It seems like everyone is talking about Ozempic, but this popular weight loss drug is only one of many glucagon-like peptide-1 (GLP-1) medications establishing themselves as the cornerstone in the management of obesity. But how did the category evolve, and what are the opportunities and risks for investors?

The Evolution of GLP-1 Medications

The U.S. Food & Drug Administration (FDA) approved the first commercial GLP-1 medication for the treatment of type 2 diabetes in 2005. The core function of GLP-1 medications is managing hemoglobin A1c levels, crucial to long-term glucose control. Their efficacy surpasses that of many earlier generations of diabetes medications.

But what’s unique about GLP-1s is their ability to induce weight loss, a significant advantage given that many diabetes treatments, particularly insulin, can lead to weight gain. Other type 2 diabetes medications also promote weight loss, but to a lesser extent.

GLP-1 medications function by addressing two critical pathways in glucose management: They enhance the pancreas’s ability to produce insulin, the hormone responsible for lowering blood sugar, and reduce the release of glucose from the liver,

However, their impact extends beyond mere glucose regulation. By slowing down the process of gastric emptying, these medications also prolong the sensation of fullness after eating. This helps prevent overeating and promotes satiety.

Furthermore, GLP-1s interact with the central nervous system—specifically targeting the hypothalamus, the brain region that controls appetite. This interaction leads to a reduced urge to eat, further contributing to their weight loss benefits.

Moreover, clinical trials have demonstrated that these medications can significantly reduce the risk of major cardiovascular events such as heart attacks, strokes, and cardiovascular death, enhancing their appeal within the medical community.

The market trajectory for GLP-1s reflects their growing acceptance and increased usage. Since the approval of the first GLP-1 medication in the mid-2000s, the market has seen substantial growth. Now you see celebrities (such as Kim Kardashian) endorsing them and Instagram ads promoting them, and these medications have continued to capture a larger market share, driven by their robust clinical profiles. By 2023, the GLP-1 category reached a staggering $30 billion in sales for diabetes management alone. And now that these drugs have proved effective in weight loss, their growth trajectory should increase.

Exploring the Market Opportunity for GLP-1 Medications

More than 800 million people are estimated to be overweight or obese worldwide, and the growing prevalence of obesity, despite the availability of various treatments, suggests that isn’t going to change. As a result, obesity represents one of the largest total addressable markets (TAMs) in the biopharmaceutical industry’s history.

To frame the potential TAM for GLP-1 medications, we can start with those 800 million overweight people. If even a quarter of these individuals receive treatment at an estimated cost of $2,500 each, the TAM could reach $500 billion.

To put that number in perspective, the oncology sector, the largest single category within the prescription drug market, is forecast to be a $200 billion category.

The potential GLP-1 TAM figure stands out even more when placed in the context of the global prescription drug market, which is projected to total about $1 trillion in the near future. So, the potential $500 billion market for GLP-1s could represent half of the entire prescription drug market as it stands today.

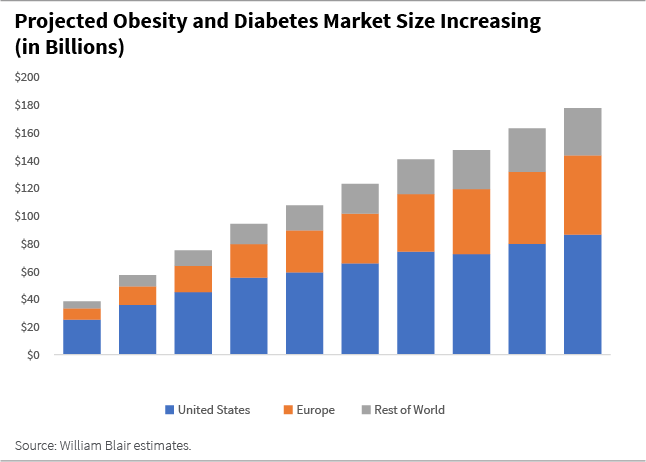

Further analysis from our internal models anticipates the market size for obesity treatments alone (that is, separate from diabetes treatments) to be around $180 billion by 2032.

This projection is supported by the broad utility of GLP-1 medications, which not only are effective for weight loss but also improve a range of comorbid conditions associated with obesity, including heart failure, chronic kidney disease, sleep apnea, and fatty liver disease.

Moreover, the therapeutic potential of GLP-1 medications extends beyond traditional metabolic conditions. These drugs are also being studied for their impact on Alzheimer’s disease and substance addictions due to their interactions with the brain.

This expanded utility could further enhance their market potential, providing pharmaceutical companies with robust evidence to support the effectiveness and versatility of GLP-1 medications, justifying broader coverage and reimbursement by healthcare payers.

