A Quick Take On FibroBiologics, Inc.

FibroBiologics, Inc. (FBLG) has filed to raise in a Direct Listing of its common stock, according to an SEC S-1 registration statement.

The clinical-stage firm is developing fibroblast-based treatment options for various serious medical conditions.

At the firm’s last private market valuation, the company is valued above the typical range for a biopharma firm at the listing date.

My opinion on the listing is to Sell [Avoid].

FibroBiologics Overview

Houston, Texas-based FibroBiologics, Inc. was founded to develop allogeneic fibroblast cell-based therapy approaches to the treatment of degenerative disc disease, multiple sclerosis and diabetic wound care.

Management is headed by founder, Chairperson and CEO Pete O’Heeron, MSHA, who has been with the firm since its inception in April 2021 and previously served in various executive-level positions at Christus Health Care Corporation.

The firm’s lead candidate, CYMS101, has received FDA clearance for a Phase 1/2 clinical trial for patients with degenerative disc disease, assuming approval of its master cell bank.

It is in the preclinical stage for treatments for multiple sclerosis and diabetic wound care.

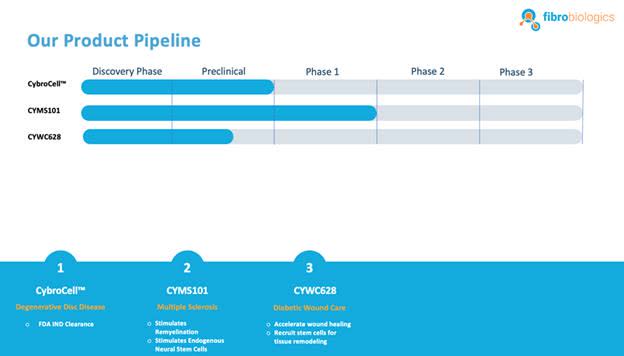

Below is the current status of the company’s drug development pipeline:

SEC

FibroBiologics has booked fair market value investment of $23.8 million as of June 30, 2023 from investors, including Golden Knight Incorporated and various individuals.

FibroBiologics’ Market & Competition

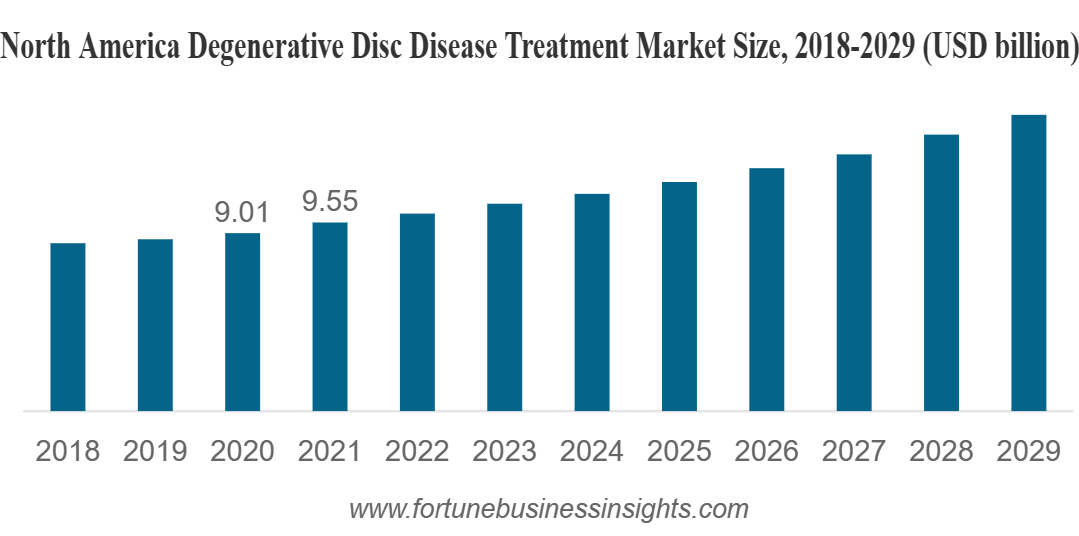

According to a 2022 market research report by Fortune Business Insights, the global market for degenerative disc disease treatment was an estimated $26 billion in 2021 and is forecasted to reach $45.9 billion by 2029.

This represents a forecast CAGR (Compound Annual Growth Rate) of 7.4% from 2022 to 2029.

Key elements driving this expected growth are an aging global population resulting in increasing incidence of the condition as well as growing research and development into solutions for patients.

