Stock futures traded slightly to the downside Monday with time running out on the White House and House Republicans to reach an agreement to raise the U.S. debt ceiling.

These stocks were poised to make moves Monday:

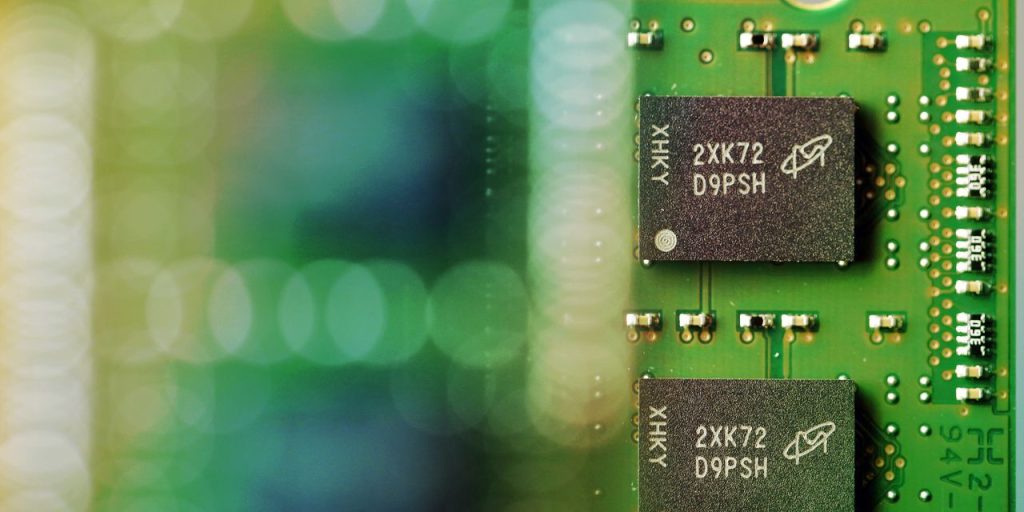

Micron Technology

(MU) declined 5.7% in premarket trading after Beijing banned companies involved in China’s critical information systems from buying chips from the U.S. chip maker, saying they posed a major national-security risk. China’s investigation into Micron was seen as retaliation for the U.S. reducing China’s access to key technology.

JPMorgan Chase

(JPM) and

Ford

(F) will be hosting investor days on Monday. The auto maker hosts its 2023 “Capital Markets Day” in Dearborn, Mich. It’s calling the event “Delivering Ford+,” a strategy around digitizing the car, adding software on both electric and traditional vehicles.

Ford

shares rose 0.5%.

Exxon Mobil

(XOM) recently purchased drilling rights to a sizable chunk of Arkansas land from which it aims to produce lithium, a key component for batteries in electric cars, The Wall Street Journal reported, citing people familiar with the matter.

Foot Locker

(FL) declined 1.1% in premarket trading. The stock sank more than 27% on Friday after the footwear retailer slashed its earnings and sales guidance for the fiscal year. Williams Trading downgraded the stock to a Sell from Hold with a price target of $25, down from $38, the Fly reported.

Nike

(NKE) also was downgraded to Sell from Hold at Williams Trading. Nike was down 1.1% after tumbling 3.5% on Friday.

Videoconferencing company

Zoom Video Communications

(ZM),

Heico

(HEI), and

Nordson

(NDSN), are scheduled to report earnings after stock markets close Monday.

Full Truck Alliance

(YMM), the China-based digital freight company, is expected to report before Wall Street begins trading.

Read the full article here