Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed Daimler Truck (OTCPK:DTRUY) (OTCPK:DTGHF) is well positioned to benefit from the secular trend of electrification in the commercial vehicle sector. I am reiterating my buy rating as I now believe growth will be much better than I initially thought, and that margin will expand at a much faster rate as well.

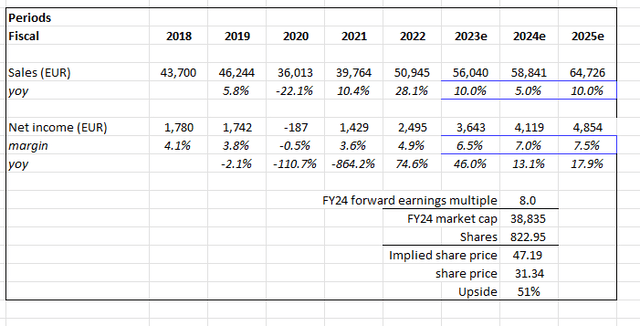

Financials / Valuation

DTRUY reported a robust 3Q23 quarter, with group revenue coming in at $13.86 billion. Contributing to the group’s revenue is NA revenue of $5.7 billion, Mercedes-Benz [MB] Trucks revenue of $5.4 billion, Asia revenue of $1.65 billion, Daimler Buses [DB] revenue of $1.18 billion, and Financial services revenue of $688 million. At the group level, adj EBIT came in at $1.34 billion, bringing the adj EBIT margin to 9.7%. Adj EBIT margin expansion was seen across all segments, except Financial services, with DB showing the highest step up in margin from 2.4% in 3Q22 to 5.9% in 3Q23.

Based on author’s own math

My last model update was in late October 2022. Looking over the past 4 quarters, DTGHF/DTRUY has outperformed my expectations by a huge mile, with FY22 revenue growth coming in at 28% vs. my expectation of 23.4%. Also, 9M23 performance has been outstanding, and management is guiding FY23 growth of 8.5% to 10%, beating my initial expectations of 2.6%. With the order growth, visibility, and pricing growth, I believe DTRUY can hit the high end of its guided range for FY23. However, given that backlog orders are normalizing, I expect growth in FY24 to be much slower than FY24, followed by a recovery in FY25. I have also increased my margin expectation as I see catalysts that should crystallize over the next few quarters that will drive margin upwards. However, for DTRUY, while my outlook is positive, I am not going to go against market expectations by assuming higher-than-historical-average earnings. I now assume DTRUY to trade at 8x forward earnings, its historical average as of 6th December 2023.

Comments

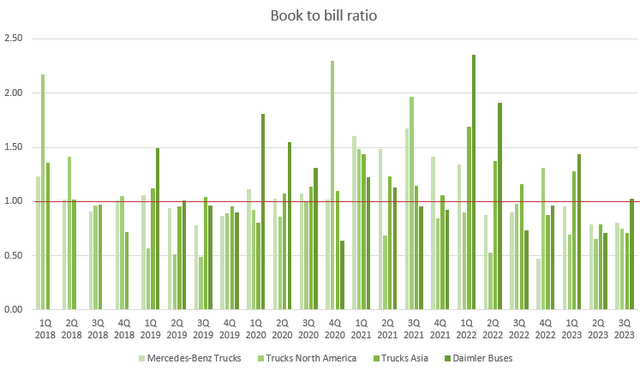

With the 3Q23 results out, I think the growth outlook is a lot clearer in the short term for DTRUY as orders growth is normalizing. In 3Q23, group orders declined 27% y/y to 99k units, largely driven by North America, where orders were down 26% y/y. Orders in Asia were down 44% y/y due to softer demand in Indonesia and China. However, management stated that it sees end markets only slightly down next year, which implies strong sequential improvements from 1Q24 onwards. Specifically, they mentioned that absolute volumes will be decent next year and described end markets as sunny. I am giving management credit for their confidence, as they have very strong visibility into the FY24 backlog. Importantly, the normalization of delivery timing should help bring the book-to-bill ratio back close to 1, which helps with the timing of revenue recognition.

We know the order backlog for the first and second quarter and looks extremely well. Secondly, it was during my entire life in the trucking industry, normally you order and then you want your truck latest about three months later. Source: 3Q23 earnings

Based on author’s own math

The other leg of the growth equation is pricing, and the pricing environment remains very favorable towards DTRUY, with no signs of easing. To be specific, the entire industry is facing very strong inflationary pressure, driven by higher wages and supplier charges, which is pushing pricing higher. The total cost of ownership depends on the cost of hydrogen and electricity. With both of these showing no signs of slowing down, I believe the inflationary pressure will continue in the near term. Importantly, the pricing surcharge appears to be well accepted by customers, as cancellations remain rather low and there has been no unusual rise in cancellations.

Summing up the topline outlook, orders should remain strong in the near term, with pricing tailwinds continuing. As such, I believe DTRUY should continue to see margin expansion as well. Based on management’s comments, the pricing growth is actually margin-accretive (not just enough to cover the cost headwinds). I don’t see a reason why this dynamic will change if there is still room for pricing to continue increasing (customers are not cancelling orders). Aside from pricing, there are also three other catalysts that should crystallize in FY24. Firstly, DTRUY saw elevated costs due to the integration and ramping up of new markets in Europe. These cost investments should ease in FY24 as the initial cost layout is accounted for in FY23. Secondly, DTRUY should continue to see further fixed cost savings (3Q22 earnings call) from the MB trucks segment as they continue to work through the integration. Lastly, the supply chain issues faced in North America during the quarter should ease, as the issue was isolated to one supplier and not a systematic one. As such, I believe they will be able to find a way to work around it.

Risk & Conclusion

As mentioned above, pricing is a key driver for growth and margin expansion. While customers are still accepting the price increase, the risk is that customers will start to reduce orders because of excessive price surcharges. This would impair near-term growth and margin expansion potential. The worst case is if the industry cuts prices together to win orders.

My buy rating on DTRUY remains unchanged. DTRUY performance so far has exceeded my expectations with strong revenue growth and margin expansion across segments. Despite normalization in order growth and backlog timings in FY24, pricing remains favorable, contributing to continued margin expansion. I also expect easing cost structures in FY24, due to reduced integration costs and improved supply chain conditions.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here