By Samantha McLemore

A Differentiated View on Diversification

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.” – Misquote by Charles Darwin

Patient Opportunity Equity strategy advanced 11.8% net of fees in the first quarter, beating the S&P 500’s (SP500, SPX) 10.6% gain. Large cap growth and quality led the market. The smaller-cap Russell 2000 advanced only half as much, 5.2%. The strategy performed well despite our broad all-cap exposure.Since I took over sole management of the Strategy at the end of 2022, it’s gained 53.8% net of fees vs. 39.6% for the S&P 500 and 23.0% for the Russell 2000. Our 41.14% annualized net returns clearly can’t continue. A lucky accident of the calendar resulted in a start date that closely coincided with the market bottom.We aim to deliver double-digit returns over the long term, which we believe should outperform the market from here. We’ve delivered better in an internal strategy I’ve managed since the end of 2014. While higher current valuations are likely to lead to lower future market returns, we think a recovery in the traditional “classic value” segment (approximately 58.3% of the current net portfolio) should help us. We still see some pockets of the market that remain deeply undervalued and unloved. We think our flexible, opportunistic style will be an advantage.Classic value, defined as low accounting multiples, possesses a superb long term track record. According to Fama and French data, stocks possessing the lowest quintile of P/Es produced average annual returns of 15.1% since 1951, besting the S&P 500’s 11.0% returns and crushing the highest P/E’s 9.4% returns.After suffering one of its worst periods ever from 2007 through the middle of 2020, classic value seems to have been mostly abandoned or ignored. Many may not have even noticed its recent comeback. Since the end of 2020, the lowest P/E quintile stocks averaged 12.0% per year vs. the S&P 500’s 10.0% and the highest P/E stocks’ 5.0%.Low multiple stocks’ recent outperformance might surprise you given talk of the dominance of the Magnificent 7. These darlings have continued to lead, up 16.5% on average over the period but the gains didn’t come at the expense of classic value’s recovery.The improved performance coincided with the popping of the Innovative Disruption Bubble, best represented by Ark Innovation ETF (ARKK). In the 3 years leading up to 2020, ARKK delivered +52% average annual returns! In typical fashion, money chased performance and was sucked away from other areas. In the 3 years following 2020, ARKK returns were -25% per year. Investors, markets, and companies have rationally resumed prioritization of cash and profits. We expect this to continue.

