Overview

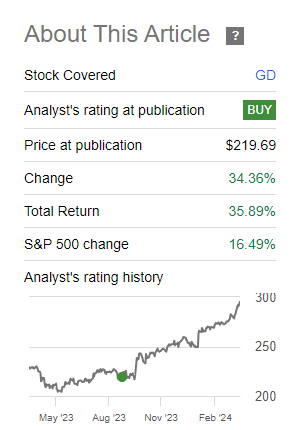

General Dynamics (NYSE:GD) is a defense and aerospace company with global operations. Their I previously covered this dividend aristocrat back in September of 2023 and since then the total return has outperformed the S&P500 (SPY) by double. However, I still believe there to be ample price growth despite the new highs because of the company’s strong financials.

Seeking Alpha

The current dividend yield is only 1.92% but GD is a well established dividend aristocrat, having increased their dividend payouts for over 29 consecutive years. Since my last coverage, the dividend was raised by 7.6% to continue this streak. Based on my dividend discount calculations, the price is also undervalued with additional upside to be captured.

While I am normally like to focus on companies that have a higher starting yield, I believe GD to be one of those companies that still deserve a spot in a dividend growth portfolio. The consistent price appreciation and dividend raises make it a good neutralizer that adds an ample amount of total return to your portfolio. The company is also well-diverse and actively growing their different streams of revenue.

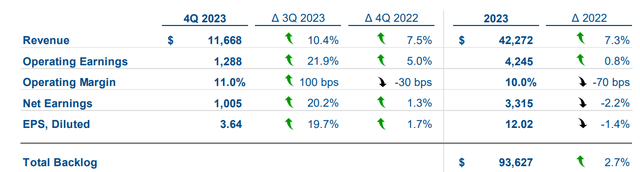

Record Revenues

As of GD’s Q4 earnings report, they raked in an all time high of $42.3B in total revenue for the fiscal year of 2023. For Q4 alone, revenue was $11.7B which is a large increase of 7.5% over Q4 of the prior year. Operating earnings also increased to $4.2B for but this increase was much smaller, accounting for a 0.8% growth over the prior full year. Net earnings and EPS (earnings per share) slightly decreased but there’s no concern here as I believe the strong backlog of contracts should bolster these numbers over 2024.

GD Q4 Presentation

For example, GD was recently awarded with a $311M contract for maintenance, modernization, and repairs of the USS Bataan. The work on this is expected to be completed by May of 2026 so this means that GD has increased revenue by approximately $155M per year for the next 2 years. This contract is only one of many, with GD having a large backlog of future revenue streams. Total 2023 backlog amounted to $93.6B across all segments of the business. For context, General Dynamics operates across 4 main segments.

- Aerospace

- Combat Systems

- Marine Systems

- Technologies

Each one of these segments saw an increase in revenue which means the business is firing on all fronts and growing their reach. Within the aerospace segment, aircraft services revenue increased by 8% and orders exceeded $10B for 3 consecutive years in a row. The combat systems segment saw the highest level of revenue and earnings ever over the last decade with over $9B in orders, earning over $595M in different awards over Q4. Marine systems experienced a record revenue of $12.5B which represents a 12.9% growth over the prior year. Lastly, the technologies sector was the tamest but still experienced low single digit growth with full year revenue increasing to $12.9B.

I realize the price currently sits at all time highs but this is while the company simultaneously brings in all time high levels of revenue. The revenue is likely to remain growing as the backlog of contracts build up. These backlogs basically tell us that they have a ton of work and ongoing interest in their services for the future. It’s essentially like getting a guaranteed that you will be employed for another year. For example, their Aerospace segment had so many pending orders that the amount totaled $3.2B for Q4. This is a 4.8% increase in backlog activity since last year.

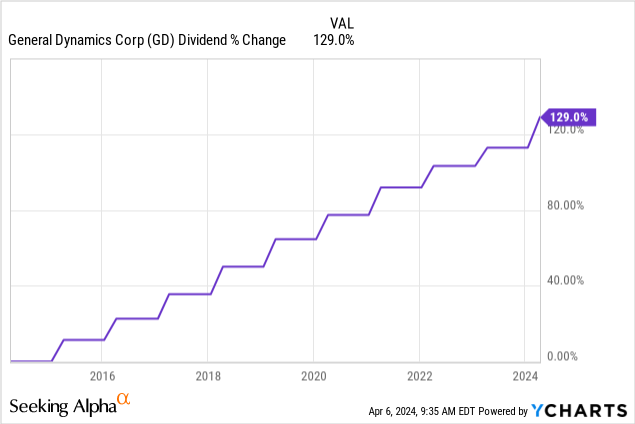

Dividend

As of the latest declared quarterly dividend of $1.42 per share, the current dividend yield remains quite low at 1.9%. As I previously mentioned, I usually shy away from low yielding stocks like this but the dividend growth and total return potential is so strong here that I believe it deserves a spot in any dividend investor’s portfolio. The dividend has been increased for over 29 consecutive years, making this an established dividend aristocrat. We can see that the dividend has increased by 129% over the last decade.