Also, the chart below shows the historical and projected future growth trajectory of the market:

Fortune Business Insights

Major competitive vendors that provide or are developing related treatments include the following companies:

-

Aesculap Implant Systems, LLC

-

Novartis AG

-

Pfizer

-

Eli Lilly and Company

-

DiscGenics

-

Spine BioPharma

-

Ferring B.V.

-

Sanofi

-

TG Therapeutics

-

Apligraf

-

Grafix

-

DermACELL

-

TheraSkin

-

PolarityTE

-

Smith & Nephew.

FibroBiologics, Inc. Financial Status

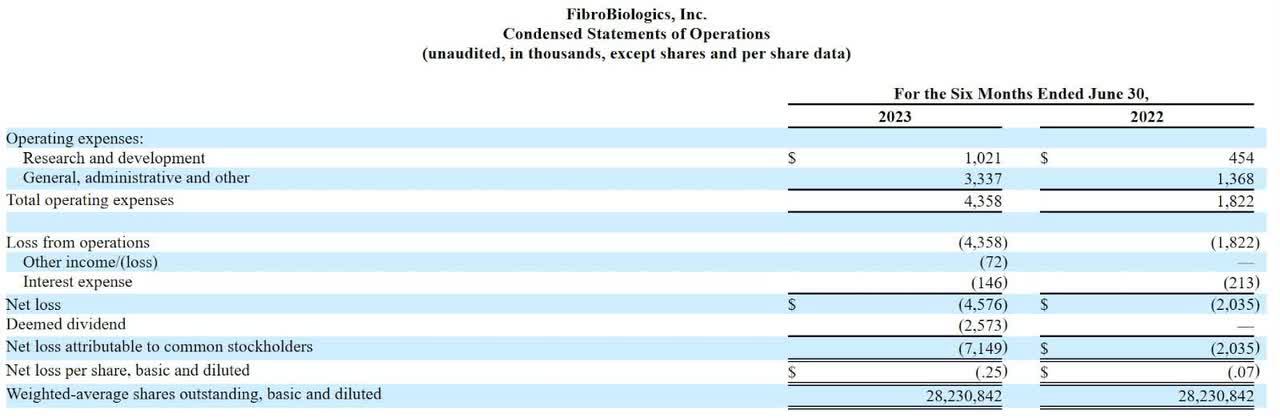

The firm’s recent financial results are typical for a development-stage biopharma firm in that they feature no revenue and material R&D and G&A expenses associated with its pipeline development activities.

Below are the company’s financial results for the periods indicated:

SEC

As of June 30, 2023, the company had $11.4 million in cash and $2.5 million in total liabilities.

FibroBiologics, Inc. Direct Listing Details

FibroBiologics intends to float its shares publicly from a Direct Listing of its common stock on the Nasdaq stock exchange.

In consultation with its advisor, Maxim Group, the company will publish a Current Reference Price for initial trading purposes.

No existing shareholders have indicated an interest in purchasing shares at the listing price.

The most recent private market price for the firm’s shares in a Series B-1 round was $18.00 per share.

Assuming a successful listing, the company’s enterprise value at listing would approximate $508 million, excluding the effects of underwriter over-allotment options.

The firm will not receive any proceeds from the sale of shares by existing shareholders.

Management will host an Investor Day and engage in various other investor meetings.

Regarding outstanding legal proceedings, management said the company is not a party to any material legal proceedings to the best of its knowledge.

The advisor for the listing is Maxim Group.

Commentary About FibroBiologics’ Direct Listing

FBLG is seeking to go public via a direct listing, which, for a biopharma firm, is highly unusual.

To my knowledge, it hasn’t occurred previously, at least on a major stock market.

The firm’s lead candidate, CYMS101, has received FDA clearance for a Phase 1/2 clinical trial for patients with degenerative disc disease, assuming approval of its master cell bank.

The market opportunity for treating degenerative disc disease is large and expected to grow at a moderate rate of growth in the coming years, but the company faces extensive competition from a variety of deep-pocketed pharma and medical device firms.

Management hasn’t disclosed any major pharma firm collaboration agreements or relationships.

The company’s investor syndicate includes primarily individuals and doesn’t include any well-known institutional life science venture capital firms.

As for valuation expectations, if the direct listing trades at a price of $18.00 per share, investors will be valuing FibroBiologics, Inc. at an Enterprise Value of approximately $508 million, which is above the typical valuation range for a mainline biopharma firm backed by highly-regarded institutional or strategic investors.

Given the likely high price of the listing and the oddity of it, my opinion on the listing is to Sell [Avoid].

Expected Listing Date: To be announced.

Read the full article here