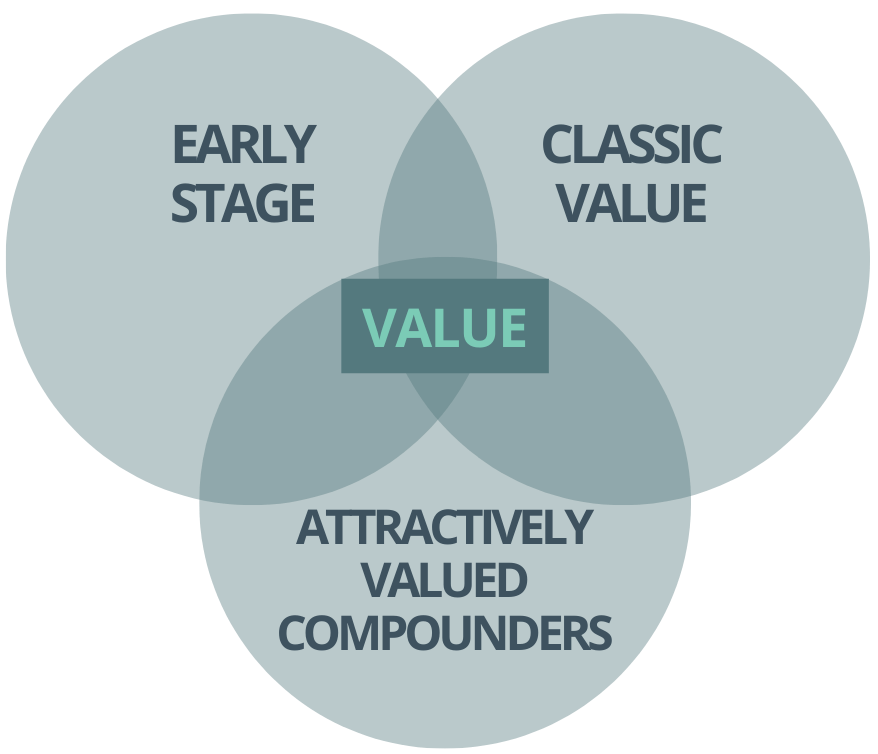

One of the benefits of our approach to value investing is versatility. We believe it can succeed in a variety of investing environments. We define value traditionally, as the present value of future free cash flows. We analyze the fundamentals of businesses to determine intrinsic values. Unlike most others, we also attempt to quantify long-term market expectations. What is the market telling us a company can grow and earn? We then seek clear disconnects between market expectations and fundamental business values. In a competitive market, these opportunities are difficult to find.Most often, we find unreasonably low expectations in areas of panic and controversy, as stock prices move far more than business values. We also find them in new areas not yet as well understood by Mr. Market. We seek to diversify types of undervalued opportunities between attractively valued compounders, classic value, and earlier stage companies. Gains stem from patiently compounding and opportunistic flexibility.Compounders tend to be market leaders whose advantages are well understood by the market. We seek to invest in attractively valued ones. Those aren’t easy to find! More than ever before, people recognize the power of investing in a “wonderful business at a fair value”, as Charlie Munger said. Demand and, thus, prices are high. We find these opportunities during growth scares (like recently at Illumina), or because the market may not reflect the long duration growth potential (like Amazon) creating a time arbitrage opportunity.The low multiples of classic value stocks signal low market expectations. Many times, the discounts are well deserved. Low valuations stem from perceived problems, like a deteriorating business, a turnaround, cyclicality, broad market malaise or something else. We want to be selective and invest in ones we believe the market misunderstands.Many of our lower multiple names tend to be cyclical businesses. Secular deterioration creates value trap risk. We mostly steer clear. While we love low market expectations, we want strong business fundamentals. We don’t see cyclicality as a significant long-term problem. The market’s short term, myopic focus on volatility can create amazing opportunities in cyclical companies. We especially like to monetize volatility in this group.JPMorgan (JPM) is our best example. We’ve owned it for over a decade. I wrote about it in the fall of 2011 after it got walloped in the Eurozone selloff. People feared the worst for all banks after the financial crisis (classic recency bias). JPMorgan made money even during the financial crisis, though. We saw it as a high-quality company mischaracterized by the market as overly “risky.” Since September 2011, JPMorgan has compounded at 19.7% per year vs. the S&P 500’s 15.3%. We see parallels today in a name like Delta Air Lines (DAL) which we view as a high quality company that is misunderstood by the market.Finally, we’ve always invested in companies earlier in their life cycle. The market misunderstands these companies more often due to their short history. Amazon (AMZN) was misunderstood when we first invested. People compared it to retail companies when the business model more closely resembled DELL Computer’s distribution business. Its business evolved significantly and unpredictably over the years, most notably with the growth of Amazon Web Services (‘AWS’). We’ve benefited from being open-minded and patient. Coinbase (COIN) is a current example. Most of its historical earnings have been generated by the exchange business, which is how people characterize it. We see it as a platform for crypto. It’s still early days so expect the crypto market and company will continue to evolve.This portion of the portfolio has return dynamics more like venture portfolios. Most venture companies fail, but a few big winners drive returns. Public companies are more mature so the dynamics shouldn’t be as extreme, but we expect to be wrong more often with these investments. Farfetch (OTCPK:FTCHF), which I’ve written extensively about, is a prime example. We size positions accordingly, with smaller initial position sizes.Our flexible mandate provides broad hunting grounds that have served us well over our long history, and we expect it to continue to do so in the future.As for our view on the markets, we will be brief. The secular bull market that began in March 2009 continues. While a cyclical bear market disrupted the advance in 2022, the cyclical bull that started in October 2022 shows no signs of deterioration.It is widely rumored that Einstein decreed long-term wealth compounding as the Eighth Wonder of the World. Reaping its benefits requires patience.While we believe the path of least resistance for the market is higher, we did pay down a significant portion of our margin debt after quarter end. We want to be able to add aggressively in market declines. We think using our margin in this opportunistic manner should enhance returns. It should also lower volatility. Fortunately, these sales created a net loss.Since the financial crisis, the cost of debt was low, as were valuations. Sentiment was subdued and we were in a secular bull market. Those are the perfect conditions to be levered long. We are still in a bull market, but valuations, cost of debt and sentiment are higher. In this environment, we think being more opportunistic makes sense.As always, we appreciate the support of our clients and will work our hardest to deliver excellent returns.

