By Breakingviews

For Compagnie Financiere Richemont, not all that glitters is gold. The $65 billion owner of jeweler Cartier finally agreed to sell a portion of its struggling digital arm, Yoox Net-A-Porter, to high-end online marketplace Farfetch in August 2022. At the time, it looked like a savvy fix. But now, Farfetch’s slumping performance means the bling conglomerate could have a new problem on its hands.

Richemont’s negotiations with Farfetch to offload YNAP had already dragged on before it signed the deal. Securing antitrust approvals added further delays, and, to date, it still hasn’t closed. To clinch the sale of a 47.5% stake in YNAP, Richemont agreed to sweeten the package by committing to ensure its vendor would have at least $290 million in cash on its balance sheet and provide YNAP with a $450 million credit line lasting 10 years. The luxury goods giant also promised to sell its products on founder Jose Neves’ platform, using the U.S.-listed group’s technology to power its e-commerce operations.

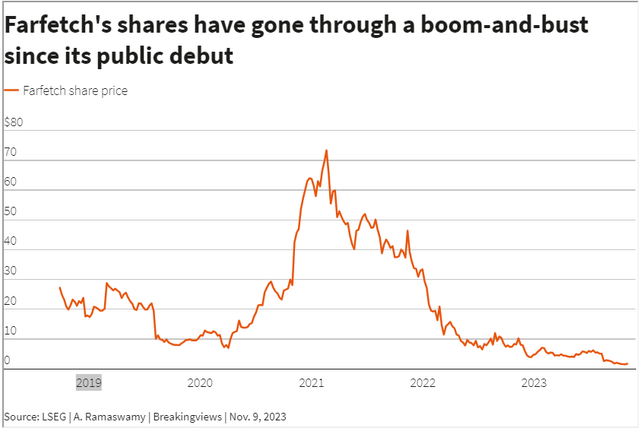

The already-generous concessions Richemont made look even more problematic today. The Swiss group agreed to let Farfetch pay for the YNAP stake with up to 58.5 million of its shares, which have tanked more than 80% in value since the deal was announced. The share payment is now worth less than $100 million against around $560 million when the deal was signed.

Farfetch, once a rising star among e-vendors, is on shaky grounds. With a market capitalization of just $564 million today, its finances looks stretched after paying more than that in 2019 to buy the parent company of fashion brands Off-White and Palm Angels, a strategic mismatch in its technology-focused business. Also, its decision last year to exit Russia, its third-largest market by sales, hindered growth. Meanwhile, luxury goods demand is slowing. With net debt of $1.1 billion, nearly 9 times its expected EBITDA for next year as per LSEG estimates, Farfetch’s borrowing looks outsized.

It’s unclear whether Richemont Chairman Johann Rupert can walk away from the YNAP deal now or renegotiate its terms. But going through as agreed looks problematic. Richemont’s online distribution would be subject to the cash-strapped platform’s ups and downs. And any hope that Farfetch would eventually pay an additional $250 million in shares and later exercise an option to buy the rest of YNAP looks increasingly unlikely. As a large Farfetch shareholder, Richemont may even find itself tempted to shell out more cash to rescue the market player it once thought could be its own savior.

Keeping YNAP might be a sunk cost for Richemont. But the bigger risk is that Farfetch’s woes become yet another headache.

Context News

The European Commission approved on Oct. 23 U.S. online marketplace Farfetch’s acquisition of a 47.5% stake in digital platform Yoox Net-A-Porter from its owner Compagnie Financiere Richemont. The deal has yet to close. Richemont agreed to sell the stake on Aug. 24, 2022. The $65 billion Swiss-listed owner of jeweler Cartier is set to report its latest financial results on Nov. 10.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here