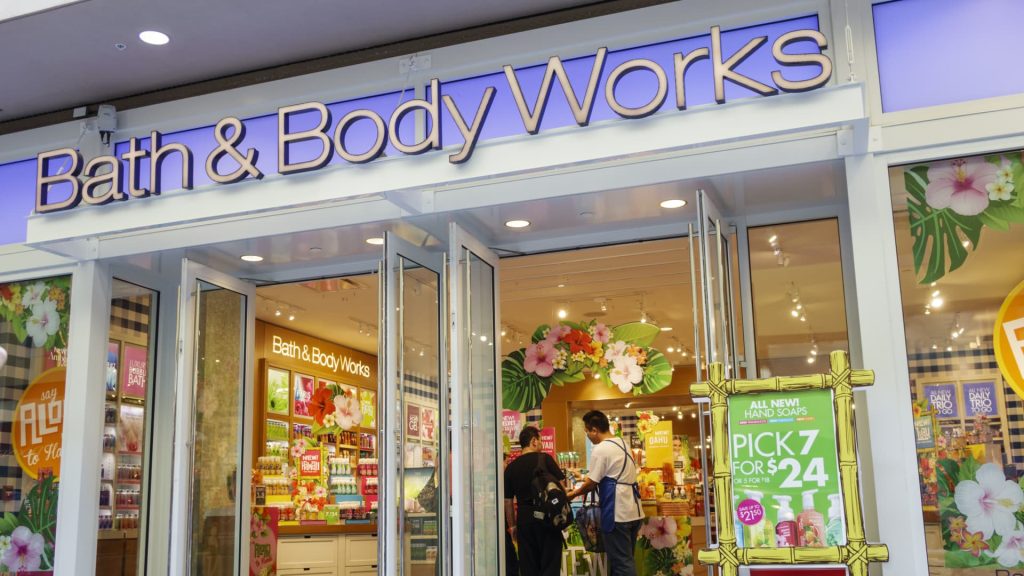

Check out the companies making headlines in midday trading: Bath & Body Works — Shares of Bath & Body Works sank 14% and headed for their worst day since 2021. The retailer beat first-quarter earnings and revenue estimates but offered disappointing second-quarter guidance. Bath & Body Works expects earnings to range between 31 cents and 36 cents a share, behind a FactSet estimate of 38 cents in earnings per share. Carnival — Shares popped 4.8% after the cruise company announced it will fold P & O Cruises Australia into Carnival Cruise Line. The company said it was the latest in a series of strategic moves aimed to increase capacity for its flagship brand. GameStop — The meme stock retreated about 5% following a 21% rally Monday. The advance was sparked by GameStop champion Keith Gill, better known as “Roaring Kitty,” who shared a screenshot of his portfolio showing five million common shares and 120,000 call option contracts. He seemingly held onto his positions after Monday’s rally . GameStop closed well off highs Monday after The Wall Street Journal reported Gill’s brokerage E-Trade was debating whether to ban him from the platform for concerns over potential market manipulation. Saia — The freight company popped 7.7% after it posted higher less-than-truckload shipments per workday for April and May compared to a year earlier. Shares of fellow freight companies Old Dominion Freight Line and XPO rose around 4% and 2%, respectively. Maxeon Solar Technologies — Goldman Sachs downgraded Maxeon Solar and slashed its price target to $1 on Tuesday, leading shares to drop about 5%. Existing shares will likely be diluted as the company undergoes debt restructuring and relies on an equity investment from its largest shareholder, TZE, to shore up its liquidity, Goldman said. Energy stocks — A slump in oil prices pressured energy stocks Tuesday after OPEC+ announced plans to phase out 2.2 million barrels per day of production cuts beginning in October 2024 through September 2025. Shares of BP , Exxon Mobil and Diamondback Energy fell around 2%, while Chevron shares fell more than 1%. Stanley Black & Decker — The industrials stock fell 2.8% after Barclays downgraded the stock to equal weight from overweight. Analyst Julian Mitchell believes the company’s earnings estimates look too high and sees its sales and production figures likely facing a bit of downward pressure from swollen inventories. Flutter Entertainment — Shares rose more than 1.1% after Oppenheimer initiated the sports betting and gambling company at an outperform rating. Analyst Jed Kelly listed the company’s structural advantages over its peers and top U.S. parlay mix as catalysts. Boot Barn — The stock climbed nearly 3% after the western apparel company disclosed same-store sales grew 1.4% in the first nine weeks of the fiscal first quarter. Boot Barn had previously guided for a decline in same-store sales. — CNBC’s Samantha Subin, Michelle Fox, Yun Li, Pia Singh and Lisa Han contributed reporting.

Read the full article here