The dividend growth has also been quite solid with an average five year CAGR (compound annual growth rate) of 7.26%. This means that if you held for the last 5 year period, your yield on cost would now be above 3%. Suddenly, the low starting yield doesn’t seem that bad! Zooming out to a longer period of time still shows us solid growth. The ten year dividend CAGR is 8.95%.

The dividend can absolutely continue growing at this rate as well when you consider all of the backlogs and record breaking revenue. The current dividend payout ratio is only 44%, which does sit higher than the sector median of 24.35% but this is no cause for concern. This is because they have an interest coverage ratio of 9.29x and cash from operations totaling $4.7B. I imagine that as time passes and they continue growing revenues, the payout ratio will decrease over time and become more aligned with the sector median.

The cash from operations totaling $4.7B is equivalent to 142% of net earnings and shows that GD has an ability to convert revenue into cash efficiently. As a result of their cash management, free cash flow over the last quarter increased to $3.8B as well so it’s safe to say that I am not worried about continued dividend growth or any threat that would cause the dividend to get reduced.

Valuation

According to the average Wall St. price target of $298.74, the stock currently trades around fair value. However, I anticipate a rating upgrade here as the company continue to pull in stronger revenues than ever before. The already high level of backlogged work continues to increase and the free cash flow continues to grow. This free cash flow can be used to research and develop new products and services which would then result in more revenue.

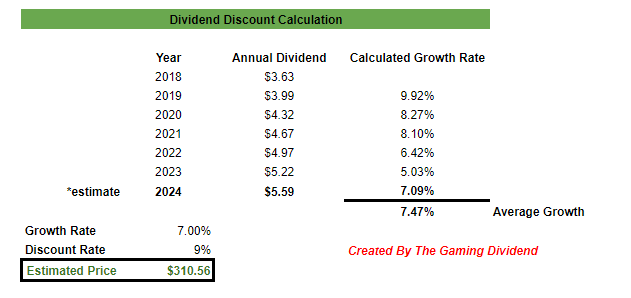

I thought this would be a good opportunity to run a dividend discount calculation to get my own estimated price target. I first started by compiling all of the dividend data dating back to 2018. I then used the estimated annual dividend payout of $5.59 for 2024. I input an estimated growth rate of 7% since this is around the revenue growth as of last quarter and this also aligns with the average dividend growth rate since 2018.

Author Created Dividend Discount Model

As a result, I think a price target of $310.56 per share is reasonable based on these metrics. This price target presents a potential upside of about 6% from the current levels. When you combine this was a dividend yield of 1.9%, you are looking at about a solid 8% growth rate from the current price level. Although this doesn’t seem like a huge upside, we have to remember that GD is currently pulling in record revenues across all segments and backlogs continue to increase. The financial picture and valuation can change and improve if this growth continues over the next few quarters.

Risk

The risk with GD remains that the majority of their revenue comes from the government contracts they are awarded. If we enter a time where global conflict slows, we would see less of this record breaking revenue and fewer contracts rewarded. Therefore, General Dynamics stays vulnerable to shifts in government spending on maintenance, repairs, and supplies. Although it seems like there is always some sort of conflict across the globe, there may extending periods of peace where the services of GD and military defense contracts aren’t in high demand.

Second, as the price sits near all time highs it’s fair to stay cautious. Any downward momentum of revenue growth over the next few quarters has the potential to have the price moving back down. If you do not believe GD is able to maintain the same momentum, it would be fair to wait on the sidelines to get a better price entry.

Takeaway

General Dynamics (GD) serves as a great choice for investors looking to capture a superior total return. Despite the low starting yield of 1.9%, the consistent dividend growth is where the value lies. The dividend has been increased for over 29 consecutive years which makes this an established dividend aristocrat. The dividend has grown at an average rate of 7% and this has the power to significantly increase your yield on cost over time. Their cash management gives me confidence that the dividend can continued to be increased over a long period of time.

In addition, the business is pulling in record levels of revenue throughout each of the four segments of their business. This is due to higher contracts rewarded, increased demand globally, and a growing backlog of work that needs to be serviced over the next few years. Despite the price being near all time highs, I believe there is still some modest upside that remains based on my dividend discount model.

However, GD does remain vulnerable to government spending since a lot of their revenue comes from government contracts. Any reduction in defense budgets and shifts in priority can leave us with a decreasing revenue.

Read the full article here