Introduction

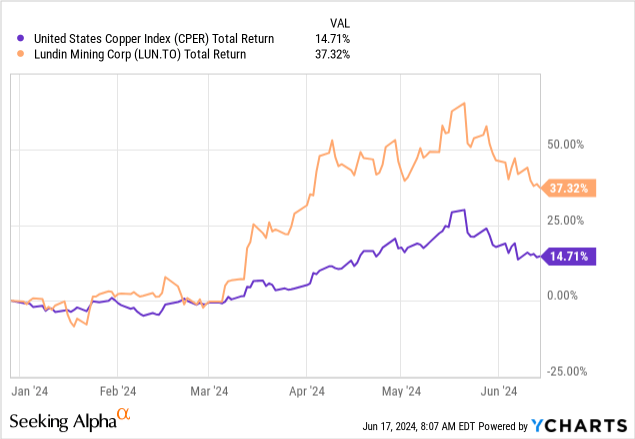

I covered Lundin Mining (OTCPK:LUNMF, TSX:LUN:CA) in a number of articles, most recently here. Since my initial recommendation in August 2022, the stock is up more than 100%, and 33% year-to-date. The year-to-date copper rally has been the primary driver of the company’s solid performance. However, copper prices have been sliding from their peak over the last three weeks. This has pushed Lundin Mining close to my accumulation zone again.

I am a long-term copper bull, but a short-term bear. The demand destruction due to the implosion of the Chinese property bubble will likely take years to be fully absorbed (as I discussed in a separate article). Nonetheless, the long-term fundamentals of the copper market remain strong. The increase in demand from the energy transition, combined with constrained primary supply, indicate that copper is in a secular bull market. In my opinion, Lundin Mining represents the best way to buy exposure to copper prices for the long term due to its impressive growth pipeline.

In this article, I comment on the company’s recent Q1 2024 results and discuss the company’s progress to advance its many projects. In particular, I suggest that Lundin Mining is likely to become a true copper giant over the next decade, at the very center of the Vicuña district, an emerging giant copper-gold district located in one of the most prospective copper regions in the world.

Vicuña: an emerging giant copper-gold district

About 40% of all copper comes from the Central Andes. Of this, the majority comes from just a handful of giant deposits. Well-known examples include Escondida (controlled by BHP), and Chuquicamata and El Teniente (controlled by Codelco). These are some of the biggest copper mines in the world.

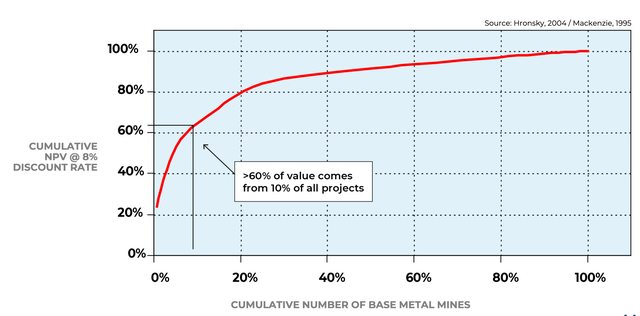

In mining, size matters. More than 60% of value is created by the top 10% of copper projects, as shown in the plot below. A bigger size is associated with higher grades; in addition, it leads to infrastructure synergies, and thus lower costs. Giant deposits can sustain production for more than one hundred years. Some of the biggest mining companies in history were built on their backbones.

Hronsky, 2004 / Mackenzie, 199

Unfortunately, giant deposits are exceedingly rare. Extreme geological processes must occur in one place to create an exceptional concentration of metals. It is estimated that a greenfield copper exploration program has just a 0.07% chance of finding an economic deposit, which is less than one in a thousand. The probability of finding a giant deposit is less than one in ten thousand.