Opportunity Equity Annualized Performance (%) as of 3/31/24

| QTD | YTD | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception (12/30/1999) | |

| Opportunity Equity (gross of fees) | 12.03 | 12.03 | 41.35 | -5.84 | 9.95 | 8.90 | 8.35 |

| Opportunity Equity (net of fees) | 11.77 | 11.77 | 39.98 | -6.79 | 8.85 | 7.82 | 7.28 |

| S&P 500 Index | 10.56 | 10.56 | 29.88 | 11.49 | 15.05 | 12.96 | 7.40 |

Patient Strategy Annualized Performance (%) as of 3/31/24

| QTD | YTD | 1-Year | 3-Year | 5-Year | Since Inception (12/31/2014) | |

| Patient Strategy (gross of fees) | 14.53 | 14.53 | 47.39 | -5.64 | 15.05 | 14.92 |

| Patient Strategy (net of fees) | 14.39 | 14.39 | 46.68 | -5.70 | 13.46 | 13.42 |

| S&P 500 Index | 10.56 | 10.56 | 29.88 | 11.49 | 15.05 | 12.57 |

|

Data Sources: Bloomberg, Patient Capital Management, and Kenneth R. French Data Library at the Dartmouth Tuck School of BusinessThe low multiple portfolios are constructed at the end of June. E/P is earnings before extraordinary items at the last fiscal year end of the prior calendar year divided by Market Cap at the end of December of the prior year. Annual returns are from January to December. Cheap: highest quintile of E/P; Expensive: lowest quintile of E/P. Data as of 12/31/23.The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. The Russell® 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. Magnificent 7 is a group of stocks made up of mega-cap stocks Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA). A multiple is simply a ratio that is calculated by dividing the market or estimated value of an asset by a specific item on the financial statements. Earnings Yield is the inverse of the P/E ratio. Earnings yield is one indication of value; a low ratio may indicate an overvalued stock, or a high value may indicate an undervalued stock. Earnings per share (‘EPS’) is the portion of a company’s profit allocated to each outstanding share of common stock and serves as an indicator of a company’s profitability. Alpha, often considered the active return on an investment, gauges the performance of an investment against a market index or benchmark that is considered to represent the market’s movement as a whole. The excess return of an investment relative to the return of a benchmark index is the investment’s alpha.The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. References to specific securities are for illustrative purposes only. Portfolio composition is shown as of a point in time and is subject to change without notice.Portfolio holdings and portfolio discussion are for a representative Opportunity Equity account. Holdings discussed may or may not be included in all portfolios subject to account guidelines.Investors should carefully review and consider the additional disclosures, investor notices, and other information contained elsewhere in this document as well as the Offering Documents prior to making a decision to invest.All historical financial information is unaudited and shall not be construed as a representation or warranty by us. References to indices and their respective performance data are not intended to imply that the Strategy’s objectives, strategies or investments were comparable to those of the indices in technique, composition or element of risk nor are they intended to imply that the fees or expense structures relating to the Strategy or its affiliates, were comparable to those of the indices; since the indices are unmanaged and cannot be invested in directly.The performance information depicted herein is not indicative of future results. There can be no assurance that Opportunity Equity’s investment objectives will be achieved and a return realized. Returns for periods greater than one year are annualized.The views expressed in this commentary reflect those of Patient Capital Management portfolio managers as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Patient Capital Management disclaims any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or investment advice. Because investment decisions are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of any portfolio. Any data cited herein is from sources believed to be reliable, but is not guaranteed as to accuracy or completeness.Patient Strategy Composite Performance incepted in 12/31/2014 and is used to show Samantha McLemore’s individual track record where she was Lead/Sole PM on the strategy.Click for the Opportunity Equity Strategy Composite Performance Disclosure. Click for the Patient Strategy Composite Performance Disclosure.©2024 Patient Capital Management, LLC |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here