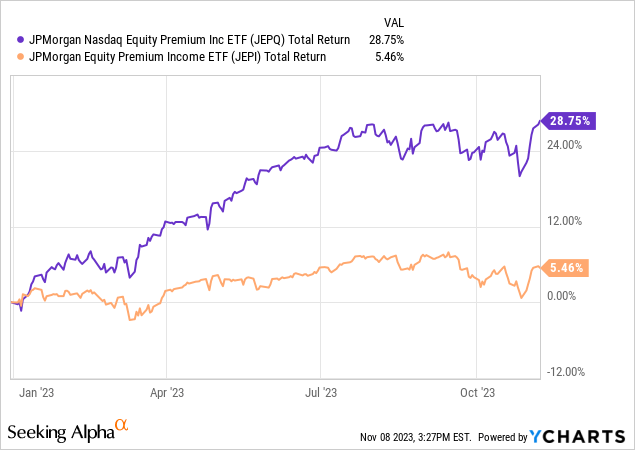

The last time I covered JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) several months ago (3 Reasons JEPQ Is Different From JEPI) I talked about how this fund is fundamentally different from JPMorgan’s other popular fund JPMorgan Equity Premium Income ETF (JEPI) and how investors could expect vastly different results from the two funds because at the time there was a belief that JEPQ is just a tech version of JEPI when in fact this wasn’t the case. When you look at the year-to-date performance of two funds, you can clearly see that these funds are not interchangeable and they are vastly different funds that are built differently and will perform differently.

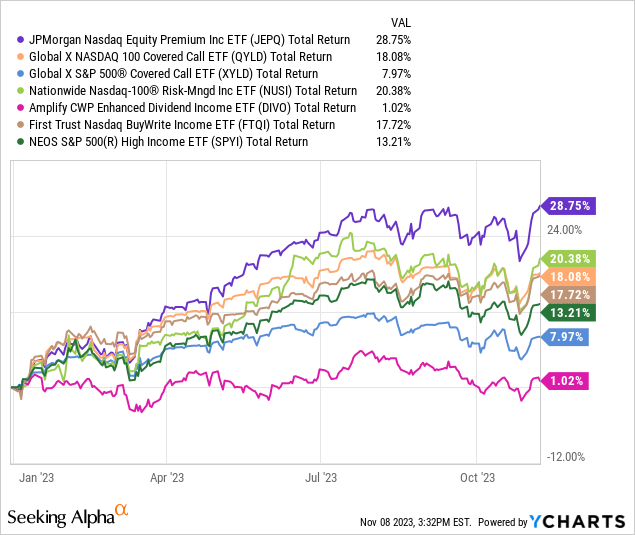

Having said that, JEPQ has proved to be one of the top performers of the year so far in its class. It outperformed not only JEPI but a majority of well-known covered call funds out there. One could simply say that JEPQ outperformed JEPI because Nasdaq outperformed S&P 500 in general but that doesn’t explain how JEPQ also outperformed many other covered call funds including Global X NASDAQ 100 Covered Call ETF (QYLD) and First Trust Nasdaq BuyWrite Income ETF (FTQI) which are also Nasdaq based.

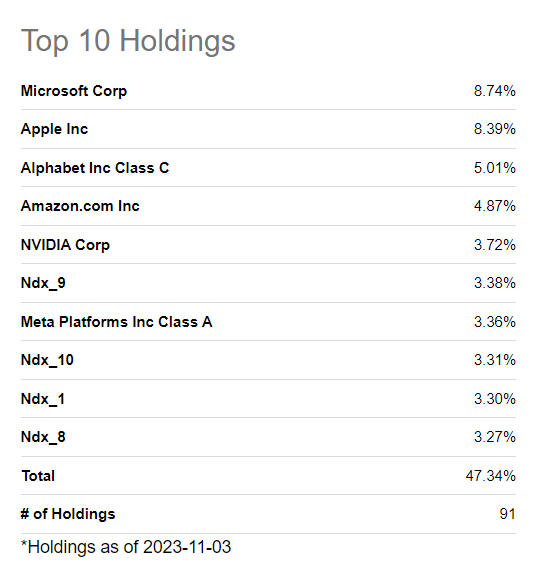

This fund’s strength comes from a few places. First, it holds big tech stocks that pretty much hold the market together such as Microsoft (MSFT), Apple (AAPL), Amazon (AMZN) and Nvidia (NVDA). These stocks have been outperforming the overall markets not just this year but for more than a decade. One thing that truly sets this fund apart from JEPI is that JEPI mostly holds low-beta stocks which tend to underperform markets during wild bull runs (and outperform during bear markets or when things get volatile) but JEPQ isn’t concerned about this at all. JEPQ mainly holds the biggest tech companies that represent Nasdaq most of which are highly profitable and posting solid growth. A vast majority of these companies enjoy strong margins, solid cash flows, low debt levels and balance sheets that prove strength.

Top 10 Holdings (Seeking Alpha)

Second, JEPQ is actively managed and it sells options about 2% out of money. This might feel like not a big difference but it matters over time. Selling options 2% above the current price can generate additional upside as compared to selling options right at the money by about 1.5% per month (not full 2% because you collect slightly less premium). This might not seem much but the difference can total up to 18% annualized without compounding and 19.6% with compounding.

