By Bob Iaccino

At A Glance

- The primary use of equity options has always been hedging, a strategy that essentially acts as insurance

- With only a small initial investment, equity options allow a trader to control a much more prominent position in an underlying equity index

Have you ever looked at the financial markets, particularly at equity options, and wondered what purpose they serve beyond mere speculation? If so, you’re not alone. Let’s pull back the curtain on this financial instrument in order to truly grasp its various vital uses in the financial ecosystem.

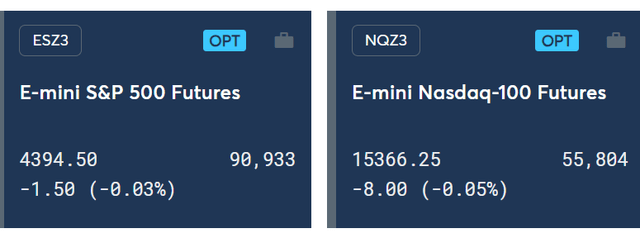

Options on futures are derivative contracts that give the holder the right, but not the obligation, to buy or sell a futures contract at a specific price on or before a certain date. Equity options refer to options on futures contracts based on equity indices (like the S&P 500, the Nasdaq-100, or the Dow Jones Industrial Average). This flexibility makes these options an invaluable tool for achieving various financial objectives and makes them well-suited for the following goals.

Hedging Against Risk

The primary use of equity options has always been hedging, a strategy that aims to offset potential investment losses. Suppose an investor anticipates a downturn in the market. In that case, they can purchase a put option on an equity futures contract, providing a safeguard if the market drops. It essentially acts as insurance, ensuring portfolio stability against market fluctuations.

In the middle of June, as my tech stock positions continued to profit, the Relative Strength Index (RSI) shot up well into overbought territory. Based on that, I began spending some of the accrued profits to buy E-mini Nasdaq-100 options puts, which started to pay dividends by mid-August.

Generating Income

A less volatile but sometimes more risky use of these options is income generation. By writing or selling options, traders can earn premiums. An “option premium” is the current market price of an option contract. If the market remains stable or moves in the anticipated direction, the trader retains the premium, enhancing their overall returns.

A similar situation took place for me with E-mini S&P 500 futures. The E-mini S&P 500 options continued to rally through July, but the RSI hit the same oversold levels that the E-mini Nasdaq-100 options did in June. In this case, however, since I was long on the outright E-mini S&P 500 options, I was able to sell call spreads once the RSI turned down and headed toward overbought territory, and covered them shortly after. This trade was strictly to generate income rather than to hedge and add that income to the gains I already had in my E-mini S&P 500 options position. One should never jump into selling options without educating themselves on ways to mitigate risk when using option contracts to generate income.

Harnessing Leverage

One of the main attractions of equity options is their leverage. With a small initial investment (the option premium), a trader can control a much more prominent position in the underlying equity index. This leverage comes at a cost (the premium paid), but buying calls or puts outright also has a limited-loss benefit. There are times in my risk-focused trading process when there is only a tiny amount of risk left in my futures portfolio where I will take advantage of the leverage in equity options. If I have a strong trade that triggers, but my total risk capital per trade isn’t available, I will buy call spreads or put spreads rather than outright calls or puts to lower the cost of the overall trade and harness the leverage that equity options provide.

Crafting Investment Strategies

Equity options are rife with strategies tailored for different market conditions. From straddles and strangles to ratio spreads and condors, these strategies can exploit market volatility, stagnation, or anticipated directional moves, allowing investors to position themselves optimally.

In 2022, when the markets were coming off their October lows, I bought several call butterflies in the E-mini S&P 500 options and the E-mini Dow. A call butterfly is when you buy one out-of-the-money (OTM) call, sell two further OTM calls, and buy one even further OTM call, all as one combined trade. These trades achieve maximum profit when the options expire, and the underlying future is precisely at the center call strike of the butterfly. The risk is limited to the premium paid for the entire trade. Some were profitable, and some were not, but I was able to craft a strategy that fit my theory at the time. The markets would rally, but the turnaround risk was still excessive.

Liquidity and Market Efficiency

CME Group Equity Index options are known for their around-the-clock liquidity. Deep and liquid markets mean trades can be executed efficiently without causing significant price distortions. This liquidity ensures traders can enter or exit positions quickly and with less slippage than illiquid markets.

Speculative Ventures

Sometimes equity options are used for speculating. When used correctly, equity options on futures offer a risk-controlled environment for expressing a speculative opinion for those with a higher risk appetite. Traders can take positions based on their predictions of market direction without buying the underlying futures contract. This approach allows for potentially high rewards, though it’s essential to remember that speculation can come with significant risks, even in equity options, depending on the structure of a trade.

This list is by no means the complete book of advantages of equity index options, and certainly, reading this piece doesn’t make you an options expert. But perhaps it’s triggered you to want to explore where this particularly clever and useful tool could fit into your active trader toolbox.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here