The U.S. Department of Education is giving borrowers more time to meet a key student loan forgiveness deadline.

Those who request a so-called loan consolidation by June 30 — which will combine their federal student loans into one new federal loan — could get their debt canceled sooner than they would have otherwise. Some could even see their debt forgiven immediately.

Previously, the deadline to qualify for the Biden administration’s account adjustment was April 30.

“The Department is working swiftly to ensure borrowers get credit for every month they’ve rightfully earned toward forgiveness,” U.S. Under Secretary of Education James Kvaal said in a statement Wednesday.

More from Personal Finance:

Americans can’t stop ‘spaving’ — how to avoid this financial trap

Americans are splurging on travel and entertainment

Shoppers embrace ‘girl math’ to justify luxury purchases

Until June 30, borrowers enrolled in an income-driven repayment plan who consolidate will get a one-time adjustment on their payment count.

They’ll earn credit toward all their loans based on the one they have been making payments on the longest, as well as for certain periods that previously didn’t count, including certain months spent in deferments or forbearances.

Borrowers pursuing the popular Public Service Loan Forgiveness program can also receive additional credit from the payment count adjustment, as long as they certify their qualifying employment for those months.

The payment count adjustment is an attempt to rectify longstanding issues for student loan borrowers.

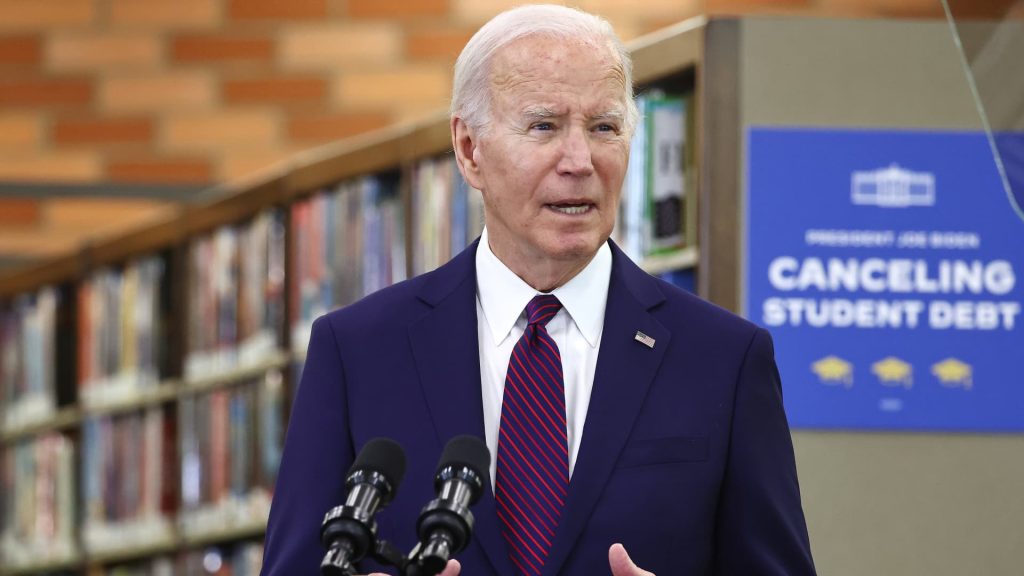

The Biden administration said in 2022 it would review the accounts of those in income-driven repayment plans, which are supposed to lead to debt cancellation after a set period.

Its announcement followed evidence, including a 2022 U.S. Government Accountability Office report, showing borrowers weren’t always getting a proper accounting of their payments. The Consumer Financial Protection Bureau also found that borrowers were needlessly steered into expensive forbearances, during which interest accrues and credit toward forgiveness is paused.

How the payment count adjustment helps borrowers

Usually, a student loan consolidation restarts a borrower’s forgiveness timeline, making it a terrible move for those working toward cancellation, education experts say.

Now, consolidating to take advantage of the temporary payment count adjustment opportunity is an especially good deal for borrowers who’ve been paying off loans for many years, and for those who carry multiple loans from different time periods. Now all those loans could be soon forgiven.

For example, say a borrower graduated from college in 2004, took out more loans for a graduate degree in 2018 and is now in repayment under an income-driven plan with a 20-year timeline to forgiveness. Consolidating could lead them to immediately qualify for forgiveness on all of those loans, experts say, even though they’d normally need to wait at least another 14 years for full relief.

Read: Education Dept. announces highest federal student loan interest rate in more than a decade

How to check if you’d benefit from consolidation

“Everyone who thinks there is even a possibility they may be eligible should take the time to find out,” said Jane Fox, the chapter chair of the Legal Aid Society’s union. “It is a quick phone call or a check of a website that could mean full cancellation of your student debt.”

You can apply for a Direct Consolidation Loan at StudentAid.gov or with your loan servicer. It should take under 15 minutes to do so, Fox said.

All federal student loans — including Federal Family Education Loans, Parent Plus loans and Perkins Loans — are eligible for consolidation, said higher education expert Mark Kantrowitz.

“If a borrower ends up with more payments than required for forgiveness, the extra payments may be refunded in some circumstances,” Kantrowitz said.

Read the full article here