Recently, things have been relatively good for the stock market.

Basically, the underlying feeling amongst investors is that the Federal Reserve will not be raising its policy rate of interest any further this year, and, in all likelihood, the Fed will begin to drop its policy rate once… maybe twice… next year.

So this past week, the stock market opened with “good feelings”.

I had written about this at the end of last week.

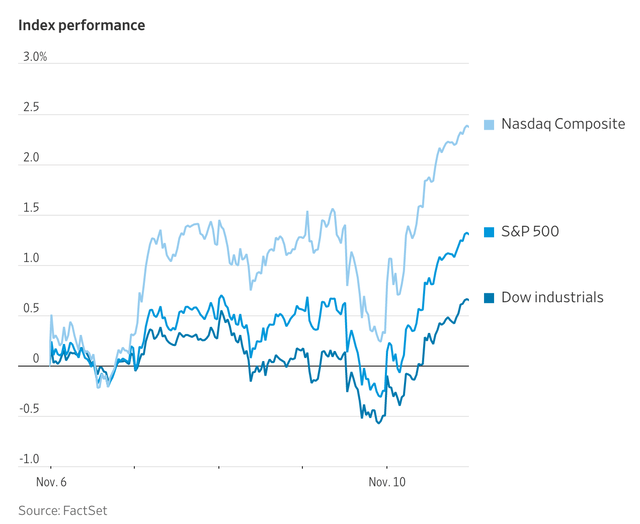

Index Performance (Fact Set)

By the end of ‘Wednesday, the NASDAQ index was up about 1.5 percent, the S&P 500 stock index was up about 0.5 percent, and the Dow Jones Index was up about 0.3 percent.

The NASDAQ was particularly “bouncy” as the outlook for technological companies seemed tied in with less inflation and a looser monetary policy.

But, then on Thursday, Fed Chairman Jerome Powell spoke and the week’s market rally softened.

All market indices were down.

The reason?

Mr. Powell suggested that maybe the Fed was not done with interest rates increases.

That was not what investors wanted to hear.

On Friday, investors were re-insured that the Federal Reserve thinking that there would be no more increases and that in all likelihood, the policy rate would be coming down next year.

To me, the week’s performance just reinforces the feeling that the investment community is primarily interested in what Federal Reserve officials are saying and what the Federal Reserve seems to be doing.

The Federal Reserve statistics came out at 4:30 p.m. on Thursday afternoon and everything seemed to be in place… nothing really seemed to have changed.

And so, on Friday, all three indexes rose by a good amount.

Furthermore, this is the way it probably will be for quite some time.

The Federal Reserve has captured the attention of the investment community and so is dominating the analysis of future stock prices.

Unfortunately, to my way of thinking, this is not the way it should be.

But, the is where Mr. Powell and the Federal Reserve have taken us.

So, I guess, we must live with it.

What is the stock market going to do?

Tell me what the Federal Reserve is going to be saying and what it might be doing?

Then I will give you my opinion.

Well, the bets are for a Federal Reserve that is not going to be raising its policy rate of interest any further this year and will probably lower the rate at some time next year.

If this is so… then, expect the stock market to rise.

All else?

It’s a world of radical uncertainty. Live with it.

Read the full article here