Investment Thesis

LifeMD (NASDAQ:LFMD) is what I’ve called the “Phoenix Of The Health Industry”. Why? Because this business appears primed for yet another revival.

As you read through my analysis, you may believe that I’m being too risk-averse and wary of LifeMD. That I don’t “see the big picture”. And that is perhaps true.

But all I can do is go on with my professional experience. There are undoubtedly many very positive aspects in this earnings report. But there are also a few pesky detractions that keep me away from fully endorsing this business.

Nonetheless, altogether, I believe it’s positive enough that I can be tepidly bullish on this stock.

Quick Recap

As we headed into the earnings release I said,

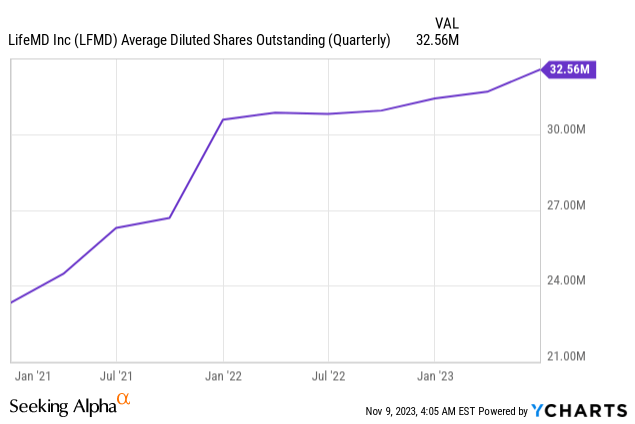

[LifeMD’s] valuation has tripled within a few months. Also, its share count appears to be rapidly increasing with time. That’s the bad news.

The good news is that LifeMD’s prospects appear to be gaining substantial traction. This stock has a long history of being a battleground stock. And, I don’t see this fact changing any time soon.

I stand by those comments. This is a battleground stock, led by a company with a history of being over-promotional. Consequently, even as I have a bullish rating on this stock, I recommend that investors approach this investment with caution.

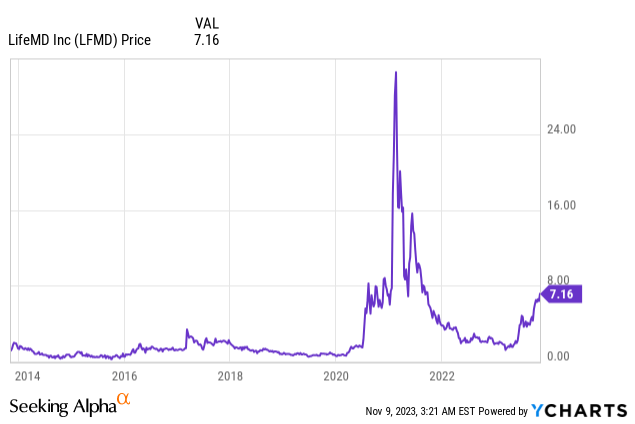

After all, in the past 10 years, this stock has frequently been susceptible to its fair share of bubbles and pops.

However, it appears that this time it’s different.

LifeMD’s Near-Term Prospects

LifeMD is jumping on board the latest GLP-1 crazy. This is a weight management drug.

During the earnings call, we heard how LifeMD is seeing subscriber retention rates of 80% to 90% after the initial period.

The company anticipates continued growth in this segment, expecting more than 100% sequential growth in the next quarter. Additionally, the company is planning to expand its offering by introducing new complementary products geared toward hormone replacement therapy, weight management, and cardiovascular health.

LifeMD’s telehealth operations, including its Virtual Primary Care business, have also contributed to the company’s success, with substantial revenue growth and an increase in the number of active subscribers.

Furthermore, the company’s subsidiary, WorkSimpli, has demonstrated strong performance and is expected to continue delivering solid results, with at least 20% CAGR in 2024.

As you may recall, WorkSimpli is a completely different business LifeMD holds that was previously focused on PDF solutions, but now has expanded towards HR solutions, e-signing, and as you’d expect, AI technology. There was even the allusion that LifeMD may consider selling this business at a premium at some point.

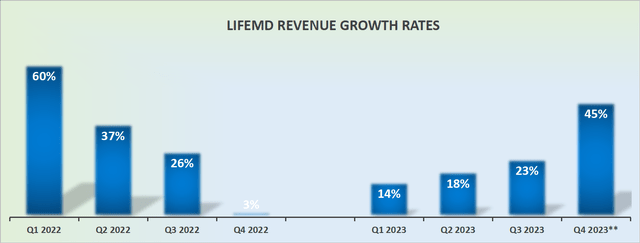

Revenue Growth Rates Expect to “Breakout” in 2024

LFMD revenue growth rates

Let me highlight a quote from LifeMD’s press release that succinctly describes its opportunity.

All of these factors continue to position 2023 to be a tremendous year for LifeMD while setting the stage for what we believe will be breakout performance in 2024.

Q4 was always expected to be strong, given that Q4 of last year saw practically no topline growth. That being said, I did not expect LifeMD to guide towards such strong revenue growth rates.

In my previous analysis, I said,

[…] if LifeMD ends up reporting around 25% CAGR in 2024, this is undoubtedly a very commendable growth rate. After all, LifeMD is now on a run rate of about $160 million in annual revenues. These are not small immaterial revenue figures. LifeMD is now big enough to be taken seriously.

Given LifeMD’s recent results and guidance, I believe that LifeMD could in actuality end up delivering around $185 million in 2024. This figure is a meaningful jump relative to my prior estimates. This could mean that in a few years, LifeMD could perhaps be able to sustainably deliver $250 million of annualized revenues. At that juncture, this small-cap starts to gain scale and become very interesting.

LFMD Stock Valuation — Difficult to Appraise

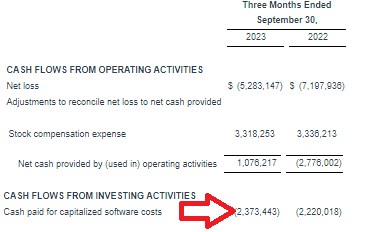

LifeMD capitalizes its costs. This means that even though it delivered strong EBITDA, which reached $2.8 million in Q3, the business was in fact free cash flow negative.

LFMD Q3 results

More specifically, LifeMD’s free cash flow was negative $1.4 million. What’s more, LifeMD continues to dilute its shareholders and this quarter brought in $900K from the sale of stock.

This translated into its total number of shares increasing by 11% y/y.

Note, the graphic above hasn’t been updated for its Q3 results, but we know that in Q3 LifeMD had 34.5 million shares outstanding.

All in all, I struggle to quantify LifeMD. It could be well poised for very strong returns in 2024, but at the same time, I find its accounting to be somewhat dubious.

The Bottom Line

In conclusion, while my analysis may reflect a degree of caution regarding LifeMD’s recent performance, there are undeniable positive indicators of growth and potential within the company’s operations.

However, historical factors, including the company’s propensity for over-promotion and the susceptibility of its stock to massive bubbles, warrant a cautious approach.

Despite these reservations, the company’s recent developments, particularly in GLP-1, along with its plans for expansion and strong revenue growth projections for 2024, present an optimistic outlook.

Despite the company’s historical fluctuations and the need for a critical eye on its accounting practices, I am tepidly bullish on this stock.

Read the full article here