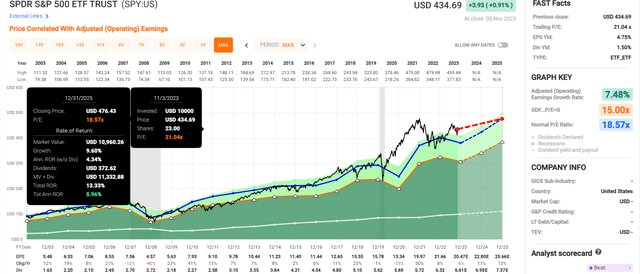

S&P 500

FAST Graphs, FactSet

If the S&P grows as expected (no recession) and returns to historical fair value, investors will see 13% returns in the next two years, just 6% per year.

In contrast, these GARP aristocrats offer

- 74% upside over two years = 6X more than the S&P 500

- 28% annualized returns, Buffett-like return potential from blue-chip bargains hiding in plain sight.

Want to see what these amazing seven dividend aristocrat bargains are?

Dividend Kings Zen Research Terminal

I’ve linked to articles about each company. Here, they are in order of lowest PEG ratio.

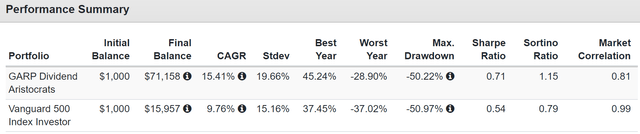

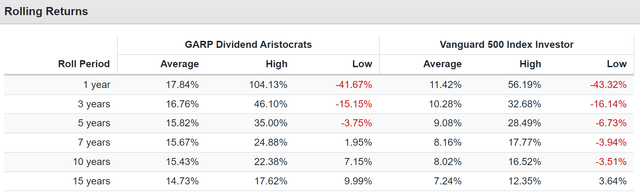

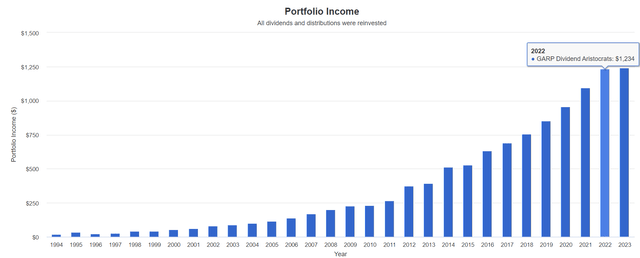

Historical Total Return Since 1994

Portfolio Visualizer Premium Portfolio Visualizer Premium Portfolio Visualizer Premium

Over the last 29 years, these aristocrats have averaged 18% annual returns while delivering 13% annual income growth.

Adjusted for inflation, these aristocrats have doubled their dividends every seven years for three decades.

Consensus Total Return Potential Through 2025

- if and only if each company grows as analysts expect

- and returns to historical market-determined fair value

- this is what you will make.

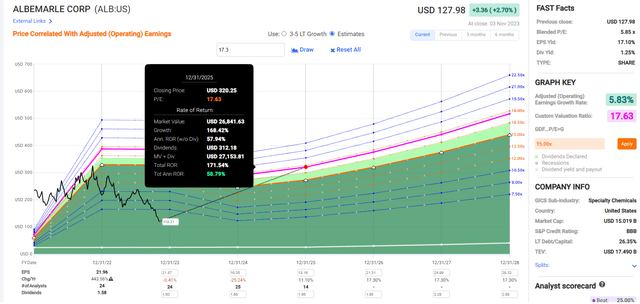

Albemarle – Down another 6% on Nov 6th (FAST Graphs Adjusted For This)

