AMC Entertainment Holdings, Inc. (NYSE:AMC) recently completed its $250 million at-the-market equity offering and also did a debt-for-equity swap to remove $163.85 million in debt. These are positive moves for the company that have reduced its net debt by over $400 million.

AMC still has a lot of work to do as it has roughly $3.4 billion in remaining net debt pro forma for these transactions and is also likely to have some additional cash burn during the rest of the year.

There is a path to survival for AMC, but it will require an increase to its authorized shares. As well, AMC’s continued efforts to improve its financial position would be greatly helped if its stock stayed near $5+ range.

That would lead to a plausible scenario where AMC could reduce its net debt to around $2 billion by 2026 (through more exchanges and offerings) and give its shares an intrinsic value of $4+ per share.

I remain bearish on AMC, since it still has a lot of work to achieve that intrinsic value. AMC has made progress, though, with its debt reduction efforts chipping away at its interest costs. I had previously identified its interest costs as a major issue.

Debt Exchange

In mid-May, AMC entered into agreements to exchange approximately 23.28 million shares of its Class A common stock for $163.85 million of its 10%/12% Cash/PIK Toggle Second Lien Subordinated Notes due 2026. These notes also had approximately $6.87 million in accrued interest.

AMC noted that the implied value of the common stock in the exchange was $7.33 per share if the notes were valued at 100% of par plus accrued interest.

AMC’s notes traded at 75.75 cents on the dollar on May 13 and 85.66 cents on the dollar on May 14. Those bond prices would result in an implied value of $5.63 to $6.32 per share for AMC’s stock in the exchange. It appears that AMC got a solid deal with this debt-for-equity exchange.

Equity Offering

AMC also completed its at-the-market equity offering that it launched on March 28, 2024. It completed this offering on May 13, one day before it announced its debt-for-equity exchange.

AMC raised $250 million in gross proceeds with the sale of 72.5 million shares, with an average price of around $3.45 per share.

AMC reported having approximately 296 million shares outstanding as of May 8, 2024, and at that time had already issued around 32 million shares under its at-the-market equity offering. The spike in AMC’s shares and trading volumes on May 13 allowed it to quickly finish its offering and boost the average price it received per share.

Pro forma for the at-the-market equity offering and the debt-for-equity exchange, AMC will have around 360 million outstanding shares.

Updated 2024 Outlook

So far in 2024, box office results have been pretty dismal, at -28% YTD compared to the same period in 2023. This can largely be attributed to the SAG-AFTRA strike pushing a number of movie releases to later in 2024.

The domestic box office is expected to pick up soon, helped by a stronger slate of movies such as Inside Out 2. However, projections still put the domestic box office at around $8.2 billion for the full year, down -8% from 2023.

AMC has gained market share, contributing to its year-over-year results being better than the domestic box office. AMC’s revenues in Q1 2024 were essentially flat compared to Q1 2023, while the domestic box office was -6% over the same period. Thus, my expectation that AMC may see a 2% revenue decline in 2024 compared to 2023 seems reasonable. I have also been modeling AMC’s operating cash burn at near zero for 2024.

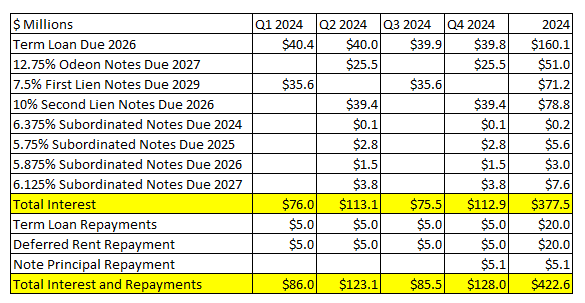

With its recent debt-for-equity swap, AMC’s annual interest costs have been reduced to approximately $377 million. If it can eliminate its 10%/12% Cash/PIK Toggle Second Lien Subordinated Notes due 2026, it could reduce its annual interest costs to around $300 million.

AMC’s Interest Costs And Repayments (Author’s Work From SEC Filings)

Path To Survival

I do see a potential path for survival for AMC if it continues with equity offerings and debt-for-equity swaps. However, AMC will likely need to get shareholder approval to increase its authorized share count again, and I’m not sure how willing shareholders will be to do that.

As noted above, AMC has around 360 million outstanding shares pro forma for its latest transaction. It is authorized to have up to 550 million common shares.

I figure that AMC may need to issue around 110 to 130 million shares to take out the remaining 10%/12% Cash/PIK Toggle Second Lien Subordinated Notes due 2026.

It could also issue 200 million to 250 million shares to raise $1 billion in cash (at an average price of $4 to $5 per share). Without additional equity raises, I projected that AMC may have around $500 million in cash on hand at the end of 2025. The cash can go to pay down some of its other existing debt.

This would result in a scenario where AMC has around 670 to 740 million outstanding shares at the end of 2025 along with $2 billion in net debt.

If AMC’s share price falls significantly below current levels, the number of shares it would need to issue for these transactions would increase accordingly.

Assuming the domestic box office rebounds to the $10 billion to $10.5 billion range in 2026, AMC could do around $750 million EBITDA. This would translate into $300 million in free cash flow with $200 million in interest costs and $250 million in capex.

Valuing AMC at an enterprise value of 7x EBITDA would then translate into an estimated value of approximately $4.40 to $4.85 per share (based on 670 million to 740 million shares). AMC’s free cash flow yield would be around 9.2%.

AMC’s near-to-medium term share price has a direct influence on its ability to pull these moves off, though. If AMC’s share price drops (and stays below $3), it would probably end up with close to a billion outstanding shares with the same transactions. To be able to make these moves without asking for an increase in authorized shares above 550 million would require AMC’s share price to get to around $10 and then stay near there despite dilution from equity offerings and debt-for-equity exchanges.

Conclusion

AMC has made progress in improving its financial situation with its ATM equity offering and its debt-for-equity exchange. These moves have reduced AMC’s net debt by over $400 million, but at the cost of adding over 95 million shares.

I believe that AMC needs to achieve another $1.8 billion in equity raises or debt-for-equity swaps (factoring in projected near-term cash burn) to put itself into a solid position for long-term survival with a sustainable business, though. This will likely require it to ask for an increase in authorized shares.

If AMC’s share price stays around $5, it may be able to pull off various debt-reduction moves while ending up with around 670 million to 740 million shares. Assuming the movie theater business also recovers over the next couple of years, that could translate into an intrinsic value of a bit under $5 per share.

There is a reasonable path to survival for AMC Entertainment Holdings, Inc., but I am maintaining a sell rating on it since even if things work out for it, AMC’s intrinsic value would seem to be a bit below its current price.

Read the full article here