Open Text (NASDAQ:OTEX) is a Canadian company developing information management software for the enterprise market.

Overall share performance since going public in 1996 has been relatively satisfactory. However, recent performance has been volatile. OTEX is currently trading at $30, up over 1,100% since IPO, but also down -17% over the past year. A lot of the downside there appears to be driven by the weak YTD performance. OTEX was still trading above $40 towards the start of the year, but is currently down by more than -25%, driven by the selloff after the recent Q3 2024 earnings call.

I rate OTEX a buy. My 1-year price target of $30.76 per share and quarterly dividend per share target of $0.25 projects just under 5% upside. However, I believe OTEX remains undervalued and presents an attractive risk-reward. In my opinion, OTEX is a steady, cash-rich business that just saw a recent pullback as it expects lower revenue in the next FY due to a divestiture. Nonetheless, OTEX has the potential to drive higher upside than my already-conservative 5% return, enabled by its share buyback and dividend strategies.

Financial Reviews

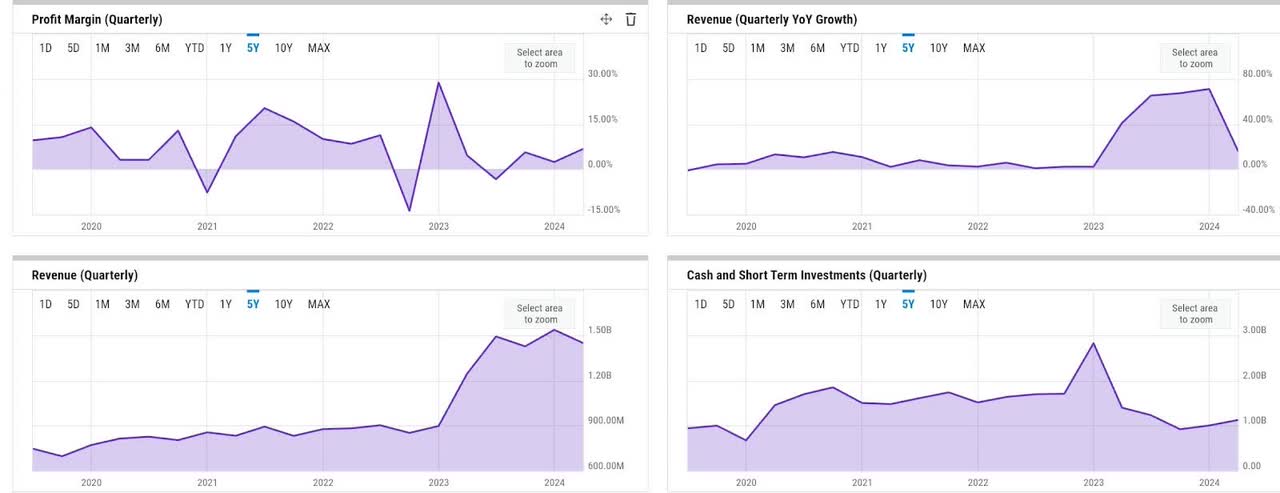

ycharts

Revenue growth has normalized post Micro Focus acquisition last year, with OTEX delivering over $1.4 billion of revenue in Q3, up 16% YoY. Net profitability also improved in Q3, with net margin expanding to 6.8%, driving higher operating cash flow from operations (OCF). With over $384 million of OCF, OTEX pretty much achieved a quarterly record high figure. This has resulted in an uptick in liquidity in Q3. OTEX ended Q3 with over $1.1 billion of cash and short-term investments, up almost 12.5% from the prior quarter.

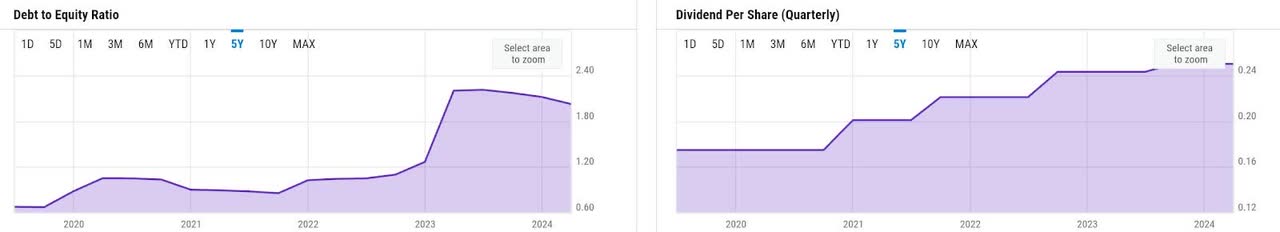

ycharts

Debt-to-equity (‘DE’) ratio has remained quite elevated as of late due to the debt issuance to support the almost $5.7 billion cash payment for Micro Focus acquisition last year. However, OTEX has done quite well to bring the DE ratio down from 2.2x to 2x over the past year. I believe the relatively steady OCF and liquidity situations have also enabled OTEX to continue raising dividend payments. OTEX recently raised its DPS to $0.25, maintaining the consistent uptrend since five years ago.

