Green hydrogen company Plug Power Inc. (NASDAQ:PLUG) released its third-quarter or FQ3 earnings this week. Are there any surprises with its underperformance and management’s attempt to explain it? I’ve covered PLUG several times, arguing why investors must be wary of the company’s track record in overpromising and underdelivering.

Moreover, Plug Power’s Q3 release came just one month after its investor update in October. Investors should recall that Plug Power telegraphed a $6B revenue outlook by 2027 with a gross profit margin of about 31.7%. In addition, the company maintained its $20B revenue target by 2030, which led to a momentary surge in its shares from its October lows.

However, astute investors who didn’t buy the company’s confidence likely cut their losses or sold the surge, as PLUG is now officially a penny stock (under $5) following its post-earnings hammering.

The battering is well-deserved, reminding the bulls trying to catch PLUG’s falling knife that they should have given up many moons ago. Some investors could question whether I have shares in a renewable energy stock. I do, but not through highly speculative, unprofitable, and cash-burning companies like PLUG. I decided to invest in market leader NextEra Energy (NEE) as my primary exposure to renewable energy plays, but not solely focusing on green hydrogen.

It’s important to consider that long-duration plays like green hydrogen have such immense execution risks as the thesis on Plug Power’s ability to scale its strategy has not been proven. While the company has demonstrated progress in material handling for its fuel cell solutions, the performance in Q3 was nothing short of terrible.

Accordingly, Plug Power reported revenue growth of just 5.3% YoY. The company stressed it faced significant challenges in hydrogen availability, leading to downtimes and “temporary outages across the hydrogen network caused significant problems.” In addition, it highlighted a surge in hydrogen prices that elevated its cost of production. However, Plug Power indicated that the situation has largely “stabilized, and many planned outages have diminished.”

Management indicated that such unexpected challenges should be mitigated as it brings its own production capacity online. These include the resumption of its Tennessee plant and Georgia facility by the end of 2023.

However, given the post-earnings hammering, I assessed that significant damage had been inflicted on investor confidence. Why? The company’s balance sheet also took a substantial hit in Q3, burning through about $400M of cash. As such, Plug Power is left with just $550M in unrestricted cash and short-term securities on its balance sheet, indicating an urgent need for financing can no longer be delayed.

The company highlighted that it’s still considering the most appropriate financing options to go ahead, as it “received multiple expressions of interest from potential funding sources with various terms.” Management stressed that it “expects to make decisions on funding sources in the near term.” However, investors are likely not convinced about a constructive deal structure in the current high-interest rate environment.

With Plug Power not expected to reach free cash flow profitability through FY27, the execution risks on its investment thesis have increased substantially with Q3’s terrible performance. Investors are urged to consider carefully why they continue to see merit in Plug Power’s recovery thesis, worsened by its unenviable record of underperformance (corroborated by Seeking Alpha’s Quant “D+” earnings revisions grade).

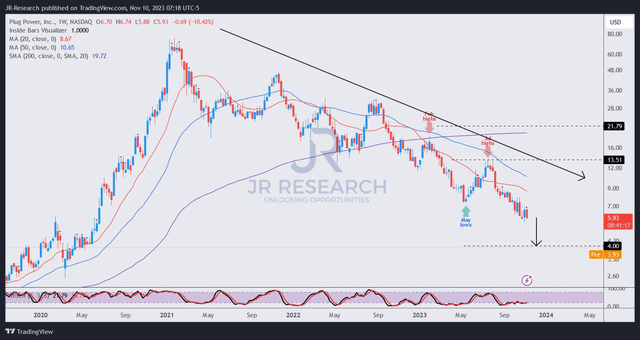

PLUG price chart (weekly) (TradingView)

PLUG has been a nightmare for investors since 2021, as it topped out resoundingly. In addition, once PLUG fell below its February 2023 highs, it also lost its pivotal 200-week moving average. Corroborated by PLUG’s lower highs and lower lows market structure, PLUG is clearly in a medium- and long-term downtrend.

Astute short-sellers likely used a resistance re-test against its 50-week moving average or MA (blue line) to reload their shorts. As such, I believe the steep selloff post-earnings should allow them to cover. Therefore, a potential short-covering rally could follow, but not one PLUG holders should consider following and buying.

I assessed that PLUG is a bottomless pit, with a further drop into the abyss increasingly likely. Investors should use the next bear market rally to sell most or all of their positions. It’s time to consider moving on from PLUG once and for all.

Rating: Maintain Hold

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here