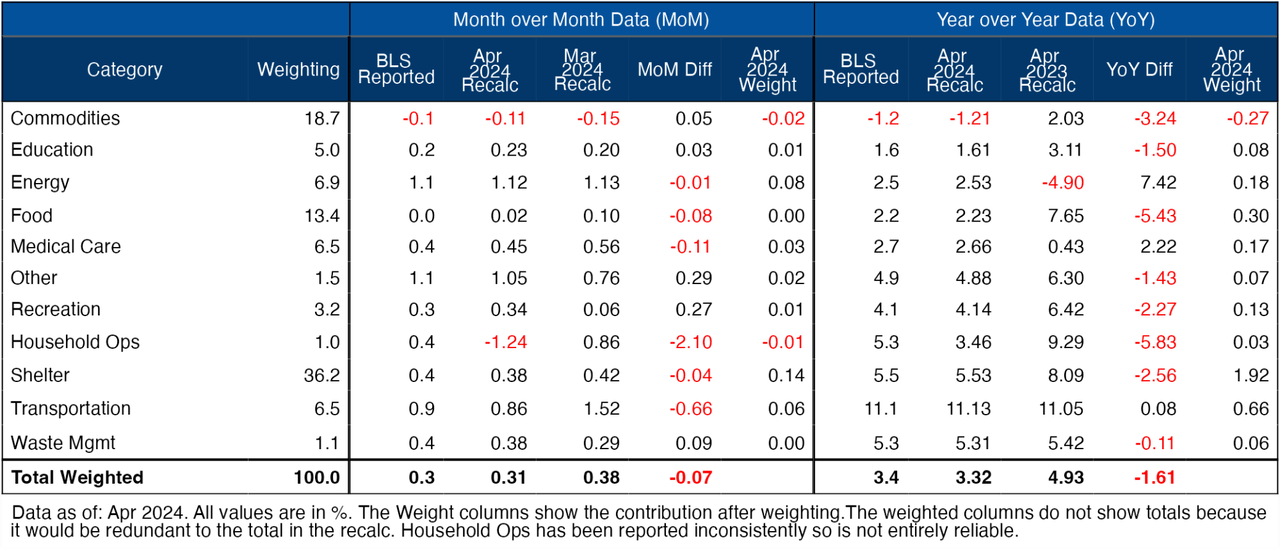

This analysis takes the BLS inflation data and recalculates the percentage changes at the category level to get unrounded numbers. The total number ties to the BLS, but it gives more detail at the granular level.