FAST Graphs, FactSet

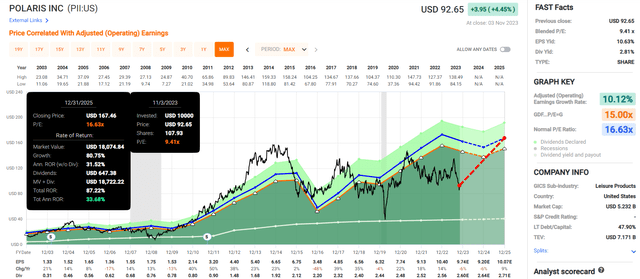

Polaris

FAST Graphs, FactSet

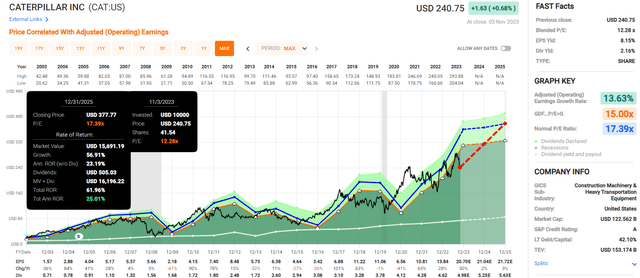

Caterpillar

FAST Graphs, FactSet

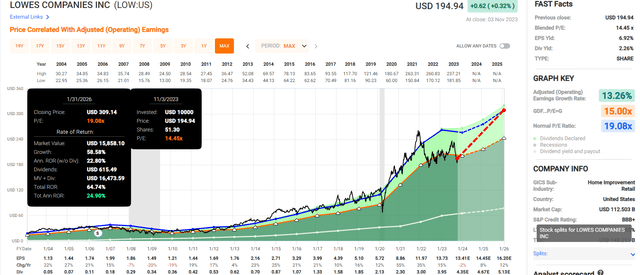

Lowe’s

FAST Graphs, FactSet

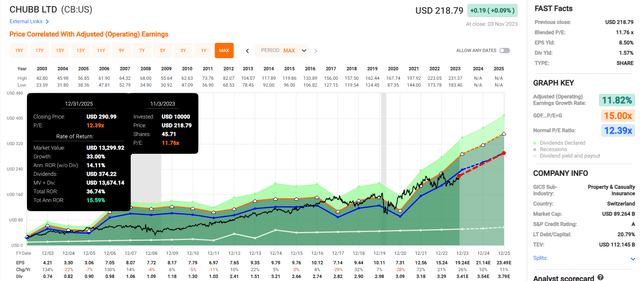

Chubb

FAST Graphs, FactSet

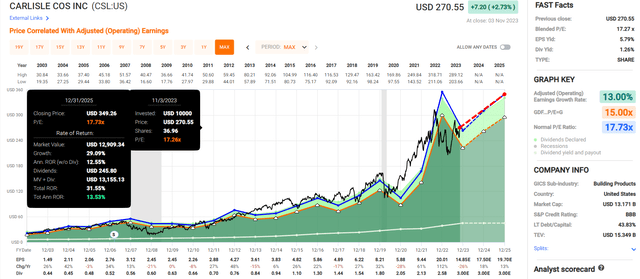

Carlisle

FAST Graphs, FactSet

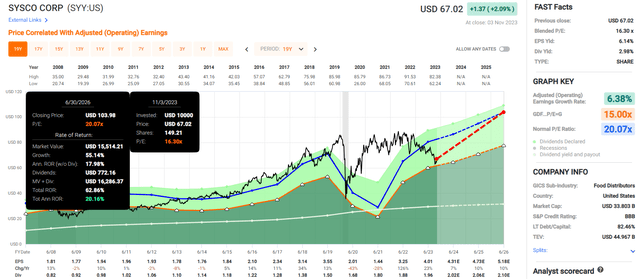

Sysco

FAST Graphs

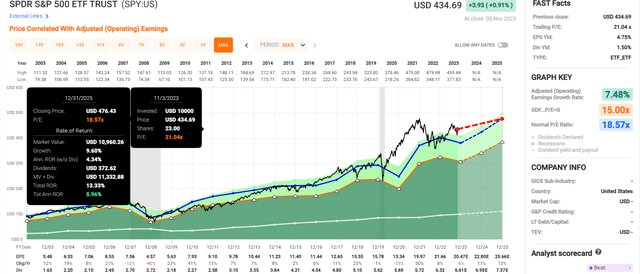

S&P 500

FAST Graphs, FactSet

If the S&P grows as expected (no recession) and returns to historical fair value, investors will see 13% returns in the next two years, just 6% per year.

In contrast, these GARP aristocrats offer

- 74% upside over two years = 6X more than the S&P 500

- 28% annualized returns, Buffett-like return potential from blue-chip bargains hiding in plain sight.

Bottom Line: 7 Dividend Aristocrats You Should Buy Before It’s Too Late

Last week was a great recovery rally, but whether or not stocks keep rallying in the short-term doesn’t matter.

It was a week that belonged to the speculator.

- most shorted companies (low quality) surged 18%.

It wasn’t a rally driven by fundamentals; it was a “thank god rates are lower now. Let’s go back to buying NVDA!” rally.

But while ALB, PII, CAT, LOW, CB, CSL, and SYY all had a good week, these are the best GARP dividend aristocrats you can buy today.

That means their price/earnings/growth ratio or PEG is near one or less (average 0.76), and even if that growth outlook falls in a recession, you won’t overpay today unless the wheels completely fall off the bus.

Never knowingly overpay for a company. That is one of the cornerstones of disciplined financial science, the math behind getting and staying rich on Wall Street.

Fundamental Summary

- yield: 2.1% (vs 1.7% S&P 500 and 2% Dividend Aristocrats)

- dividend safety: 97% very safe (1.15% dividend cut risk)

- overall quality: 94% low-risk Ultra SWAN dividend aristocrat

- credit rating: BBB+ stable (4.747% 30-year bankruptcy risk)

- long-term growth consensus: 16.6%

- long-term total return potential: 18.6% vs 10.2% S&P 500

- discount to fair value: 34% discount (potential very strong buy) vs 5% overvaluation on S&P

- PEG ratio: 0.76

- 10-year valuation boost: 4.2% annually

- 10-year consensus total return potential: 2.1% yield + 16.6% growth + 4.2% valuation boost = 22.8% vs 10.0% S&P

- 10-year consensus total return potential: = 680% vs 160% S&P 500.

These aristocrats are trading at 12.6X forward earnings.

How many aristocrats can you name trading at less than 13X earnings growing at almost 17%?

That’s the power of GARP aristocrat investing.

Read the full article here