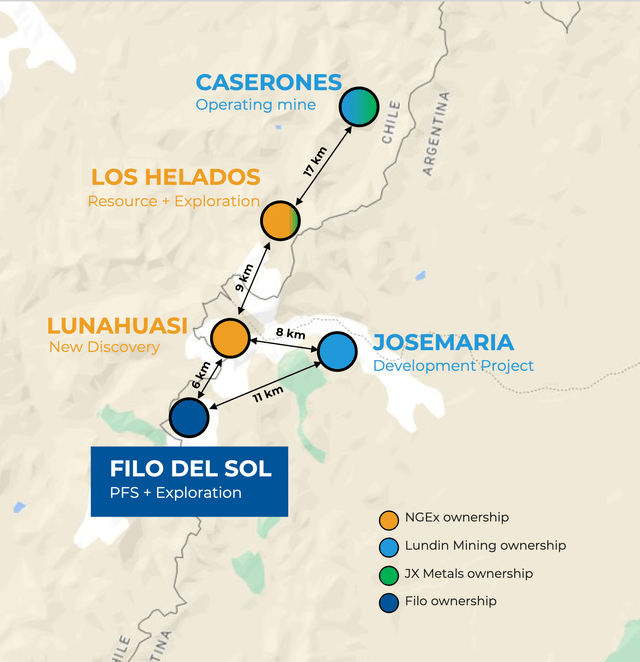

Not surprisingly, only a few of these deposits are currently known. Recently, however, a new giant copper-gold deposit has been discovered. Located in the Vicuña district between Chile and Argentina, it is the only one not already owned by a major mining companies. The district is made up of 5 megaprojects, at different stages of development: Lundin’s Caserones and Josemaria, Filo’s (FIL:CA) Filo del Sol, and NGEx Minerals’ (NGEX:CA) Los Helados and Lunahuasi. Caserones is already an operating mine, Josemaria is currently under development, while Los Helados and Filo del Sol are still under exploration. Lunahuasi is the most recently discovered of the group.

Company’s Presentation

Lundin Mining is the largest company of the three (it has a market capitalization of $8.1 billion, vs. $2.3 billion for Filo and $1.6 billion for NGEx). It is the only producing one (Filo and NGEx are exploration companies). It is currently developing the Josemaria project, thus putting in place crucial infrastructure that will likely be shared with the rest of the district. All three companies are part of the Lundin Group, and the Lundin family has a significant ownership position in all of them. Given the potential synergies, it seems likely that all 5 deposits will eventually be acquired by Lundin Mining. This is what happened with Josemaria: it was acquired by Lundin Mining in 2022 from Josemaria Resources, another company in the Lundin Group.

It also seems likely that a mining major will be brought into a strategic partnership to finance and support the development of the district. Lundin Mining does not probably have the financial resources and the technical expertise to develop Vicuña all on its own. The strategic partner could be BHP, which is known to be on the hunt for copper assets (as proven by its recent failed acquisition of Anglo American). BHP already owns a 5% stake in Filo, and would therefore represent a natural candidate as a strategic partner. Here are some comments made by Jack Lundin during the Q1 2024 Conference Call:

We want to make sure that we can have a significant influence over the development, and ultimately, the operation because we know that Josemaria is going to be something that ignites the broader Vicuña District to be developed. And we are focused on growing and being significant players in the district for the long-term. So, that’s a key requirement for us in any future or potential partnership that we would form. And so I think as well, given the fact that the Lundin Group has been involved in Argentina for the better part of 30 years, that we have the team and the capabilities in country. And also, from a project standpoint, we have got a very strong project team on Josemaria that’s capable of leading the development. So, it remains to be seen yet on what that arrangement looks like for the partnership.

Let’s now have a closer look at the two deposits already controlled by Lundin Mining: Caserones and Josemaria.

Caserones

In 2023, Lundin acquired a 51% interest in the Caserones mine from JX Nippon Mining & Metals Corporation for $950M. Lundin also has the option to increase its ownership to 70% for $350M. This would add 25 thousand tonnes of copper per year, over a mine life of 15 years. This option is very likely to be exercised (paying $14,000 per tonne of attributable yearly production, when copper is trading around $10,000 per tonne, sounds like a great deal). The option can be exercised starting in July over a 5-year period. In response to a question about whether the company would exercise the option in July, the following comments were made:

I mean, there’s no indication that we wouldn’t want to be doing that at this time. But of course, we just need to follow proper process before making a call option for that size. So, I think it’s trending in the right direction. We haven’t seen anything in the operation that is making us feel less confident in the acquisition. It’s been actually performing better than expectation. And we’ve been getting good rates from the groundwater wells that provide the water required to operate the mine. […] So, overall, I think we’re very confident in Caserones and we’re confident in its ability to actually get better as we look to optimize through various planning processes once we really update the life of mine plan for 2025. So I would say it’s going very well for us so far.

Caserones is a large-scale, long-life copper-molybdenum operation. It is guided to produce between 120,000 and 130,000 tonnes of copper, and between 2,500 and 3,000 tonnes of molybdenum in 2024. It also comes with the largest land package in the Vicuña district, which offers a lot of optionality via exploration. Several holes have already been completed during Q1, both at the Angelica oxide and sulfide target and at Caserones Deep (below the current pit shell of the Caserones deposit). We don’t have the results yet, but these high-priority targets are expected to add significant resources and mine life to the current operation.

Historically, the mine had a lot of operational challenges under the previous operator. However, Lundin was able to solve most of the problems, as well as to optimize costs by creating supply chain, logistical and management synergies with Candelaria (Lundin’s flagship operation), which is also located in Chile, about 100 kilometers from Caserones.

