Brookfield Renewable (NYSE:BEP) (NYSE:BEPC) is having a great 2023, its commons are up 22% since the start of the year and it recently reported dual beats on its fiscal 2023 first-quarter earnings. The yieldco generates long-term contracted revenue from the sale of its power and distributes the bulk of its income to its unitholders and shareholders. The yieldco last declared a quarterly cash dividend of $0.3375 per share, in line with its prior payout and for a 3.87% forward yield. The equivalent yield on the limited partnership units is 4.3% as they’re lower priced. Brookfield Renewable has remained resilient against wider concerns around the health of the US economy and a regional banking crisis that has weighed on other yieldco peers. Indeed, Clearway Energy (CWEN) (CWEN.A) is down 6.5% since the start of the year with Atlantica Sustainable Infrastructure (AY) down 5% over the same time period.

Hence, is Brookfield Renewable still a buy? It depends. The yield from alternative yieldcos is substantially higher and more compelling. Clearway currently offers a 5.3% dividend yield on its class A shares while Atlantica is yielding 7.11%. Further, Brookfield Renewable’s current price multiple relative to its operating cash flow per share for the last twelve months stands at 7.23x, this is versus 4.37x for Clearway and 5.92x for Atlantica. Hence, Brookfield Renewable is not cheap on a comp basis at its current price. The year-to-date rally has been abnormal against the broader market chaos sparked by a Fed funds rate hiked to its highest level since 2008 and a rate of inflation that still sits far above its historical average. However, bulls would be right to flag a business that has fundamentally evolved from a string of acquisitions that look set to drive Brookfield’s target to grow its dividend by 5% to 9% every year. The preferreds (NYSE:BEP.PA) offer an alternative 7% yield on cost and trade at a 25% discount to par.

FFO Growth Surges From Year-Ago Comp

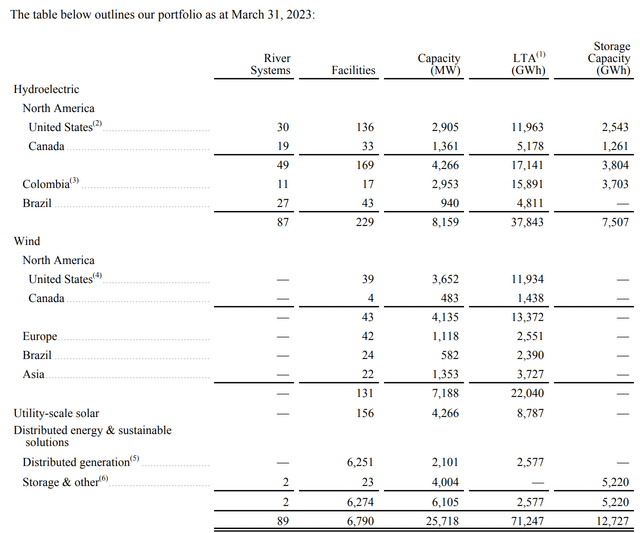

The $15 billion yieldco recently reported fiscal 2023 first-quarter results that saw revenue come in at $1.33 billion, a 16.7% increase over the year-ago quarter and a beat by $50 million on consensus estimates. This growth was pushed higher by inflation-driven price escalation across most markets and favorable hydroelectric generation. As of the end of its first quarter, Brookfield held 25,700 MW of operating capacity and annualized LTA generation of approximately 71,200 GWh. This was against a development pipeline of approximately 126,000 MW.

Brookfield Renewable Partners

The yieldco generated FFO of $275 million, around $0.43 per unit, and a 13% increase on a per unit basis over its year-ago comp. This also beat consensus estimates by $0.02. The hydroelectric segment generated FFO of $219 million with wind and solar generating an aggregate of $119 million in FFO against corporate costs of $106 million. Interest expenses did jump by 48% year-over-year to $394 million against Brookfield’s effort to grow through fixed-rate debt. Critically, the current quarterly payout forms a 78.5% payout ratio against the current FFO per unit.

Brookfield together with a consortium agreed to acquire Australian utility Origin Energy during the quarter for $12.4 billion. The deal will give Brookfield ownership of Australia’s largest integrated power generator and energy retailer and should see Brookfield invest $20 billion over the next decade to construct 14 GW of new renewable generation and storage facilities in Australia. Hence, the company continues to keep the growth ball rolling.

2023’s Returns Outlook

From a macroeconomic perspective, the rest of the year is likely to be characterized by the Fed’s more data-dependent approach to fighting inflation. The May FOMC meeting saw the Fed funds rate get hiked by 25 basis points and the market now widely expects the Fed to pause rates at its June FOMC meeting. Markets are currently pricing in an 82.6% chance of a pause, a development that would help broader stock market sentiment recover. This could set the backdrop for Brookfield’s valuation to potentially move higher. Overall, I think its yieldco peers look more attractive here. Any such improvement in stock market sentiment was inflation to continue to fall and the Fed to perform a dovish pause would likely see stronger positive volatility from both Clearway and Atlantica.

Brookfield Renewable owns and is building the infrastructure of a low-carbon world that’s being pursued by most of the world’s developed economies. There will need to be substantial investments into renewable energy production capacity over the next decade. The need for this has been emphasized by the 2022 energy crisis sparked by Russia’s invasion of Ukraine. I like that Brookfield has teamed up with Shoals (SHLS) to introduce a Charging-as-a-Service solution for electric vehicle charging infrastructure. This is a move that provides exposure, albeit marginal to FFO, to the secular growth of EVs. As one of the largest renewable energy companies, Brookfield Renewable has positioned itself in a strong position to fully ride the opportunities posed by the generational shift to low-carbon energy. However, I’m rating the stock as a hold against its current valuation versus peers.

Read the full article here