Looking for Market Leaders

Only two companies, Eli Lilly and Novo Nordisk, have sizable GLP-1s available today, and we expect them to dominate the market over the intermediate term.1

Eli Lilly (LLY) and Novo Nordisk (NVO) have been the leaders in insulin therapies and diabetes medicines for many years, and benefit from significant scale advantages, which are evident not only in their substantial investments in developing next-generation medicines but also in their production capabilities. Over the next few years, we believe combined capital expenditures for both companies could reach approximately $50 billion.

Furthermore, Novo Nordisk is in the process of acquiring three manufacturing plants from Catalent, a leading contract development and manufacturing organization, to enhance its supply chain capabilities. This acquisition is particularly strategic as it addresses current market supply bottlenecks.

These scale advantages extend beyond production and development to include sales and marketing efforts as well.

Given the significant TAM of GLP-1 medications, we expect there to be competition, but it could take years for competitors to make any inroads given the time it takes to bring new drugs to market. Moreover, the bar is getting higher. Some next-generation GLP-1 medications – CagriSema from Novo Nordisk and retatrutide from Eli Lilly – are showing average weight loss of more than 20%, which is close to that of bariatric surgery.

In our opinion, competitors will have to differentiate on other factors, such as convenience or tolerability.

Changing Market Dynamics

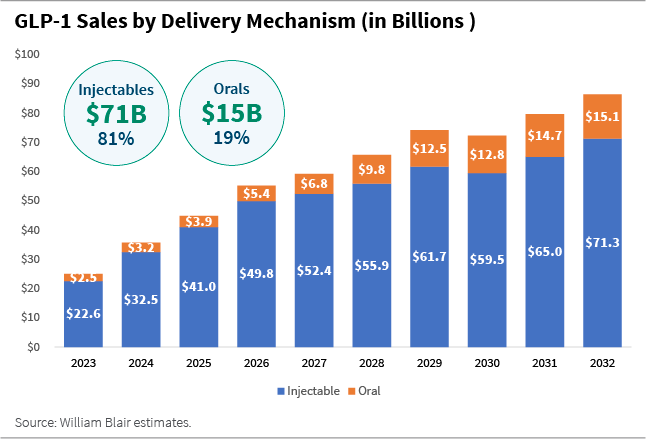

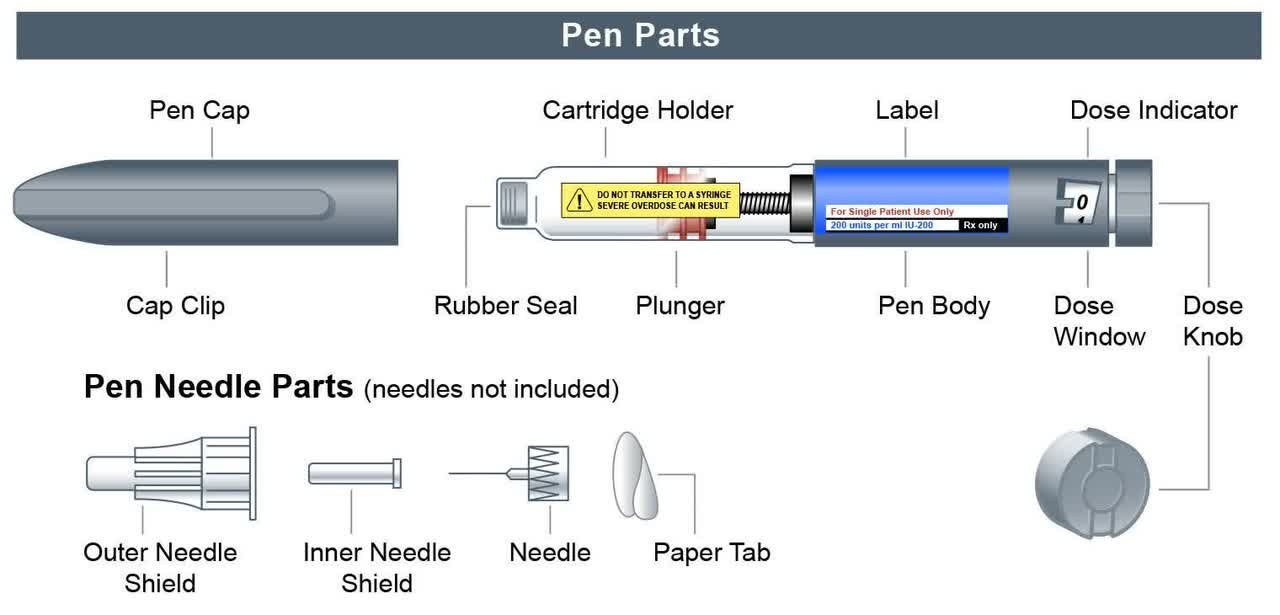

Speaking of convenience and tolerability, current GLP-1 medications sold for weight loss take the form of injectables, but oral versions are on the horizon. Novo Nordisk already has a drug with the same active ingredient (which is called semaglutide) in pill form, although it is currently approved only for diabetes (sold under the brand name Rybelsus). Novo Nordisk and Eli Lilly are both developing oral GLP-1 medications for weight loss, which we think is significant.

