By Ewa Manthey

Industrial metals continue to struggle

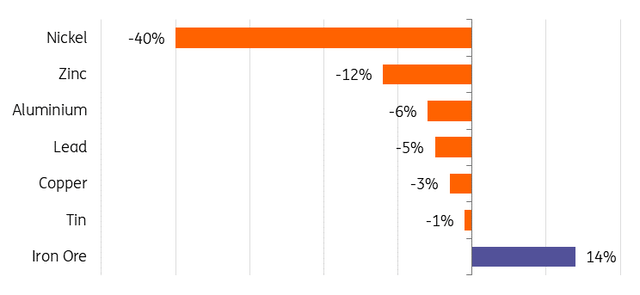

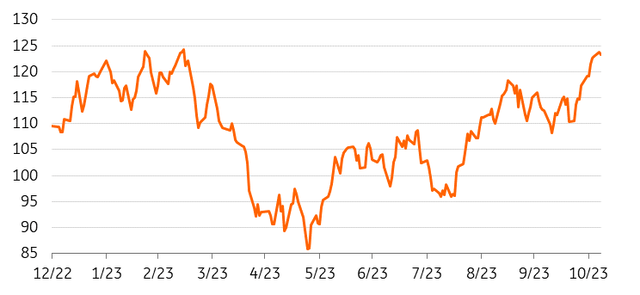

YTD metals performance %

LME, SGX, ING Research

Industrial metals have remained volatile so far in the fourth quarter, pressured by a strong US dollar and weak demand amid sluggish manufacturing activity globally. The uncertainty in the metals markets is far from over amid slow economic growth, geopolitical conflicts, and tight monetary policies.

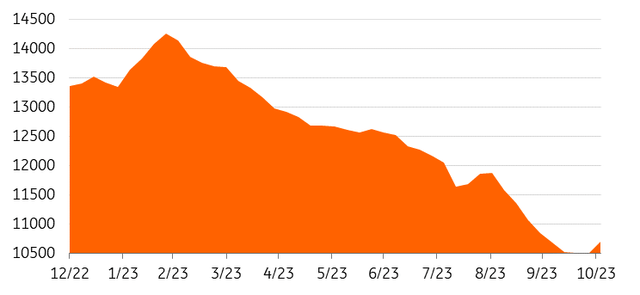

China’s recovery is still uncertain

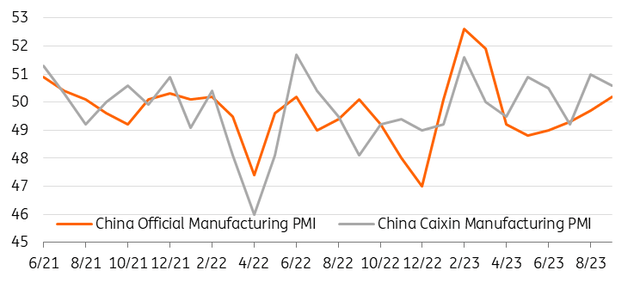

The most recent PMIs showed that after September, the momentum of the economy slowed in October, with the index returning to contraction territory. China’s recovery is still uncertain, and metals are likely to see some continued volatility for a while, at least in the near term. We still believe that until the market sees signs of a sustainable recovery and economic growth in China, we will struggle to see a long-term move higher for industrial metals.

China factory activity returns to contraction in October

China Federation of Logistics and Purchasing, ING Research

China’s property sector is still struggling

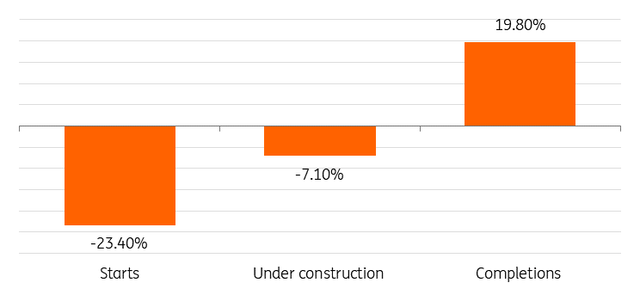

There are still concerns when it comes to China’s economy, particularly when it comes to anything related to the property sector, which accounts for more than a quarter of China’s economic activity, and is still struggling. This will continue to cap gains for industrial metals.

