Thesis

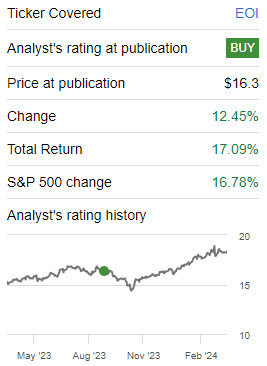

We last covered the Eaton Vance Enhanced Equity Income Fund (EOI) eight months ago in this article, where we outlined for readers why we believed at the time the CEF was a better alternative to an outright S&P 500 purchase and our view on the name. Our thesis was delivered, with the targets on positive price move and discount narrowing met:

EOI Rating (Seeking Alpha)

Since our article, EOI outperformed the SPY, while equities markets rallied hard.

In this article we are going to focus on correlations and year-end targets for the S&P 500 and outline why at today’s juncture entering EOI is no longer attractive, thus downgrading the CEF to a ‘Hold’ rating.

Historic correlations are attractive

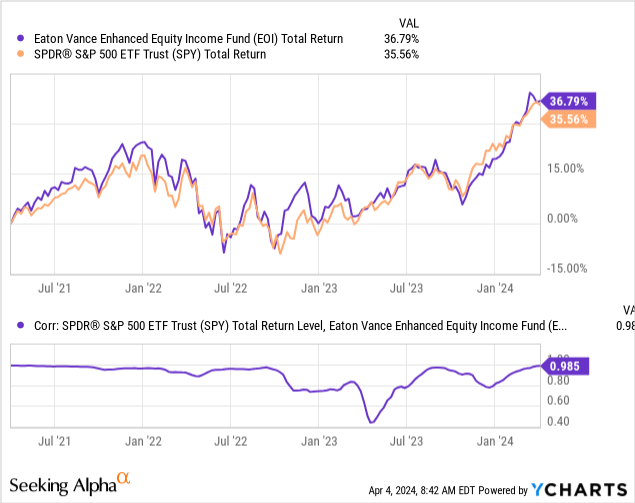

We liked EOI as a proxy for the S&P 500 because of its build and historic correlations:

The first panel of the above graph shows the total return levels for SPY and EOI in the past year, and we can observe the very close levels and movements. The second panel shows a correlation analysis run by YCharts, where we can see the correlation factor being close to 1 for the two tickers (currently at a 0.985 level). A correlation factor of 1 (or 1:1), simply means the two tickers move in sync.

A number of equity buy-write CEFs have trailed the SPY by significant margins in the past year due to their build. The more coverage for a portfolio via options, the greater the lag. This is due to the low VIX environment experienced, where investors do not get optimally compensated for the written options.

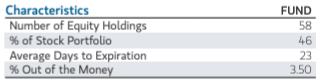

EOI covers less than half of its portfolio with calls, and has a greater-than-usual OTM strike level:

Portfolio Coverage (Fact Sheet)

Only 46% of the equities were covered via calls as of the latest fact sheet, while the ‘out-of-the-money’ percentage stood at 3.5%, meaning the upside for every month is 3.5% before the upside is capped. This set-up beats most of its peers, which have written calls with a high delta, very close to the current spot levels.

The EOI build has proven itself to be the most resilient one throughout various economic cycles, with the market assigning a lower-than-usual discount to this strategy when compared to its peers that cover more of their portfolios.

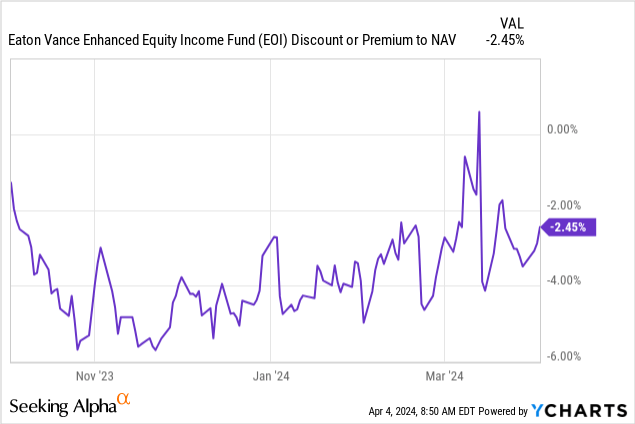

Discount has narrowed

Another factor that prompted us to assign a buy rating to EOI when compared to the SPY was its discount to NAV:

We can see how the CEF exhibited a wide discount to NAV of close to -6% late last year, but the respective discount has narrowed significantly. The attractive part of a well-correlated equity CEF is the discount to NAV metric. In a risk-on environment, it is bound to narrow versus historic norms, usually targeting flat to NAV.

We have seen most of the move in the discount already occurring, with only a meager -2% left to reach flat to NAV. From a structural perspective, this fund analysis is no longer helpful and puts us in the ‘Hold’ bucket for the CEF.

Year-end targets have been surpassed

We have shown in the above sections how well correlated EOI is with the S&P 500. The best way to think about EOI is as a way to extract dividends from the S&P 500, all while its risk factor is the SPY performance. If SPY falters, EOI will falter as well. To that end, we are going to have a look at the year-end targets for the SPY coming from a number of large banks.

JP Morgan put out their yearly ‘Market Outlook 2024’ in December 2023, a document which you can find here. In terms of the year-end target for the SPY, they have 4,200:

JPM Target (JPM)

Please note that we have already hit the JP Morgan target, all while they did mention they had a downside bias in the price they put out. That should give most investors pause since JPM has been very good at their pro forma targets.

Goldman has a more ambitious year-end target for the S&P 500, but his one has been surpassed as well:

GS Target (Bloomberg)

We have recently surpassed the Goldman 5,200 level as well, with the markets on fire in Q1 2024. While nobody can predict the markets, it is notable that large investment banks’ year-end levels have already been surpassed. We are either going to keep grinding higher or have a correction to cool down the price action.

One thing to be aware of is the propensity of many bank analysts to ‘chase the market’, hence making year-end predictions more reliable. If the market keeps grinding higher, do expect large banks to revise their expectations up, just purely out of price action rather than conviction. Nobody wants to have a price target that is 10% lower than where the market is currently. Revisions during the year are not as helpful since they reflect a chasing of the market rather than conviction research.

A good example of ‘chasing the market’ is represented by BofA:

BofA Target Revision (Reuters)

Bank of America thus recently revised its year-end target from 5,000 to 5,400 as the S&P 500 powered through their initial target levels.

Conclusion

EOI is an equity buy-write CEF. The fund has a robust build that covers less than 50% of its portfolio via calls and exhibits an almost 1:1 correlation with the S&P 500. The market has rewarded the fund with a low discount to NAV, which has narrowed even further since our last article. This CEF’s discount can be freely traded given its history. We liked the name better than the SPY when we wrote our last article, given the pick-up from the unusual discount to NAV. That metric has now closed down, and the fund has outperformed the SPY since our last article came out. We feel the SPY is stretched here, having surpassed most year-end analyst targets, and no longer feel EOI is an attractive security to buy. We are therefore downgrading the name to Hold.

Read the full article here