Centessa Pharmaceuticals (NASDAQ:CNTA) develops medicines for hemophilia A, solid tumors, narcolepsy and Pulmonary Arterial Hypertension (PAH). This list misses only a few areas of medical science. These sorts of companies are interesting – their R&D efforts must be all over the place, and if they don’t have a platform, it is a far more difficult task making medicines for so many divergent types of diseases.

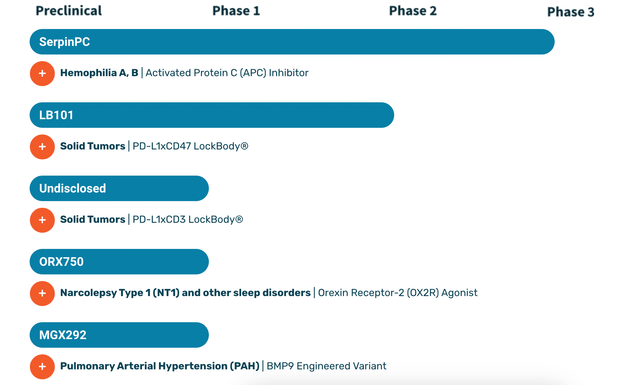

Centessa’s pipeline:

CNTA PIPELINE (CNTA WEBSITE)

Lead asset SerpinPC is an Activated Protein C inhibitor. Also known as APC, it has anti-clotting properties relevant to hemophilia. SerpinPC is a biologic inhibitor that is subcutaneously administered to inhibit APC and provide a potential treatment for hemophilia. Centessa is carrying out multiple studies as part of a registrational program. These studies include PRESent-5, initiated in late 2022, is an observational feeder study, and interventional studies PRESent-2 (moderately severe to severe hemophilia B without inhibitors, and severe hemophilia A with and without inhibitors) and PRESent-3 (hemophilia B with inhibitors).

Last year, the company published 18-month data from an open label study which showed that SerpinPC is able to stop bleeding in hemophilia patients. An oral presentation at ASH 2022 showed the molecule’s favorable safety and tolerability profile and sustained long-term efficacy results. SerpinPC was able to reduce median ABR by 93% at the highest dose tested. ABR is annualized bleeding rate. This data was for both all-bleeds and spontaneous joint bleeds. No thromboembolic events or treatment-related sustained elevations of D-dimer (a sensitive measure of excess thrombin generation) were observed.

Detailed ABR data is as follows:

|

All-bleed ABR |

||||

|

Part |

Dose Tested (administered subcutaneously) |

Median ABR from prospective baseline |

Median ABR observed in this part |

Median % change from baseline |

|

Part 3 (n=22) |

60 mg flat dose* once every 4 wks for 48 weeks |

34.1 |

6.2 |

-83% |

|

Part 4 (n=21) |

1.2 mg/kg once every 2 wks for 24 weeks |

35.5 |

2.2 |

-93% |

|

Spontaneous joint bleed ABR |

||||

|

Part |

Dose Tested (administered subcutaneously) |

Median ABR from prospective baseline |

Median ABR observed in this part |

Median % change from baseline |

|

Part 3 (n=22) |

60 mg flat dose* once every 4 wks for 48 weeks |

27.5 |

4.3 |

-86% |

|

Part 4 (n=21) |

1.2 mg/kg once every 2 wks for 24 weeks |

28.3 |

2.2 |

-93% |

*60 mg flat dose which was equivalent to 0.8 mg/kg

These ABR reduction rate percentages compare well with rates seen in Hemlibra’s HAVEN studies. Detailed data can be seen here, where rates between 87% and 99% were observed. In one HAVEN study, three thrombotic microangiopathies and two thromboses were observed; other studies did not have SAEs. It is too early to differentiate between the two molecules, but so far, SerpinPC seems to have done alright.

Centessa’s second asset is LB101, in phase 1/2a first in human trials targeting solid tumors. LB101 is the first candidate from its proprietary LockBody platform, which are “designed to selectively drive potent effector function activity, such as CD47 or CD3, to the TME while avoiding systemic toxicity.” LB101 is a bispecific PD-L1xCD47 monoclonal antibody which has:

…two anti-CD47 domains blocked by two anti-PD-L1 domains, with proprietary human IgG-derived hinges linking the anti-CD47 and anti-PD-L1 domains. The cell-killing mechanism of action, CD47, is designed to be blocked by the PD-L1 tumor targeting domain until the IgG-derived hinges are naturally degraded in the TME, thus unlocking and activating the CD47 effector function activity in the tumor.

There is some mouse and NHP data, however, nothing human yet. LB101 was shown to have a favorable safety and tolerability profile in nonhuman primates up to 50 mg/kg weekly x 4 weeks. It also showed “improved efficacy and durability over atezolizumab in a difficult-to-treat mouse model while being well tolerated.”

The other programs are in earlier stages, and there does not seem to be common ground between them. The molecules are independent of one another, and do not appear to be derived from any platform.

Financials

CNTA has a market cap of $435mn and a cash balance of $346mn. They have a $300mn debt facility from Oberland from 2021. Research & Development Expenses were $32.8 million for the first quarter ended March 31, 2023, while general & Administrative expenses were $16.1 million. At that rate, they have enough cash to last them for 6-7 quarters, without funds from the debt facility.

CNTA has 16% retail presence, while the rest is owned by institutions and funds. Key holders and Medicxi, Index Ventures and General Atlantic. Insiders are very active; until around the middle of last year, there were many purchases, but since then, there have been only sells.

Risks

CNTA’s lack of focus in a specific disease area is my one concern. It appears, though, that while their pipeline is everywhere, their focus is now on the hemophilia asset. Last year, they discontinued three late-stage assets, including two for trial failure and one to preserve capital. While their diversity entails that these failures have no direct scientific bearing on the current pipeline, they also demonstrate the problem – as well as the benefit – in having such a diverse program. The program is cash, and the benefit is, since each of these “legs” are independently standing, the entire company is not at risk if one or two or three of them fail.

Bottomline

CNTA looks interesting. The stock is quite rangebound, they are well-funded, and they have some decent if not yet differentiated data. I would like to keep watching.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Read the full article here