April CPI

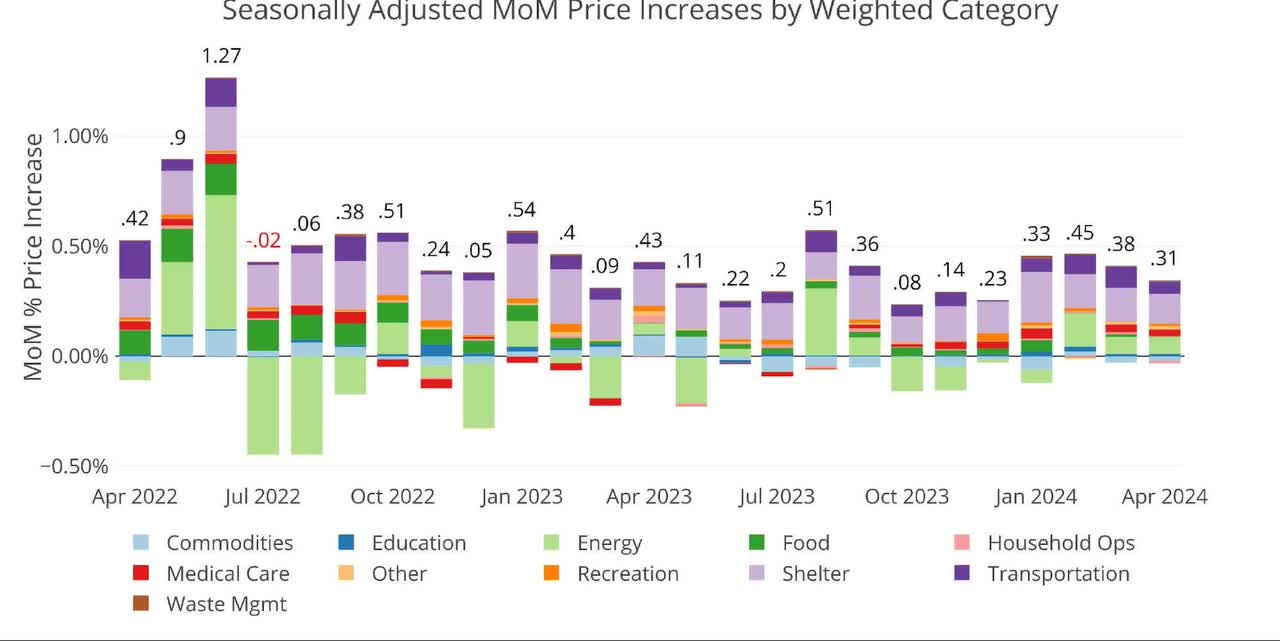

Below is the inflation data that has been taken from the BLS. After bottoming in October of last year at 0.08%, the monthly number is now at .31% which is below the last 3 months but also still running at an annualized rate of 3.7%. While the monthly number was below expectations, it’s very clear to see that we are at a new level of sticky inflation.

Figure 1: Month Over Month Inflation

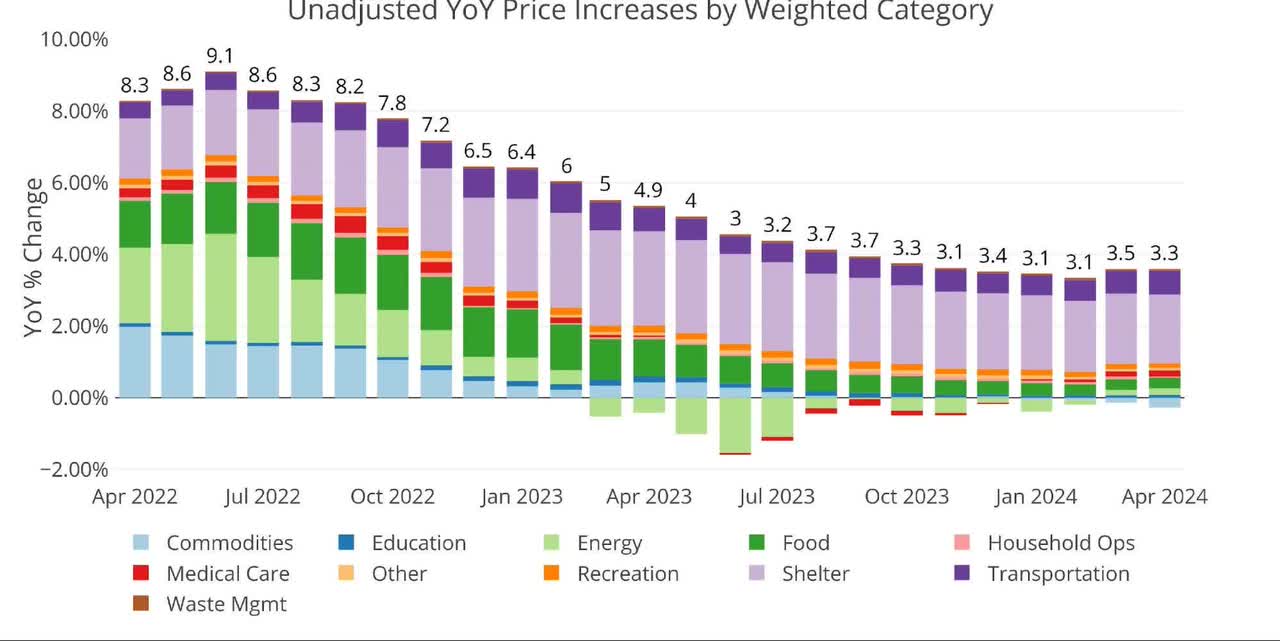

The YoY CPI has been near the low 3% range since June of last year, but it has picked back up over the last two months. This is not unexpected as the 0.09% monthly increase from March of last year fell off. Next month will also likely see an uptick in the annual number as the 2023 May 0.11% falls off.