Catalyst

Though OTEX is probably not positioned as a software or growth stock with a double-digit growth expectation due to its scale, there are some potential catalysts that should help accelerate growth beyond 2024, expand free cash flow (‘FCF’) through balance sheet improvement, and also enhance shareholder returns.

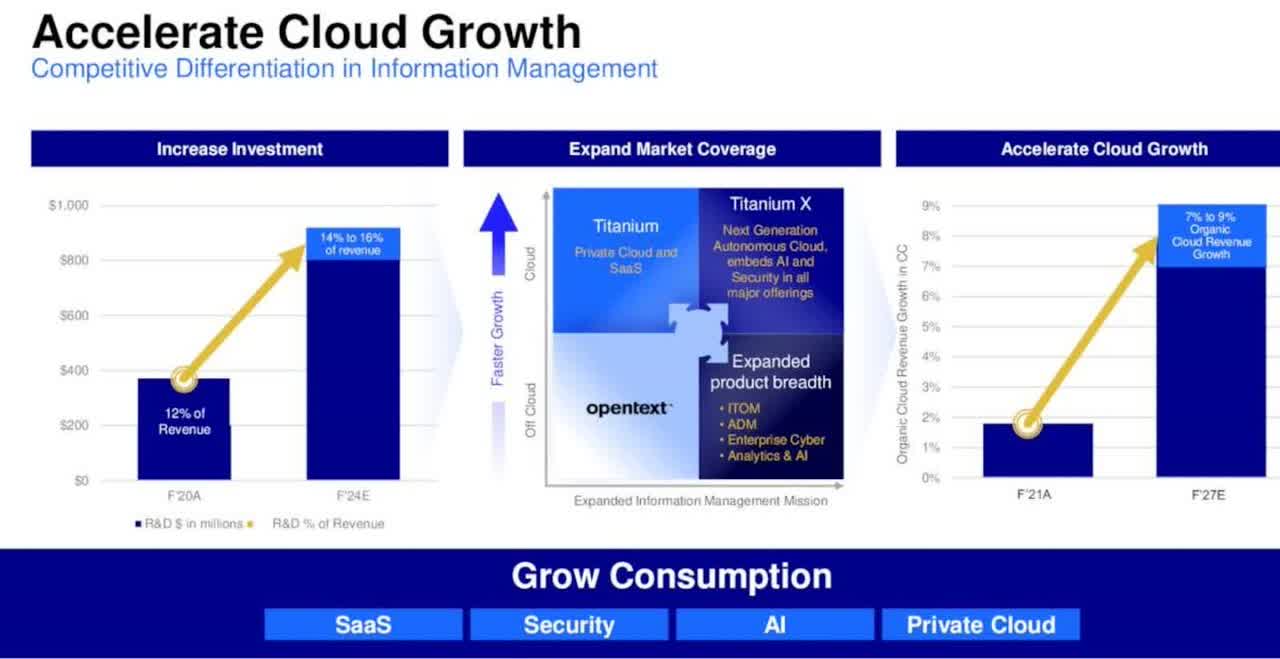

company presentation

In Q3, the management has suggested that OTEX will increase investment into R&D to drive cloud bookings growth. Given the strong demand environment, which is driven by industry trends in AI and autonomous cloud, I believe this investment is a sensible move. At only 12% of revenue, OTEX indeed still has a lot of room to expand R&D spend.

