2023 will be a big year for AbbVie. The company’s transition from a Humira-dependent enterprise to one with multiple green shoots is here. Is management’s years of preparation working?

AbbVie’s Q1 results

AbbVie reported Q1 results on April 27th, and the stock is down about 10% since. The big news, of course, is AbbVie (NYSE:ABBV) grappling with the loss of Humira revenues due to biosimilars.

We have known that Humira biosimilars are coming to the U.S. for years, but Q1 shed some light on how quickly these sales will evaporate and how quickly AbbVie can fill the void with Skyrizi, Rinvoq, Botox, and the rest. AbbVie has provided shareholders with total returns of 80% over the past three years, including the dependable, rising dividend. The company is performing without a safety net now.

It’s time to see if the current portfolio is ready for Prime Time.

How bad was the Humira fallout?

It is one thing to know it is coming and another for the market to accept the reality that AbbVie can no longer rely on this $20 billion per year drug. It’s an uneasy feeling, but the company is prepared.

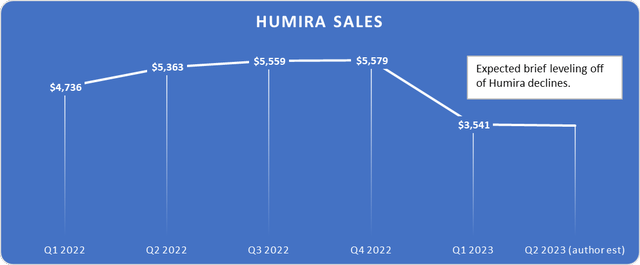

Humira sales fell sequentially 37% from $5.6 billion in Q4 2022 to $3.5 billion in Q1 2023. However, this was just a 25% fall YOY. The first quarter is typically slow for AbbVie as people grapple with changing insurance benefits. Management predicts a 27% YOY drop in Q2, slightly better than Q1 sales.

Data source: AbbVie. Chart by author.

Still, these sales will continue to evaporate, so it’s up to the new blockbusters to fill the gap.

Skyrizi and Rinvoq sales were up 46%; is it enough?

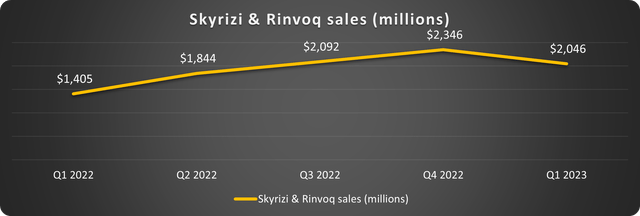

The company was pleased on the conference call with 46% combined growth in Skyrizi and Rinvoq, but the market wasn’t as impressed. We again saw a typical sequential decline from Q4, as shown below.

Data source: AbbVie. Chart by author.

Meanwhile, both drugs are gaining approvals in the US and abroad for expanded treatment options. Rinvoq’s recent indication addition is the seventh.

The combination of expanded treatments and the usual reversion to the mean in Q2 sales sets up the real possibility that AbbVie could surprise to the upside this quarter. Another 46% YOY increase would catapult sales to $2.7 billion. Management expects combined sales of $11 billion in 2023, setting up a big second half this year.

Aesthetics

Aesthetics had a rough time, which was expected given the challenging economy. Segment sales fell 6% from $1.37 billion to $1.30 billion YOY. This will be a tough year for growth in aesthetics, but this segment is still a long-term moneymaker, and the growth in Botox sales as a migraine solution is a bonus.

AbbVie Aesthetics has significant market opportunities in Japan and China, and March China sales bounced back after a COVID-related decline early in the year. This segment is fighting against some of the weakest consumer sentiment since the Great Recession and holding its own. This also reflects the economic reality that while many struggle with rising inflation, many prosper. I’m very bullish on AbbVie’s aesthetics portfolio over the long haul.

Neuroscience

Botox therapeutic sales outpaced its aesthetics sales ($719 million to $659 million) in Q1 on a 17% therapeutic increase. Neuroscience was strong across the board, with Vraylar’s 31% sales increase a standout. Keep an eye on Qulipta sales ($66 million in Q1), as it was approved for chronic migraine treatment last month.

Total neuroscience sales increased 14% to $1.7 billion in the quarter. AbbVie has a strong presence here moving forward.

Is AbbVie stock a buy after Q1 drop?

AbbVie paid down another $1.4 billion in debt and repurchased $2 billion in shares in Q1. AbbVie’s long-term debt is manageable, with maturity dates spread over the next 25 years, and nearly everything due through 2030 is at favorable rates below the cost of equity.

Dividend yield back to 4%

Even though the share price drop has pushed the dividend yield back to 4%, my minimum requirement given AbbVie’s moderate risk, I am not buying or selling.

In fact, the Humira uncertainty will probably put a ceiling on the stock price this year, so I am using this time to earn money selling covered calls in the $165 to $170 range when the stock rises.

For example, a November 2023 $165 call sold on May 1st for $4.40. It can be repurchased for just $1.90 today for a quick 56% gain which will likely increase.

Overall, shareholders should be pleased with the company’s results and long-term direction. Despite holding off on accumulating more shares and expecting volatility this year, I am still bullish on AbbVie stock as a core long-term dividend-growth position.

Read the full article here