Year Over Year Inflation

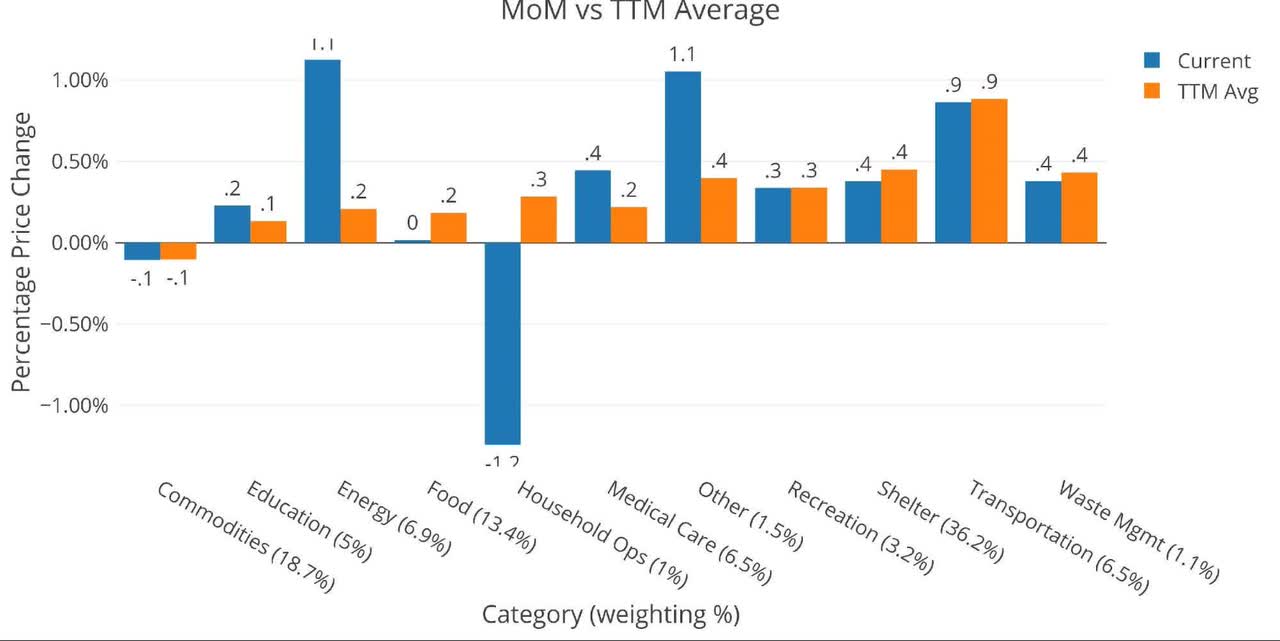

Looking at the individual categories relative to history, it is clear that Energy is having an outsize effect and that shelter remains elevated at 0.38% which is 4.7% annualized rate.

Figure 3: MoM vs TTM

The table below gives a more detailed breakdown of the numbers. It shows the actual figures reported by the BLS side by side with the recalculated and unrounded numbers. The weighted column shows the contribution each value makes to the aggregated number. Details can be found on the BLS Website.