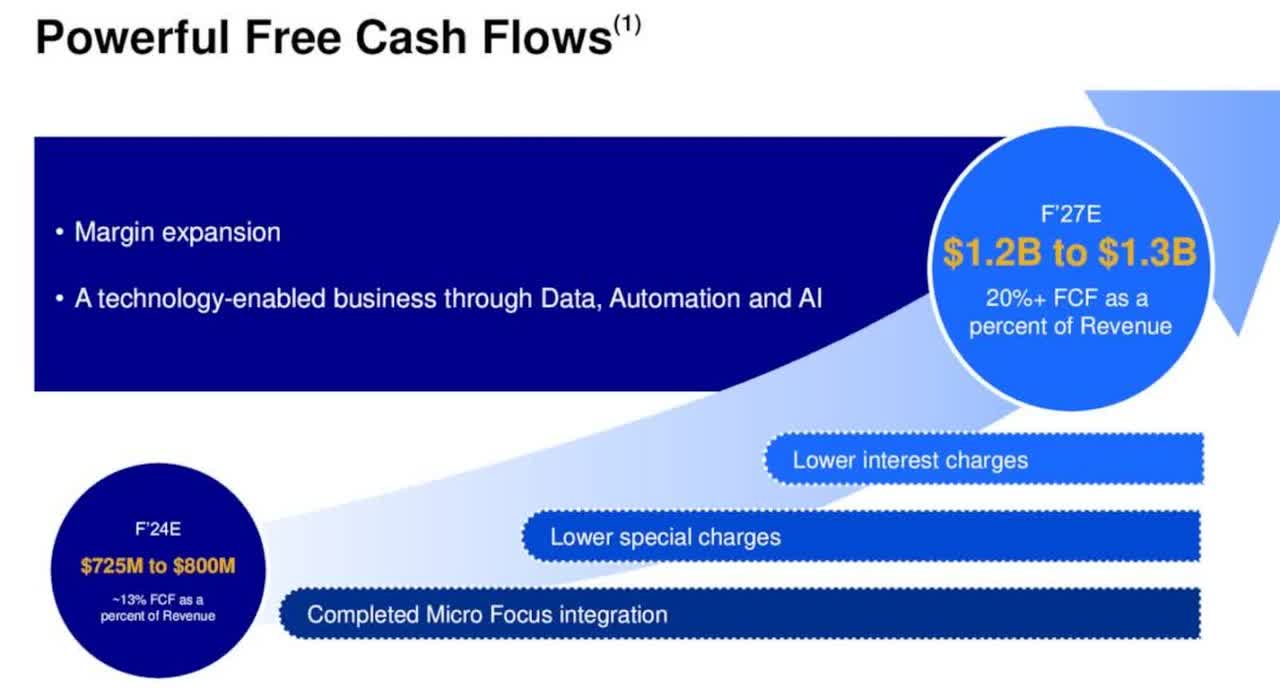

company presentation

In addition to maintaining a steady OCF generation, OTEX’s focus towards reducing its debt level, primarily through the expected $2 billion repayment potentially using the proceeds from the $2.275 billion AMC divestiture in the near term, will help expand FCF through reducing interest expenses. Interest and related expenses were over $132 million in Q3, basically making up almost 10% of quarterly revenue. As such, driving the figure down over time should definitely result in meaningful margin expansion.

