Thesis

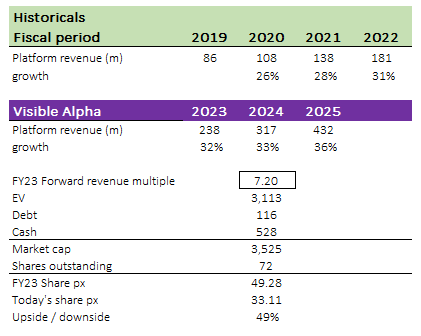

My original recommendation to long Schrodinger (NASDAQ:SDGR) has worked out well with the share price exceeding my original target price back in January. To reiterate the thesis highlight, the main value of the business comes from its computational platform that has extremely high value proposition that addresses the critical needs of biopharma companies. I believe SDGR deep experience and years of computing data are key differentiating factors for its software, which should allow it to continue capturing share. Overall, I continue to see SDGR’s software business as the key growth driver for the stock. It is apparent that SDGR is gaining a lot of market share, suggesting its offerings are resonating with organizations across the biopharmaceutical industry. I reiterate my buy rating for SDGR as I see visible catalysts ahead and the valuation is not super demanding yet at ~7x forward revenue, given its growth profile of >30%.

Updates

The results for 1Q23 that SDGR reported were in line with expectations. As I’ve mentioned before, the software segment is SDGR’s main focus because its value can be easily determined by investors and the market alike (there are no binary effects). Importantly, the software business is the only one generating meaningful revenue. Software sales for 1Q23 dropped 3% to $32.2 million for SDGR. While the headline decrease is concerning, I believe it is merely a matter of timing, as management explained that it was due to a lower-than-expected number of multi-year agreements being signed this quarter (probably just pushed back to the year due to a tougher funding environment). Importantly, management revised guidance in a positive direction, reflecting improved growth expectations. In particular, management stressed their optimism for the software platform in the back half of the year, when multi-year contracts are up for renewal and the possibility of new partnerships presents itself. Management has expressed optimism about the future of its software segment by pointing out the growing importance of their platform in the drug discovery process and the consistent preference of larger players for renewal, if not an increase in contract size, on the expiration of multi-year deals signed with them in 2021. The key word here is “back half”, which means we are less likely to see any impacts from these renewals in 2Q23. This also mean we will see strong sequential growth from 2Q23 onwards. That said, my concern is the current macro environment is forcing a lot of organizations to pull the plugs on investment activities, or to delay is. Indeed, management acknowledges the difficult funding environment faced by the biotechnology industry. ,My take is that, so long as the underlying structural is not impacted, it is only a matter of time before the demand will surface in SDGR P&L. As such, I’m not too concerned about the lackluster outlook for 2Q23 (revenue is anticipated to be flat sequentially).

Drug discovery might cause upside surprise

Although there were some positive developments and inputs in the drug discovery business in the most recent quarter, the company decided to maintain its previous guidance. Not being an expert in this field, I found myself wondering if the original $100 million target was too conservative, even if the guidance range did reflect management’s lack of insight into new business generation for the year. The company’s software operations have distracted management and investors from the value of the company’s biotech pipeline, in my opinion. Even though it’s binary, that doesn’t necessarily rule out success. Further upside surprise to the stock could occur in the next one to two years if software continues to perform well and the drug discovery pipeline begins to show good data. In fact, a catalyst could be the upcoming Pipeline Day in late September, which I expect management to share more information.

Valuation

I continue to see attractive upside for SDGR stock as the business has performed well, particularly its software business, which appears to be gaining traction. Furthermore, there are visible catalysts on the horizon that could drive even more momentum. I anticipate a strong surge in software revenue growth in the coming 2H23 as deals are renewed, resulting in a nice growth acceleration from 2Q23. Furthermore, the potential surprise from the drug discovery segment may be a potential surprise that the market is not placing much value on at the moment. Assuming SDGR trades at the same forward revenue multiple today at 7.2x, I believe the stock has an attractive upside from here. If revenue growth momentum can continue, I will not be surprised to see multiples rerate further from here.

own model

Risk

One of the key risks I see in SDGR stock is a slowdown in software revenue growth. While I believe SDGR product is gaining a lot of momentum and market share, the timing of adoption could be delayed by various reasons (recession is the most obvious cause). A slowdown in growth momentum would overwhelm all the other positives from success in the drug pipeline.

Conclusion

Despite a slight decline in software sales due to timing issues with multi-year agreements, management revised guidance positively, expecting strong growth in the latter half of the year. The challenging funding environment in the biotech industry is acknowledged, but I believe demand for SDGR’s offerings will eventually materialize. In addition, there is potential upside in the drug discovery segment, often overlooked in favor of the software operations. Positive data from the drug discovery pipeline could surprise the market. The upcoming Pipeline Day in September could act as a catalyst, providing more information. Considering the strong performance of the software business and visible catalysts ahead, I reiterate my buy rating.

Read the full article here