Figure 4: Inflation Detail

Looking at the Fed Numbers

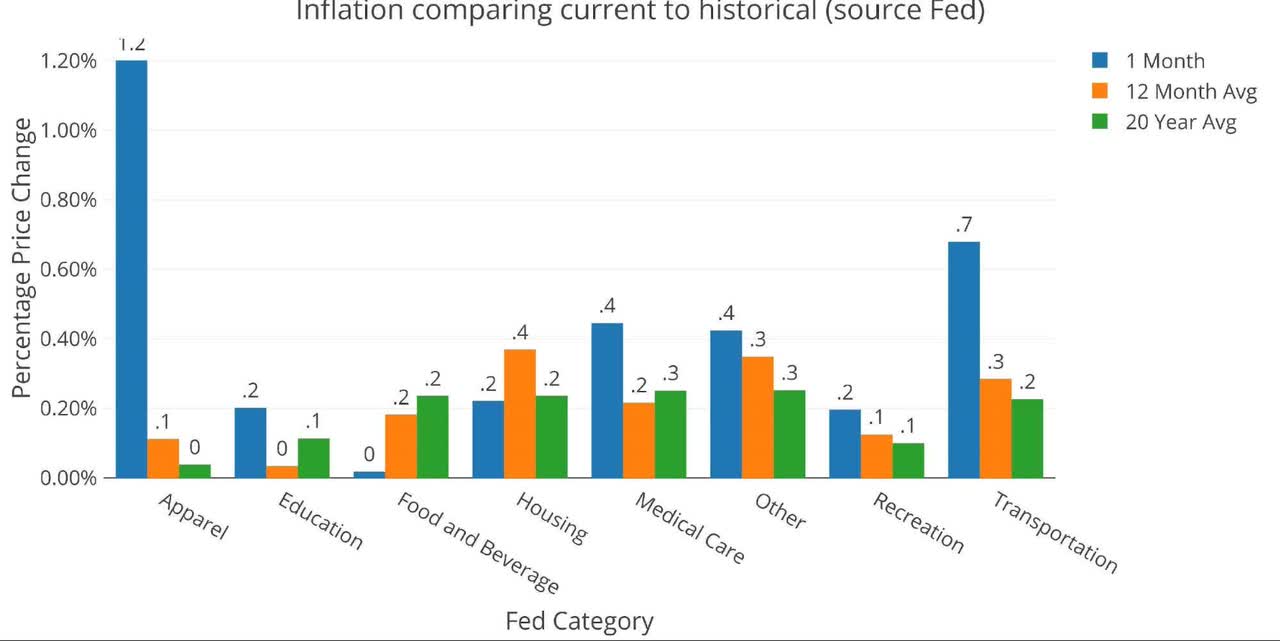

The Fed uses a different category methodology than the BLS, but the total number ties. Below is the number as reported by the Fed. According to the Fed categories, 6 of 8 categories are above the 12-month trend. Apparel had a massive upward move in the latest month. Only Food and Shelter are below the 12-month trend.