China property market shows little signs of revival despite stimulus

YTD, % growth

National Bureau of Statistics, ING Research

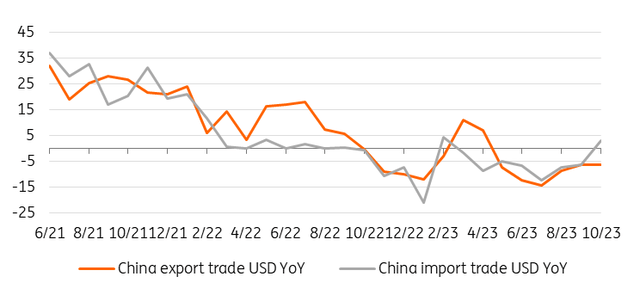

China’s exports fall more than expected in October

Weak external demand remains a challenge for the Chinese economy. Although October imports expanded 6.4% from the month before, exports fell 6.2% from September, which has underscored the fragility of the country’s recovery. A continuation of weak exports could weigh on the contribution of trade to GDP growth in the fourth quarter. Our China economist forecasts GDP growth of 5.4% for full-year 2023.

Weak external demand remains a challenge for the Chinese recovery

General Administration of Customs, ING Research

Iron ore surges despite China property gloom

Iron ore prices have managed to stay above the $100/t mark for most of the year. Prices have jumped more than 10% in the past three weeks and are now hovering around the highest since March. Over the last couple of months, the Chinese government has moved forward with a series of stimulus measures to turn around its ailing economy, which have supported iron ore. China’s recent issuance of 1 trillion yuan of sovereign debt is adding to the improved sentiment in the market.

Iron ore jumps to March high

SGX, ING Research

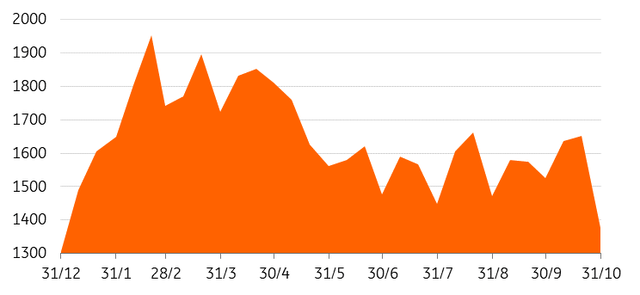

Iron ore stockpiles across China reach 7-year low

Iron ore stockpiles across China have reached a seven-year low as mills have been cautious about restocking amid property woes. We believe low inventories should support iron ore’s price at elevated levels.

China iron ore total ports inventory (10000 tonnes)

Steelhome, ING Research

10-day steel inventory of key steel mills (10000 metric tonnes)

CISA, ING Research

As well, in a sign, China’s struggling construction sector may finally be picking up, steel stockpiles in China fell sharply in October, down 16.6% at the end of October from mid-October.

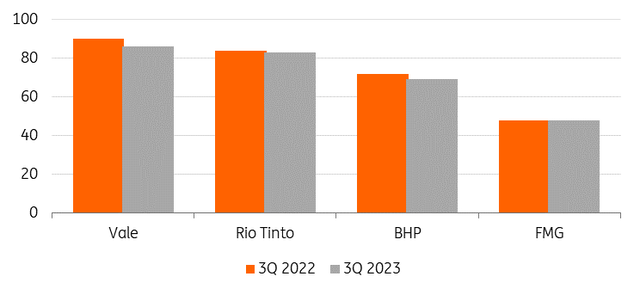

Meanwhile, slow iron ore supply growth has dampened the impact of China’s slowdown. The market is very balanced in the supply and demand sides. With the supply side largely stable, there will be demand in China that will continue to drive iron ore prices going forward.

However, we believe that the uncertainty around mandatory steel curbs will weigh on the outlook. After China’s steel output climbed to a record of more than 1 billion tonnes in 2020, the government responded by ordering production cuts in each of the next two years to cut back on emissions and match supply with demand. The intensity and the timeline of production cuts this year are still unknown, but any steel output cut would add to bearish risks for the iron ore market.

Iron ore production from major miners (million metric tonnes)

Company results, ING Research

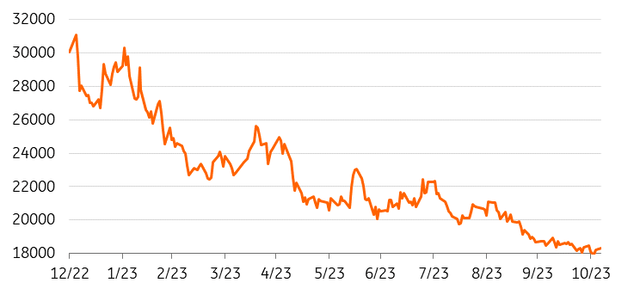

Nickel underperforms on bearish sentiment, rising stocks

Nickel has been the worst-performing metal on the LME so far this year, with prices down more than 40%, and is now trading at a two-year low. One of the key drivers has been the supply surge from Indonesia. Indonesia’s nickel mine production hit an estimated 1.6 million tonnes last year, up 54% from 2021, according to the US Geological Survey. That makes up nearly half of global nickel production that totalled an estimated 3.3 million tonnes.

