Back in April, I wrote that Williams Companies (NYSE:WMB) had one of the most valuable assets in the midstream space in the Transco Pipeline, while in August I said that I thought the company’s second-half guidance looked conservative. The stock has returned about 20% since my initial write-up versus a 7% increase in the S&P. With the company recently reporting earnings, let’s catch up on the name.

Q3 Results

Earlier this month, WMB reported its Q3 results, with adjusted EBITDA up 1%, or $15 million, to $1.65 billion. Adjusted EPS was 45 cents, down -6%. Gathering volumes rose 6% year over year.

WMB’s Transmission & Gulf of Mexico segment saw its adjusted EBITDA rise 14.7% to $748 million. The results were helped by its MountainWest and NorTex Midstream acquisitions and favorable costs.

Its Northeast Gathering segment, meanwhile, saw adjusted EBITDA rise 4.5% to $485 million, helped by increased gathering rates and volume. The results were powered by its Ohio Valley Midstream JV, Cardinal system, Susquehanna Supply Hub, Marcellus South and Blue Racer JV.

Its West segment saw EBITDA decline -6.5% to $315 million, hurt by lower NYMEX-based rates in the Barnett. Its Gas and NGL Marketing Service segment saw adjusted EBITDA of $16 million versus $38 million a year ago. The segment is seasonally sensitive, and was hurt by less volatility versus a year ago.

WMB generated $1.230 billion in cash flow from operations, down -17% versus a year ago. Available fund from operations slipped -1% to $1.23 billion.

The company ended the quarter with leverage of 3.5x. It had a dividend coverage ratio of 2.3x.

WMB did some wheeling and dealing in Q3. It sold its Bayou Ethane system for $348 million in cash, getting a 14x adjusted EBITDA multiple for the asset, which is really good price. Meanwhile, it purchased the 50% stake in Rocky Mountain Midstream it didn’t already own from KKR, as well as acquiring gas gathering pipelines and two processing plants in the DJ. The two acquisition cost $1.27 billion, and were purchased at 7x 2024 adjusted EBITDA. The two deals are expected to close by year-end.

This was a steady quarter from WMB. Its base business grew about 6%, but some of the more commodity sensitive parts of its business did knock down year over year growth. That’s a small part of its business, but it can have an impact.

Meanwhile, it showed some nice strength in its Transmission and Northeast G&P business, while it made two acquisitions to strengthen its position in the DJ. Overall, it was a solid but unspectacular quarter.

Outlook

Looking ahead, the company guided for full-year adjusted EBITDA of between $6.6-6.8 billion. That compares to a prior outlook of $6.4-6.8 billion, a $100 million increase at the midpoint.

It is looking for adjusted income of between $2.175-2.325 billion, or $1.78-1.90 per share. That compares to a prior outlook of $2.05-2.35 billion, or $1.67-1.92 per share.

WMB has project available funds from operations of $5.075-5.275 billion. AFFO per common share is projected to be between $4.09-4.26. It expects its coverage ratio to be between 2.29-2.39x. Those projections are up from its previous outlook.

It is looking to end the year with leverage of 3.65x, and to grow its dividend by 5.3% for the year. That is unchanged from prior guidance.

The company continued to forecast between $1.6-1.9 billion in growth capex.

Company Presentation

Discussing growth projects on its Q3 earnings call, CEO Alan Armstrong said:

“The really big news this quarter comes in the new project’s call. We recently signed precedent agreements of over 1.4 Bcf a day for the Southeast Supply Enhancement project, which provides takeaway capacity from our Transco Station 165 to the fast-growing Mid-Atlantic and Southeast markets. And based on the open season results, we have even more demand to be met in the future that would result likely in a follow-on project. So we are proceeding into the permitting process for this initial project due to the urgent demands to be met for this first group of customers. So in terms of impact, this will be the largest addition of EBITDA ever for a Williams Pipeline extension, yes, even more than our Atlantic Sunrise project and, in fact, significantly more than the entire EBITDA generated from our Northwest Pipeline system. And I’ll remind you that these are 20-year contracts from the time the project starts up, which would be at least through 2047. And we recently signed anchor shipper precedent agreements for a Uinta Basin expansion on our MountainWest system. We continue to be very pleased with the successful integration of the Mountain West assets into our operations and the opportunities we see to execute on more profitable growth with this asset than we had originally planned on. In fact, this is the second piece of substantial business that we have signed up just this year on the MountainWest Pipelines. And neither of which of these expansions, neither of these were in our pro forma for this acquisition. So really pleased with the team from MountainWest Pipeline and the leadership we have working to grow that business, but very pleasantly surprised with that acquisition to date.”

When I last looked at WMB, I said the company’s 2H forecast looked very conservative, and typically the company sees seasonally stronger results in the second half compared to the first half, where it posted $3.4 billion in EBITDA. The fourth quarter tends to be its strongest quarter seasonally, so that the midpoint of its increased guidance is the same as Q3 once again tells me that its Q4 guidance looks conservative.

The bar for Q4 continues to look low to me. Meanwhile, the company looks like it has a lot of nice growth projects set to be completed by the end of this year and into Q1 of next year, that should help power 2024 growth. Its two acquisitions in the DJ Basin should also be a boost.

Further out, it has a number of steady projects set to come online between 2024-26. In addition, its Southeast Expansion project looks like a really nice growth project, although that is not expected to come online until late 2027, so it won’t impact results until 2028.

Valuation

WMB trades at 9.4x the 2023 EBITDA consensus of $6.72 billion. Based on the 2024 EBITDA consensus of $6.82 billion, it is valued at 9.3x.

The stock has an attractive free cash flow yield of about 9.9% based on my 2023 projections calling for $4.2 billion in FCF. The stock has a yield of about 5.1%.

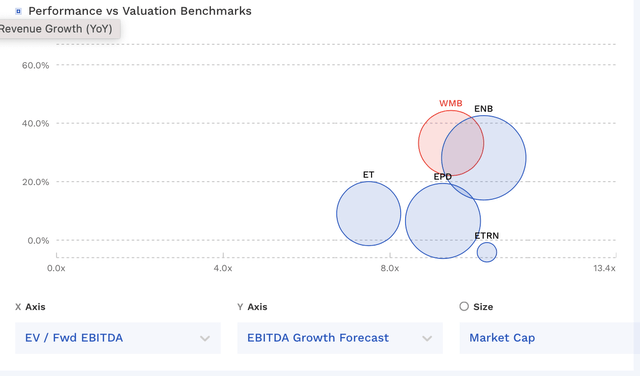

WMB trades towards the middle where other large midstream operates are currently trading. However, given how valuable its demand-pull assets in the Southeast are and the number of growth projects still ahead of it in the region, I think the company deserves to trade at a premium. Given its solid performance and increasing forecasts, I’m going to raise my price target from $42 to $43, which is still an under 11x multiple on 2024 EBITDA.

WMB Valuation Vs Peers (FinBox)

Conclusion

While it may not be one of the cheapest stocks in the midstream space, it arguably owns the most valuation pipeline in North America in Transco. The company is also able to use this pipeline to fuel further growth through related projects stemming off of Transco, with the Southeast Supply Enhancement project just being the latest example.

With a strong balance sheet, well covered dividend, and plenty of growth opportunities in front of it, I continue to rate WMB stock a “Buy.”

Read the full article here