Third, the fund is actively managed which can help a fund when done correctly (or hurt a fund when done incorrectly). Active management can make a big difference at times to a covered call fund even though the process seems very simple and straightforward (buy shares & write calls against them). The first part where you initiate the covered call position is the simplest part but then comes the management. What do you do if your stocks drop and calls you wrote lose most of their value? Do you roll down for additional premiums? What happens if your stocks suddenly have a rally and the options you wrote are not in the money? Do you buy them back? Do you roll them out for additional upside while giving up some of the premiums you’ve collected? These are decisions a fund has to make if it’s actively managed.

For example funds like QYLD and Global X S&P 500 Covered Call ETF (XYLD) are not actively managed. They use the exact same process every month no matter what. They write at-the-money calls exactly 1 month out and hold it until the end of the month no matter what the market does. For example, market could drop -5% overnight and those calls could lose most of their value which would provide an opportunity to buy them back and roll them down but the fund doesn’t do it. Similarly the market could rise 5% overnight and those options would lose most of their time-value which would mean that the max profit potential is already received since upside is capped but the fund doesn’t adjust its position either. JEPQ adjusts its position on weekly basis and rolls many of its option contracts which can give it an edge if done correctly. If a covered call reaches its full profit within its first week, there is very little value in holding the position for a whole month where there will be no additional upside but you still have the downside risk.

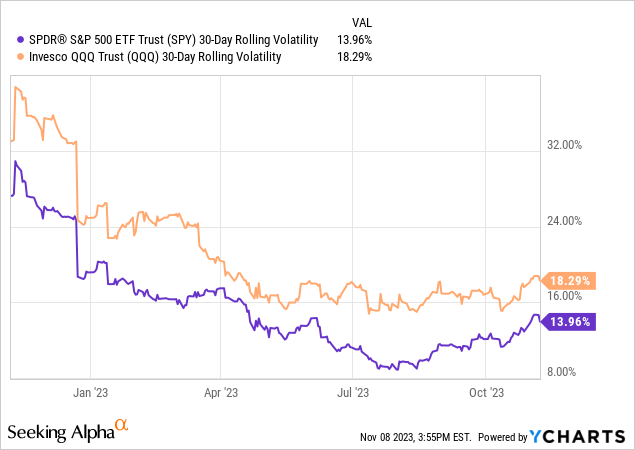

Earlier this year, one of the issues that affected most covered call funds was low volatility and declining VIX which caused many funds to reduce their distributions significantly because IV (implied volatility) is bread and butter of these funds and how they generate income. As IV dropped throughout the year, many covered call funds like XYLD saw their yields drop from 12% to 8%. JEPQ also saw its dividend yield drop but less so than others and the fund currently yields about 11-12% which is close to 1% per month. One reason is that the fund trades options on tech stocks so they tend to have a higher volatility than the overall market. For example, currently the 30-day rolling volatility for S&P 500 ETF (SPY) is 13.96% while it is 18.29% for Invesco QQQ ETF (QQQ). The difference may not look like much but it can translate into 30-40% higher yields when selling covered calls.

One could say that JPMorgan’s (JPM) covered call funds have been wildly successful and gained a huge followership. On a related news, Goldman Sachs (GS) recently launched its own version of these funds. These funds are Goldman Sachs Nasdaq-100 Core Premium Income ETF (GPIQ) and Goldman Sachs S&P 500 Core Premium Income ETF (GPIX). We will see if these funds will also see a similar success story or not but the fact that other investment banks are also joining the game shows that covered call funds are going to be here to stay and they won’t be just a fad as investors are going to be looking to generate high yield distributions fir income. Still, not all covered call funds are created equal and there will be winners and losers in this space just as every space.

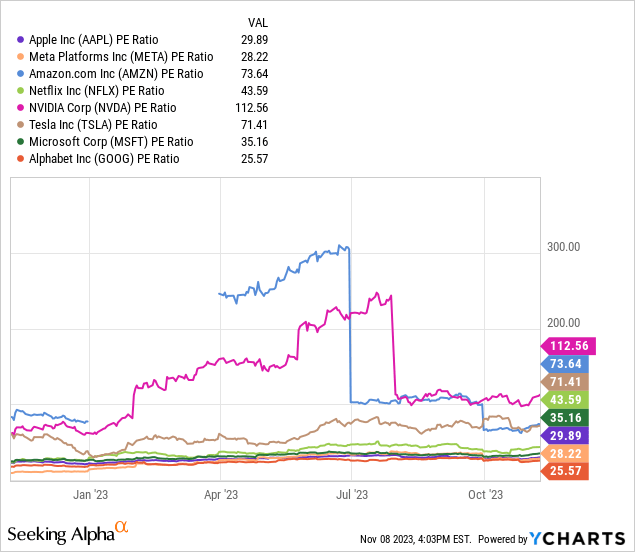

Having said that, JEPQ relies heavily on FAANG+ stocks and the fund’s success depends on these stocks. These stocks created outsized returns in the last decade as well as the last year but there is no guarantee that this will continue. In fact, we can say that this is probably the most expensive these stocks have been in a long time with their P/Es ranging from 25 to 112.

While JEPQ doesn’t rely on these stocks rallying in order to generate a yield (as it sells covered calls for that), it still assumes the risk of these stocks suffering from a sharp drop, correction or even a bear market. Investors should be cautious and know what they are putting their money into before investing in this fund. If they are looking for “value” stocks, or low beta stocks, this is probably not the best fund for them.

Read the full article here