Meanwhile, in China, the world’s second largest producer, Class 1 nickel output continues to expand. China’s refined Class 1 output is up 36% in the first three quarters of the year in response to historically elevated LME prices.

As well, EV sales growth has slowed, which means battery materials, like nickel, are likely to remain depressed in the near term. Batteries now account for almost 17% of total nickel demand, behind stainless steel.

We believe this underperformance is likely to continue, at least in the near term, amid a weak macro picture and a sustained market surplus.

LME nickel is down more than 40% so far in 2023

LME, ING Research

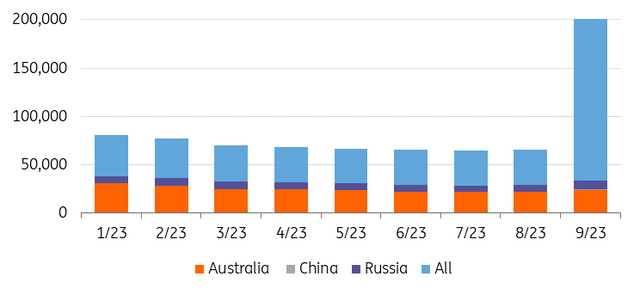

Russia-origin material increases in LME sheds

Meanwhile, LME nickel stocks have been rising amid inflows of Russian-origin material. In September, Russia-origin refined Class 1 nickel stocks increased by 2,268 metric tonnes to 9,226 tonnes. This compares to 6,756 tonnes in January this year. Russia-origin material is behind Australia-origin metal, which stood at 23,118 tonnes in September.

As well, 1,236 tonnes of China-origin material was delivered into LME warehouses in September. Although it accounted for only 3% of total nickel stocks on the exchange, this was the first arrival of China-origin nickel into the LME warehouses since the exchange started publishing the country of origin stock data report in January this year. The arrival also follows the approval of refined Class 1 nickel produced by Quzhou Huayou Cobalt New Material Co. Ltd., a subsidiary of China’s Zhejiang Huayou Cobalt Co. Ltd., as an LME-deliverable brand in July this year.

Share of Russian nickel in LME warehouses grows

LME, ING Research

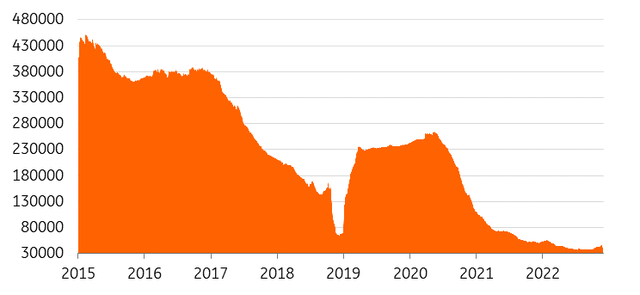

LME nickel stocks remain critically low

However, historically, LME nickel stocks remain critically low despite the recent deliveries. But we believe that the LME’s new initiative – which has reduced waiting times for approving new brands that can be delivered against its contract – could potentially increase inventories. We believe Chinese producers will continue to submit fast-track LME nickel brand applications. This will allow them to deliver their Class 1 material to LME warehouses.

There is a risk, however, that if European consumers continue to shun Russia-origin material, this could result in more Russian material being delivered into the LME warehouses. This would put downside pressure on nickel prices. Russia is the world’s largest supplier of Class 1 battery-grade nickel, accounting for around 20% of the global supply.

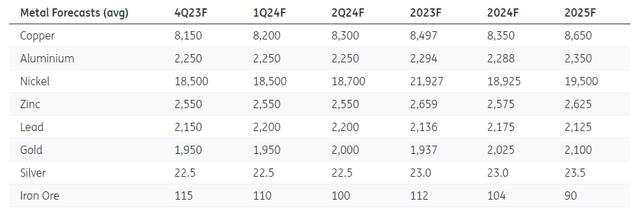

We forecast nickel prices to remain under pressure in the short term as a surplus in the global market builds and a slowing global economy mutes stainless steel and EV demand. Prices should, however, remain at elevated levels compared to average prices seen before the historic LME nickel short squeeze in March last year due to nickel’s role in the global energy transition. The metal’s appeal to investors as a key green metal will support higher prices in the longer term.

LME nickel stocks remain at historical lows

LME, ING Research

ING forecasts

ING estimates

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Read the full article here