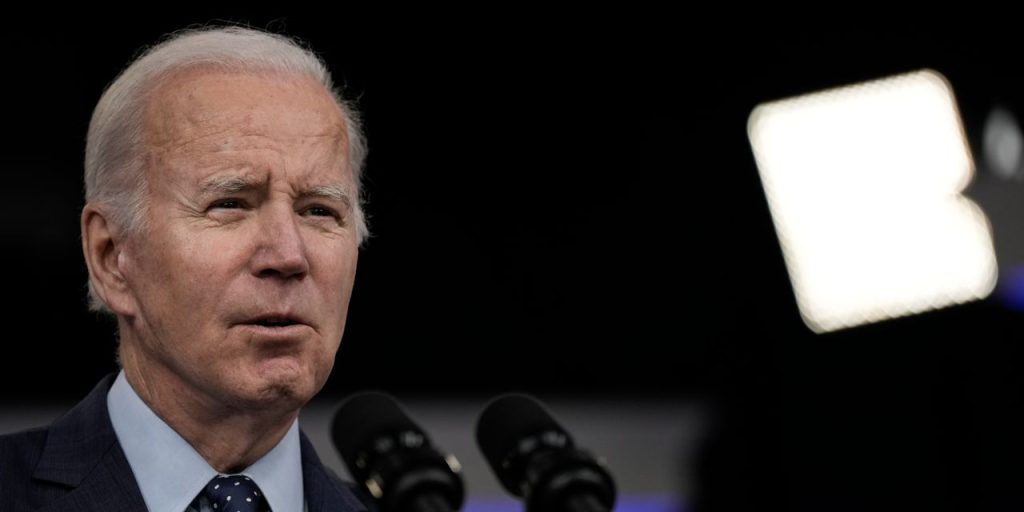

On Saturday President Biden, traveling in Japan for a meeting of the G-7, said he was “not at all” concerned about debt-ceiling negotiations in Washington, despite a tough Friday of talks between House Republicans and the White House. Maybe he should be.

Biden isn’t alone in his rather sanguine attitude. So far, markets have been relatively calm about a looming deadline to raise the nation’s debt limit by June 1, when the Treasury Department has indicated the U.S. would no longer be able to pay its bills. Big business also seemingly hasn’t asserted itself amid the negotiations, notes Joseph White, director of the Center for Policy Studies at Case Western Reserve University.

“At some level, debt-ceiling crises are like the boy who cried wolf: there’s been a bunch of them before and, yes, people believe that this time the wolf isn’t there—that the wolf has never been there,” says White. “It’s always been settled.”

But that doesn’t mean businesses and investors shouldn’t be worried about what’s to come over the next 10 days, White says. This time, there is less “centrist pressure” bearing on Republicans to avoid the economic risks of a default. In fact, the opposite may be true. Republicans are much less likely to be “shamed by potential supporters” and a political base that watches Fox, while mainstream media, in turn, has less influence to shame-and-blame than in the past. Those factors “make it much less likely they will concede this time,” says White.

Biden still seems optimistic about a deal getting done. On Saturday, he said these negotiations go “in stages” and that he believes “we’ll be able to avoid a default and we’ll get something decent done,” according to a White House release of his exchange overseas with reporters. On Friday evening, however, House Speaker Kevin McCarthy said on Twitter that “Washington doesn’t have a revenue problem—it has a spending problem.” For White, the current dynamic suggests that it’s unlikely a deal gets done without the Democrats conceding something.

“It’s hard to see how [McCarthy] gives in unless he gets something out of Biden,” says White.

That may be something the Biden White House can live with if caps on discretionary spending are small enough and can be fixed later.

But there’s a chance even that isn’t enough. White cautions that it seems that a much larger portion of Congress than ever before either wants a U.S. default, or doesn’t believe the consequences would be so bad. “[The] media environment and the political environment behind those people isn’t telling them they’re wrong, isn’t telling them it’s risky, isn’t blaming them for doing it,” he says. “If I had to predict—it’s not going to get raised.”

And only then will we find out if Republicans were right to be so cavalier with a U.S. default.

Write to Catherine Dunn at [email protected]

Read the full article here