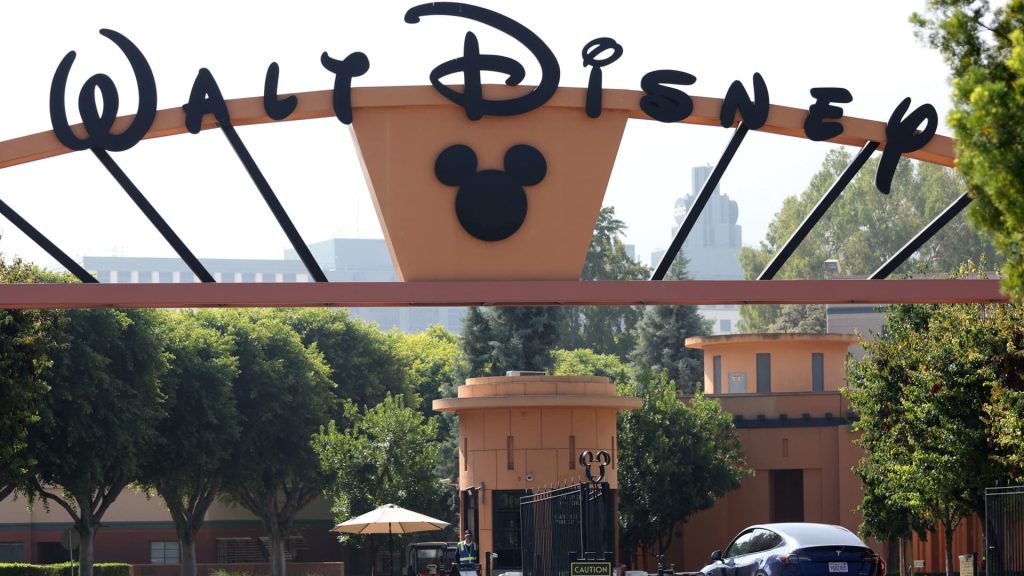

Check out the companies making headlines in midday trading: Walt Disney — The entertainment giant sank 10% after posting fiscal second-quarter results . Walt Disney reported adjusted earnings that beat estimates and posted strong Disney+ subscriber growth but slightly missed revenue estimates. The company also said it expects a loss within its direct-to-consumer entertainment business this quarter. Nvidia — Shares slipped about 1%. Billionaire investor Stanley Druckenmiller said on CNBC’s ” Squawk Box ” that he cut his stake in the chipmaker in late March, saying that artificial intelligence may be a “little overhyped” in the short term. Ferrari NV — U.S.-traded shares of the Italian sportscar maker declined nearly 5%. Ferrari surpassed Wall Street’s estimates on the top and bottom lines for the first quarter, per FactSet, but the company reaffirmed previous revenue and earnings per share guidance for the full year. Datadog — Shares tumbled 10% after the company announced in an earnings release that Amit Agarwal will step down as president at the end of this year. The maker of cloud applications posted better-than-expected adjusted earnings and revenue for the first quarter, according to FactSet. Elsewhere, deferred revenue came in light and billings were in line with expectations. Lucid Group — The electric vehicle company dropped 13% after posting a loss of 30 cents per share on generally accepted accounting principles. The result was worse than the loss of 25 cents per share expected by FactSet. Other electric vehicle stocks also declined, with Tesla and Li Auto last down about 3% each. Xpeng declined more than 6%. Palantir Technologies — The defense tech firm plunged nearly 14%. Palantir Technologies topped revenue expectations and posted adjusted earnings that were in line with estimates, but offered disappointing full-year guidance. The company said its expects revenue to range between $2.68 billion and $2.69 billion for the year, below an LSEG estimate of $2.71 billion. UBS Group — The U.S.-traded shares of the European bank jumped nearly 7% after first-quarter results topped expectations. UBS reported 52 cents in earnings per share on $12.74 billion in revenue. Analysts surveyed by StreetAccount were expecting 18 cents per share on $11.95 billion of revenue. Rocket Lab — Shares declined nearly 4% after the company posted a revenue miss in the first quarter. In the first quarter, the aerospace manufacturer posted revenue of $92.8 million, below the FactSet consensus estimate of $95 million. The loss of 9 cents per share came in line with estimates. Rocket Lab also delayed the launch of its Neutron rocket to mid-2025. Peloton — CNBC reported on Tuesday that private equity firms have been considering taking Peloton private, sending shares higher by 13%. Hims & Hers Health — The telehealth consultation platform gained 7%. Hims & Hers Health issued second-quarter revenue guidance that exceeded expectations. The company expects revenue in the range between $292 million and $297 million, better than the $288 million anticipated by analysts polled by LSEG. First-quarter results also exceeded expectations. Target — The retailer added 1.3% on the back of two bullish analyst calls . Citi upgraded the stock to buy from neutral and said it is one of the winners within the retail sector. UBS, which also holds a buy rating, said the upcoming first-quarter earnings report should be a positive catalyst for shares and bolster the bull case. Simon Property Group — The mall operator popped 4% after posting a first-quarter revenue beat. Revenue came in at $1.30 billion, topping the $1.29 billion expected by analysts, per LSEG. — CNBC’s Jesse Pound, Brian Evans, Alex Harring, Sarah Min, Hakyung Kim and Tanaya Macheel contributed reporting.

Read the full article here