We expect this to further expand the market. Injectables don’t just involve the manufacturing of a drug; they involve the manufacturing of an injectable device, which adds a layer of complication to the supply chain, so the price point of orals will likely be lower. The chart below illustrates our anticipated market split.

But this raises the question of how other companies, beyond drug manufacturers, might ride this tailwind. Certainly, companies involved with the production of injectable components and assembly of the devices stand to benefit. Drug distributors (such as wholesalers and pharmacy benefit managers), which historically have operated at very low margins, also stand to benefit, as the chart below shows.

And then there are complementary therapeutics. Because GLP-1s stop working when not taken, weight loss maintenance is another category of interest. So is muscle preservation, since part of any weight loss entails loss of muscle mass. Some drug companies are investigating antilatent myostatin antibodies, which are being studied in some rare muscular degenerative diseases, to block the myostatin that leads to a degradation of muscle.

Of course, where there are winners, there are losers. For example, manufacturers of robotic equipment used in bariatric surgeries have seen a slowdown in demand as patients postpone bariatric surgeries while they try GLP-1 medications.

We could also see a slowing demand for the obstructive sleep apnea market, which includes a range of products such as continuous positive airway pressure (CPAP) devices. However, the obstructive sleep apnea market is still vastly underpenetrated, indicating market growth is likely to resume.

We could also see a slowing demand in joint replacements (hip and knee in particular). But when it comes to osteoarthritis, aging may be a bigger factor than obesity, so while we do see some impact from the rise of GLP-1 medications, this market isn’t likely to suffer too much, in our opinion.

And what about continuous glucose monitors and insulins pumps for diabetes patients? Increased usage of GLP-1 medications in the treatment paradigm pushes out insulin dependence and use, slowing adoption of continuous glucose monitors for type-2s. There could be less of an impact on insulin pumps because that market treats primarily type-1 diabetics, where GLP-1 medications do not play a role.

The Ripple Effects of GLP-1s on Consumer Markets

But GLP-1 agonists, such as Ozempic, are not just transforming healthcare; they’re reshaping consumer behavior and impacting various consumer industries.

It might seem at first glance that the impact of GLP-1 medications on overall calorie consumption might be limited. However, studies indicate that GLP-1 users consume 20% to 30% less energy, and the impact is particularly pronounced in junk food and other high-calorie foods. What’s even more interesting is that GLP-1 medications have the potential to make a profound impact on broader lifestyle choices in other areas—for example, by influencing alcohol and tobacco consumption. Studies suggest a decrease in the desire for sweet alcoholic beverages in particular.

These preference changes affect more than just GLP-1 patients, as studies indicate that GLP-1 users affect their household food procurement, so their health choices translate into decisions for their families.

Thus, while the widespread adoption of GLP-1 medications creates investment opportunities (in companies that manufacture healthier food choices, for example), it also poses risks for many consumer sectors.

There are some dramatic left-tail-risk scenarios—for example, all people with above-average body mass index (BMI) take GLP-1 medications and stick to the prescribed regimen (including changing food habits per doctor recommendations) for a prolonged period. This could drive a decline in food consumption of more than 10%. However, based on our healthcare team’s view of GLP-1 penetration, we think the more likely scenario is a one- to two-percentage-point volume reduction over the course of a decade or more.

Different product types could also fare differently in this changing landscape. Early studies indicate growth (or slower decline) in volume for protein-forward products like some dairy products that appear to be less affected. In contrast, carbonated drinks and snacks might see severe cuts in consumption.

These findings underscore the need for companies to adjust their strategies, possibly focusing on premium products that offer higher quality and better nutritional value despite reduced volumes. The food industry is accustomed to constantly reacting to ever-changing science and consumer behavior. In the past, that meant reducing trans fats, salt, and sugar. Today’s trends might include catering more to consumers seeking healthier, protein-rich diets, or even investing in emerging technology (such as synthetic protein production) to maintain margins. Such innovation will be crucial for companies aiming to align with emerging consumer preferences shaped by health and sustainability trends.

With GLP-1s influencing consumer behaviors, companies must consider these factors in their strategic planning and risk assessment to maintain competitiveness and relevance in a rapidly evolving market. And as companies navigate these shifts, understanding the broader economic and sector-specific dynamics is critical for investors. Active management certainly plays a role.

Tommy Sternberg, CFA, partner, is a global equity research analyst.

Dasha Fomina is a global equity research analyst.

1 Elli Lilly and Novo Nordisk do not only produce GLP-1s and thus the companies’ profits and losses are not solely correlated to these medications. Past performance is not indicative of future results, and it should not be assumed that any investment in the securities referenced was or will be profitable. References to specific securities and their issuers are for illustrative purposes only. William Blair may or may not own any securities of the issuers referenced and, if such securities are owned, no representation is being made that such securities will continue to be held. The securities referenced do not represent all of the securities purchased, sold, or recommended for advisory clients.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here