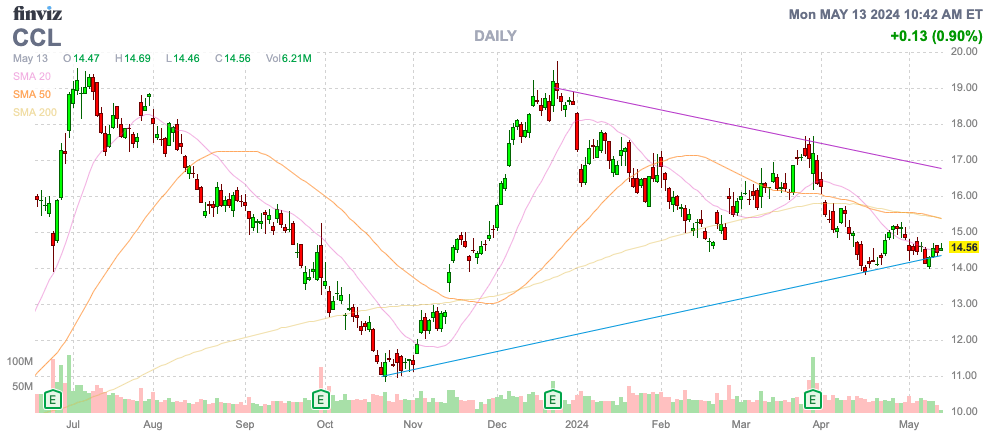

After hitting a double top around $20 at the end of 2023, Carnival Corporation & plc (NYSE:CCL) has trended back down, providing the opportunity to get back into the cruise line stock. Carnival is now entering a period of strong earnings and cash flows to reposition the company. My investment thesis is now more Bullish, with the stock back down at $14.

Finviz

Back To Big Profits

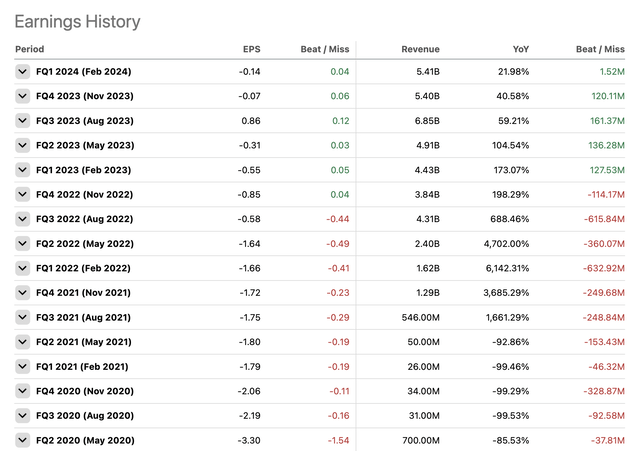

Unlike the other major cruise lines, Carnival hasn’t reported massive profits yet. The company reported losses for the last 2 quarters and only has 1 quarterly profit since the Covid shutdown started in early 2020.

Seeking Alpha

The whole investment story changes with the upcoming start of the August quarter. Carnival is set to report a quarterly profit topping $1 per share, and the cruise line might only report another quarterly loss in the seasonally slow February quarter.

As noted in prior research, Carnival crams the best 3 months into the same quarter with June, July, and August reported during the FQ3 quarter while the other cruise lines spread out these months for more consistent quarterly results in the last 3 quarters of the year.

In addition, the cruise line just completed the wave season with record bookings per the CEO on the FQ1 ’24 earnings call:

Most important, we achieved all-time high booking volumes at considerably higher prices. In fact, our North American and European brands both set booking records in the first quarter with pricing strong across all core deployments and across all quarters.

Prices ran up double-digits on limited inventory left for Q2. They ran considerably higher for our peak summer period in Q3. And they were also considerably higher for Q4 while still building on our occupancy advantage.

Carnival now enters the period where positive cash flows should help boost profits via debt repayment and cutting interest expenses. As an example, the company just redeemed second lien debt at a 9.875% rate after FQ1 ’24 generated $1.4 billion in free cash flow on $1.8 billion in operating cash flows from surging advanced sales.

Total customer deposits reached $7.0 billion, up $1.3 billion from the FQ1 ’23 level. These advanced sales provide the cruise line with both an indication of the strong demand and cash flows to begin repaying debt.

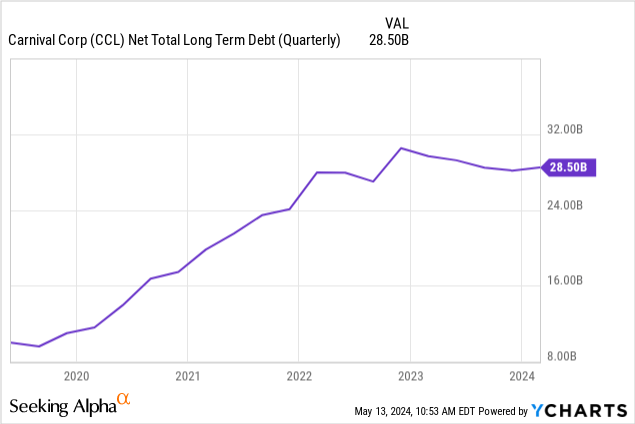

Paying Down Debt

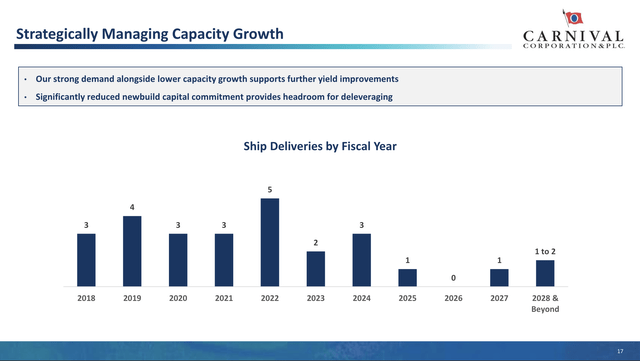

Carnival still has a net debt of $28.5 billion, and the company is entering a phase where new ship deliveries are very minimal. The cruise line has already had 2 ships delivered in FY24, with only 3 more ship deliveries through the end of FY27.

Carnival FQ1’24 Presentation

Capital expenditures are limited to $2.3, $3.0, and $2.4 billion for the next 3 years, respectively. Carnival forecasts $5.63 billion worth of adjusted EBITDA this year, providing the cash flows to slash the debt loads further.

The recent $1.8 billion debt repayment on nearly 10% debt already lowers interest expenses by $180 million annually. Carnival just reported FQ1 results, where net interest expenses dipped to $438 million, down from $483 million from the prior quarter.

The consensus estimates have EPS jumping from $1.00 in FY24 to $1.71 in FY26. Carnival just needs to cut interest expenses in half over the next few years to account for the EPS growth, while the company forecasts higher yields from bookings.

The cruise line still has a long path to investment grade debt, with the company at 5x leverage ratios now. The current bookings situation and demand scenario support Carnival continuing down the path of producing positive cash flows to repay debt and simply boost earnings from cutting interest expenses.

The recent Viking Holdings (VIK) IPO possibly placed some pressure on Carnival. The IPO raised $1.5 billion, and Carnival was probably a source of funds for some of the investors.

Takeaway

The key investor takeaway is that Carnival is finally on the footsteps of returning to consistent profits, even in any seasonally tough quarters. The stock becomes a bargain down at $14 with the earnings potential of the cruise line as better operations boost profits and the company simply repaying debt provides an extra boost to earnings.

Investors should use the recent weakness to buy back into Carnival stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here