The iShares Preferred and Income Securities ETF (NASDAQ:PFF) is one of the largest preferred share ETFs with almost $15 billion in AUM. PFF tracks the performance of ~450 preferred and hybrid securities (i.e., subordinated bonds for which the issuer has the optionality to postpone coupon payments without triggering chapter 11) that are issued by U.S. corporations. Also, because of its size and the fact that the asset manager here is BlackRock, the net expense ratio is relatively low at 0.46%.

Now, if we look at the underlying holdings of PFF, we will recognize a rather diverse picture.

First, the Top 10 allocations account for around 12% of the total exposure, which is indicative of solid diversification. Most of these securities are related to the financial sector with the exception of AT&T (NYSE:T) and NextEra Energy (NYSE:NEE) that are considered well-established defensive and/or value plays.

BlackRock, Inc.

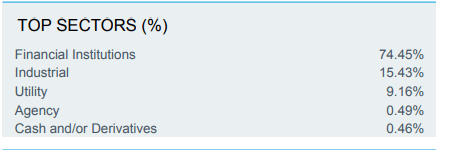

Second, not surprisingly given the Top 10 dynamics, we can see how PFF is extremely concentrated in the financial space, which represents about 75% of the total AUM. The rest is distributed primarily between industrials and utilities.

BlackRock, Inc.

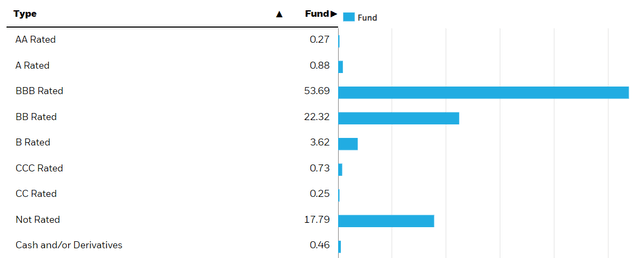

Third, more than half of the securities fall inside the investment credit rating range. The remaining allocations are spread somewhat evenly between BB (just one notch below the IG) and not rated categories. On the latter, it is important to emphasize that having no rating does not necessarily imply that the security is overly risky or even that it is below the IG. In this context, we have to also remember that these credit ratings reflect the opinions of credit rating agencies about specific securities (i.e., security level opinions) and not the credit risk of the underlying issuer. Usually, the issuer embodies at least one notch stronger credit rating than its securities.

BlackRock, Inc.

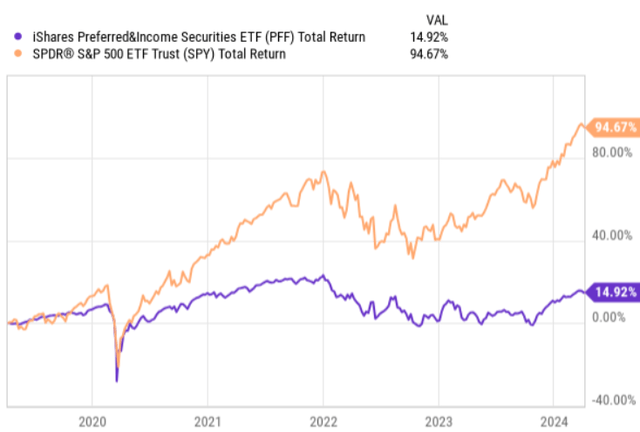

Looking at how PFF has performed since the pandemic, we don’t see great results, especially if we compare it to the S&P 500.

YCharts

The chart above depicts how PFF actually experienced steeper losses in the early days of the pandemic than the S&P 500 despite the seemingly more defensive profile that should stem from the preferred security holdings. Also, PFF has not participated in the recovery process at all (or to a very minor extent), while the equity markets have really surged higher.

With all of this being said, let me now outline my thinking on why I consider PFF an interesting option to include in investor portfolios.

Thesis

There are three aspects that together substantiate my buy thesis.