company presentation

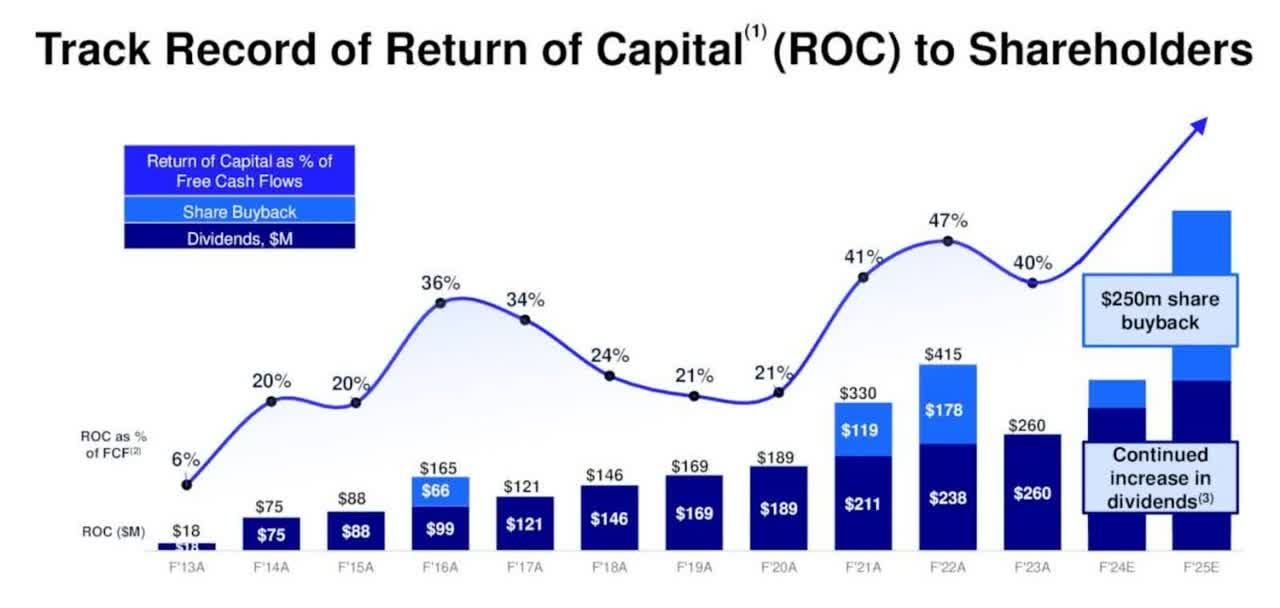

Given the potential FCF expansion, we should also expect OTEX to maintain its strong track record in shareholder returns through both buybacks and dividend increase. Aside from dividend increase, OTEX’s board has also approved a $250 million share buyback program, with a target of up to $500 million of return of capital to shareholders in the next 12 months, as commented by the management:

powerful cash flows at 20% plus of revenues, and a new return of capital framework comprised of 50% of trailing 12-month free cash flows returned to shareholders in the form of dividends and share buybacks and 50% for Cloud M&A. And to jumpstart this new return of capital program, we are announcing today a $250 million share buyback over the next 12 months, and our intention to return $450 million to $500 million of capital to shareholders in fiscal ‘25.

Source: Q3 earnings call.

Risk

The divestiture of AMC that just took place this month, as commented by the management, will present temporary revenue headwinds for OTEX in the next reporting period.

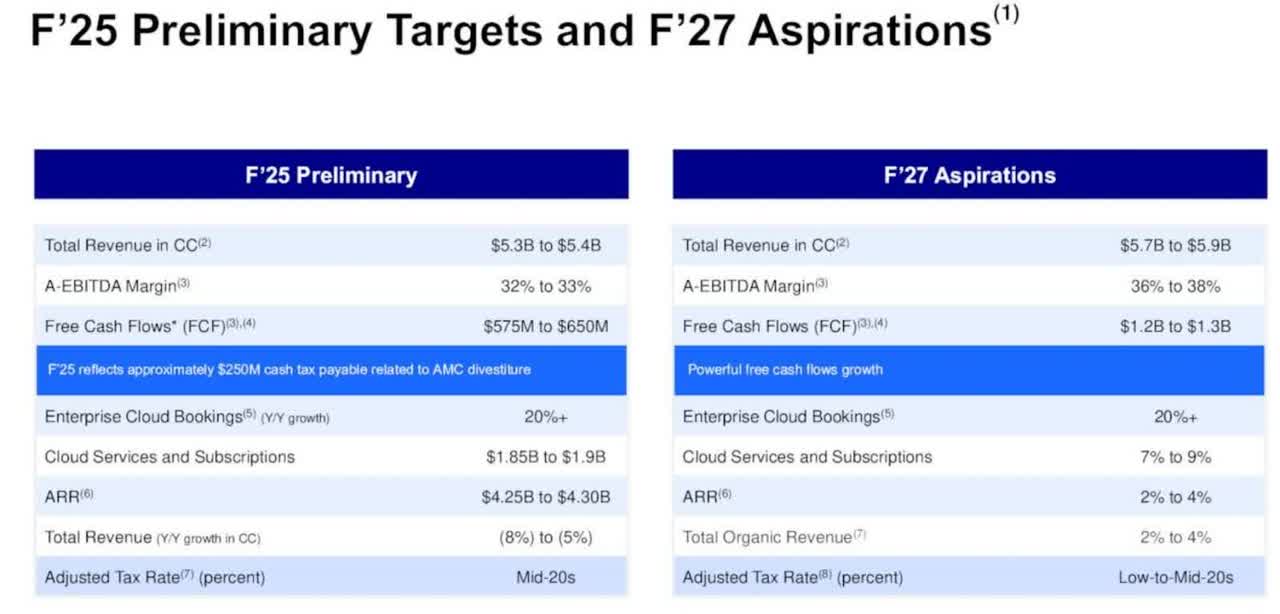

company presentation

As guided by the management, OTEX’s revenue will decline by about $528 million in FY 2025, when it will no longer realize revenue from AMC. This means that OTEX will expect FY 2025’s revenue between $5.3 billion to $5.4 billion, lower than the FY 2024’s expected revenue of $5.7 billion to $5.8 billion.

In my view, this may trigger some sell-offs at any point in the next twelve months. I also believe that this was the reason why OTEX saw a steep -15% pullback as soon as the market learned about the consequences of AMC’s divestiture. As such, I would consider this as a risk factor going into FY 2025.