Figure 5: Current vs History

Historical Perspective

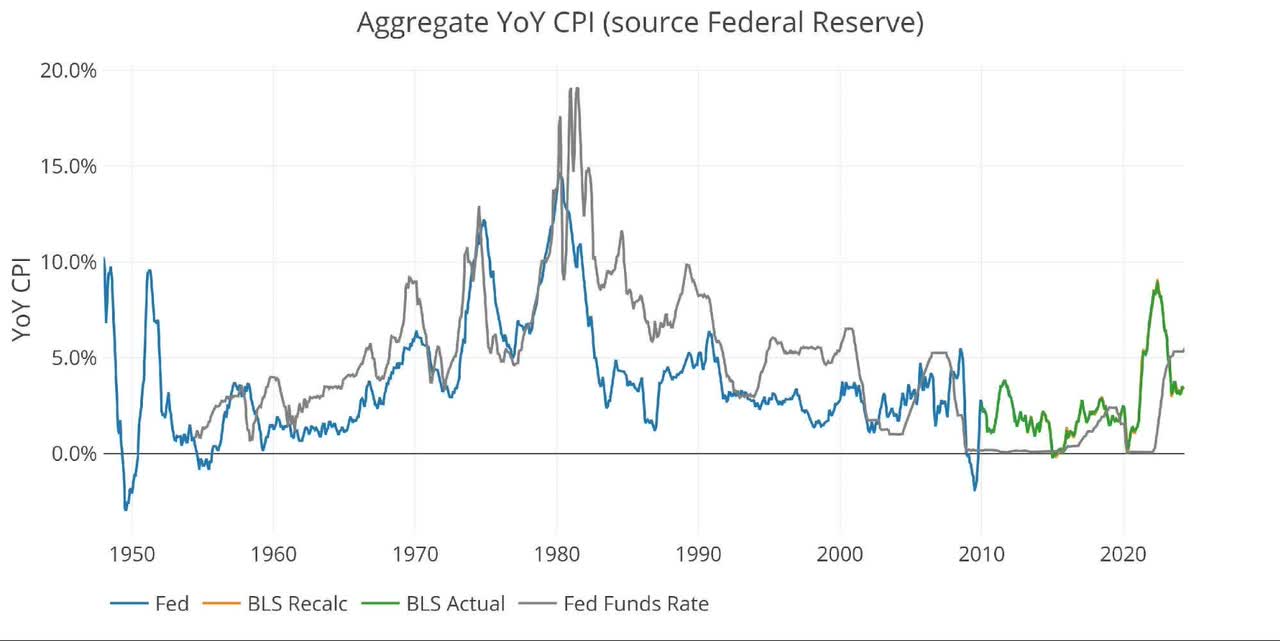

Below is a much longer view of inflation and interest rates from the Fed and BLS (at the aggregate level, the data is the same).

Figure 6: Fed CPI

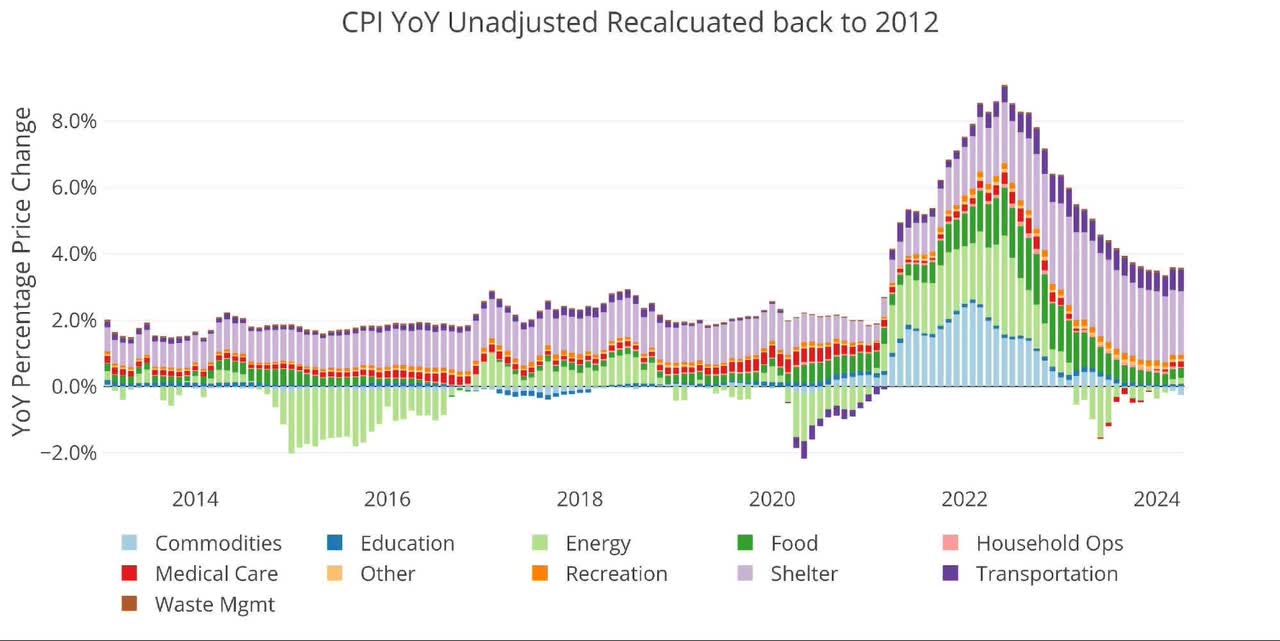

The BLS categorical data can be seen below. Again, this does not look like a wave that is ready to drop to 3% anytime soon. It looks more like a drop before another increase.

Figure 7: Historical CPI

Data Source: CPI Home and Consumer Price Index for All Urban Consumers: All Items in U.S. City Average

Data Updated: Monthly within first 10 business days

Last Updated: Apr 2024

Interactive charts and graphs can always be found on the Exploring Finance dashboard: US Debt Analysis

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here