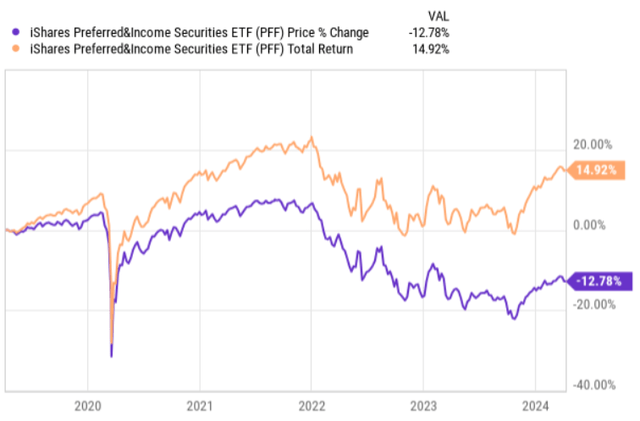

First is the enticing entry point, as of now PFF still trades ~13% below the pre-pandemic level.

It is clear that such a situation is attributable to the fact that we are now in a more restrictive interest rate territory that imposes downward pressure on fixed income (including preferred shares and hybrids) securities. However, at the same time, the underlying yield of PFF has gone up materially, to a larger extent than what is driven by the drop in the share price, as many holdings have an attached variable interest rate component. As a result, PFF’s yield has increased from ~4.2% in the pre-pandemic period to 6.3% now.

YCharts

Second, if we couple the aforementioned aspect with the forthcoming interest rate normalization, the story of PFF becomes more attractive from the price appreciation perspective as well. While PFF has some floating rate securities in the portfolio, the lion’s share is still located in fixed rate instruments, which have a notable duration factor.

As many of my readers already know, I tend not to venture into speculative investments, which also include timing investments based on how macroeconomic variables evolve. Yet, in this case, it is not that important whether the interest rates decrease this year two times or just one time, or even do not drop at all.

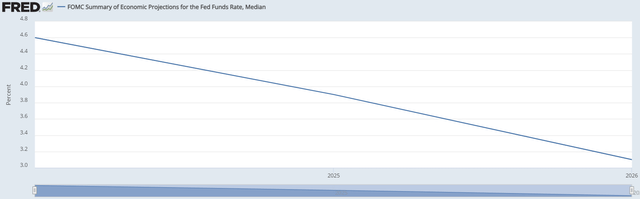

As long as the interest rates have peaked and are set to come down a bit over the foreseeable future, PFF should benefit significantly. In my opinion, such a structural scenario is very realistic and conservative considering the FOMC dot plot below.

FOMC; St. Louis Fed

The third aspect which has to be appreciated when contemplating on whether to go long PFF are the defensive characteristics of the fund.

The point I made earlier in the article on how PFF had suffered steeper losses than the equity market during the early days of the pandemic has to be contextualized with the dividend distributions, which for PFF remained fully intact. Namely, this drop was not so much driven by the credit risk, but rather investors removing their capital from non-traditional yield instruments and instead parking the capital in high IG or risk free securities. Given that PFF and preferred instruments per se are small size, coordinated and large scale capital outflows automatically create a more elevated stress on the prices (i.e., liquidity effect).

Yet, if we take a step back, PFF is per definition a safer vehicle than pure play equities as the preferred and hybrid securities rank higher in the capital structure and have to be serviced first before equity holders receive their dividends. This in combination with strong diversification at the security level, bias towards large cap names, robust credit profile and solid track record of delivering consistent monthly dividends sends the right signal for investors, who seek predictable income.

The bottom line

The iShares Preferred and Income Securities ETF could be viewed as an enticing diversifier into yield-seeking investor portfolios. It offers a more defensive exposure than average equities do, while still providing an attractive yield of ~6.5%.

On top of the yield attractiveness, PFF also embodies a meaningful price appreciation potential that is related to the embedded duration factor in its structure (stemming from fixed income like exposure). In the context of already peaked interest rates and sooner or later decreasing SOFR, PFF is nicely positioned to benefit, while distributing enticing streams of current income.

Granted, there are some risks involved here as well such as concentration in financials and the magnified sensitivity to interest rates, where in the case of a sudden interest rate hike, PFF would suffer considerably. Also, a systematic distress in the financial sector would trigger notable repricing to the downside of PFF. However, it seems highly unlikely that the interest rates go up from here, and experiencing similar problems to what we had in the GFC seems like a very low probability as well due to tighter regulations and stable performance across the board even considering the recent struggles with several issuers.

For all of the above reasons, in my opinion, PFF is a buy.

Read the full article here