Valuation / Pricing

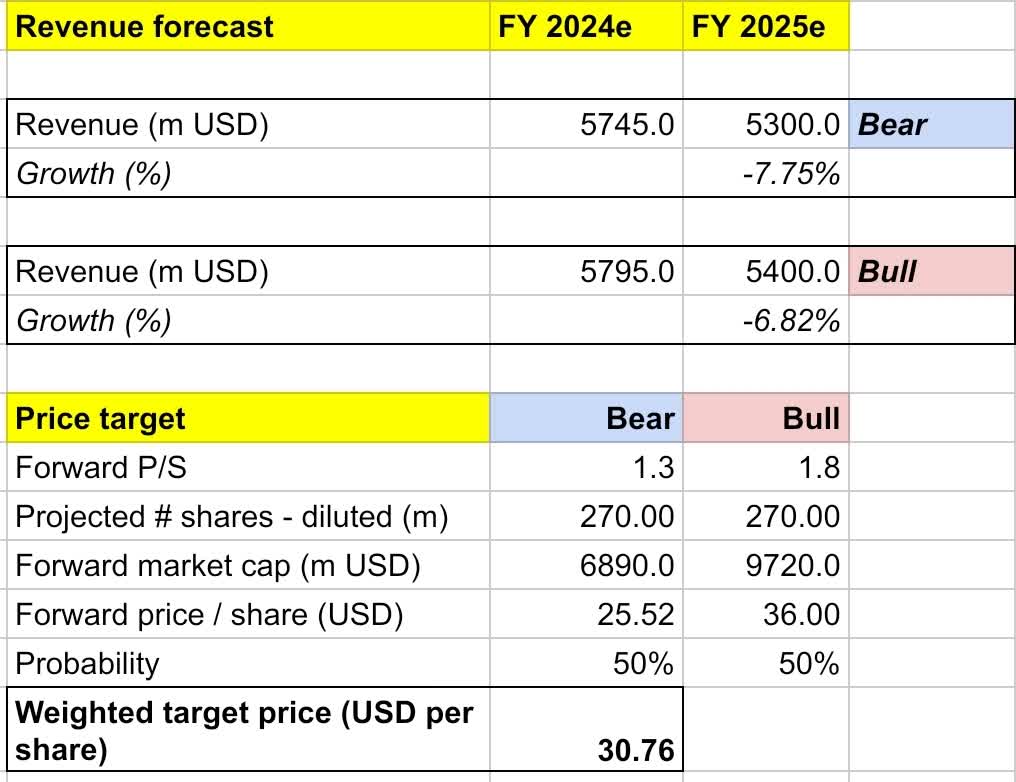

My target price for OTEX is driven by the following assumptions for the bull vs bear scenarios of the FY 2025 projection:

-

Bull scenario (50% probability) assumptions – I expect revenue to decline -6.8% YoY to $5.4 billion, in line with the company’s guidance, to bake in the impact of AMC divestiture. I assume forward P/S to expand to 1.8x, where it was trading before the correction post Q3 earnings call. It also implies a share price appreciation to $36.

-

Bear scenario (50% probability) assumptions – OTEX to deliver FY 2024 revenue of $5.3 billion, a -7.8% YoY decline, in line with the company’s guidance. I assign OTEX a forward P/S of 1.3x, where it is trading today, projecting a correction to $25.5 into the FY.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $30.76 per share. Assuming the same quarterly DPS of $0.25, the overall projected upside would be just under 5%. I would assign the stock a buy rating.

My assumption of 50-50 for bull and bear scenarios is based on my belief that the market reaction towards OTEX remains uncertain into FY 2025 and beyond. As I mentioned earlier, there is a risk of further sell-offs happening once the market learns about OTEX’s outlook pre potential rebound in FY 2027. Nonetheless, I believe OTEX is still undervalued. Moreover, it could leverage share repurchases and also further dividend increase to unlock higher upside than my projected 5% target at present. This makes my projection conservative.

Conclusion

OTEX remains an interesting cash-rich business which may continue to see growing demand for its enterprise software solutions, driven by ongoing industry trends in data, automation, and AI. However, it will also expect more than $500 million decline in annual revenue in FY 2025 due to the recent AMC divestiture. In my opinion, this could present headwinds for the share performance. I advise interested investors to be cautious. My 1-year price target model projects just under 5% upside. Yet, I believe my projection remains conservative, since OTEX may leverage more aggressive share buybacks and dividend increases to drive higher upside. Furthermore, I also believe the recent -15% pullback presents an attractive entry point.

Read the full article here