During Q1, we completed the creation of what we call the regional office in Chile. That is a group that brought together the support functions from both companies, finance, procurement, HR, IT. So, as you said, there’s more to come. In 2023, we were able to capture between $12 million to $14 million of savings from some low-hanging fruit opportunities. But this new group is looking at all the opportunities going forward. And we know that there are a lot of opportunities that will be reflected later on our cost guidance. For 2024, we have reflected some of those, but we still think that there’s more to come.

Josemaria

The Josemaria project was acquired in April 2022 from Josemaria Resources for an implied equity value of approximately $625 million. The deposit is located 20 kilometers from Caserones, again creating significant synergies. However, Josemaria is located on the other side of the border, i.e. in the San Juan Province of Argentina.

The new Argentinian presidency under Javier Milei looks decidedly pro-business and pro-mining. The government has recently proposed an incentive regime for large investments referred to as RIGI, which Lundin Mining would qualify for. The RIGI provides tax benefits, in addition to regulatory stability and protection against state abuses. The bill was approved a few days ago by the Senate with amendments; it has now to go back to the Chamber of Deputies for final approval. While the RIGI would create important incentives, the tax rate is negotiated at the provincial level. Lundin is working on a framework for fiscal stability with the San Juan authorities, which is on target to be finalized within this year.

Josemaria is one of the largest copper megaproject being developed globally. It contains 1 billion tonnes of ore at ~0.30% Cu and 0.22 g/t Au over a 19-year mine life. It is expected to produce an average of 250 thousand tonnes of copper per year during its first 3 years of operation. Field activities are currently on-going. A total of $56 million, or approximately a quarter of the guided $225 million for the year, was spent in Q1, 2024. The company started pump tests to update water models, which should be updated around the middle of this year. Important pieces of equipment, such as components of the grinding mills and gearless motor drives, were delivered in-country. What is exciting about Josemaria is that this is the first project to be developed within the Vicuña district, so all the infrastructure being put in place now will be shared by the rest of the district.

Josemaria is only 8 kilometers away from NGEx Minerals’ Lunahuasi property. Lunahuasi is where the most spectacular intercepts in the district have been found. The discovery drill hole (DPDH002) was drilled in 2023 and consists of 60m at 7.52% CuEq. This initial hole was followed by over 20 holes at grades bigger than 10% CuEq in the first drill season. In my opinion, Lunahuasi has the highest grades and highest exploration potential in the district (incidentally, this is why I am also a shareholder of NGEx). Given the proximity to Josemaria, and the fact that Lunahuasi’s mineralization remains open in all directions, Lundin is investing in exploration along the Josemaria-Lunahuasi corridor, targeting discoveries at Cumbre Verde and Portones. Q1 marked the end of the first drill season: 6 holes were drilled targeting the same mineralized system and structures from Lunahuasi. We don’t have the results yet, but I was intrigued by the following comments during the Conference Call:

We’re hitting highly mineralized veins and structures with grades approaching that of our neighbor to the north, but over a thinner width to date, but they appear to be similar in nature and extremely promising. So, we’re hopeful that as we get further west in our drilling, further north and slightly deeper, we’re going to see more exciting results, and those will probably come with longer drill holes in future campaigns.

Company’s Presentation

Q1 2024 results

Given Lundin Mining’s growth prospects and the long-term nature of its projects, the focus should not be put on quarter-by-quarter results. In any case, Q1 was a strong quarter, in line with expectations. Copper production was 88,000 tons (guidance of 366,000 tons to 400,000 tons was confirmed). In addition, 46,000 tons of zinc and 33,000 ounces of gold were produced in the quarter. About 40% of copper production came from Candelaria, where production is expected to be 60% weighted to the second half of the year, as grades improve. Caserones also had a solid quarter, with 34,000 tons of copper produced, despite unscheduled shutdowns of the processing plant. Zinc production was lower than expected, affected by lower throughput and grades at Neves-Corvo. Nickel production at Eagle was in-line with expectations.

The company generated $937 million in revenue, of which 76% from copper. Costs continue to fall after the increase in the last year due to inflationary pressures. Overall, costs are down 12% due to a weaker Chilean peso and various optimization initiatives. Adjusted EBITDA came in at $363 million and adjusted operating cash flow at $314 million. The balance sheet remains in good condition, with $1.45 billion in a revolving credit facility and net debt of $980 million, which equates to a leverage ratio of 0.7x adjusted EBITDA. With a market capitalization of $8.2 billion, Lundin Mining does not look expensive, even based on its current production profile. However, the main reason to buy remains, in my opinion, its involvement in the Vicuña district.

Conclusions

Lundin Mining has one of the most exciting growth pipelines in the sector. In addition to a solid portfolio of high-quality producing assets, the company is developing the Josemaria project. This project is sparking the development of the Vicuña district, an emerging giant copper district. Lundin Mining is right in the middle of this historic development, already controlling 2 of the 5 deposits. I speculate that, in the end, both Filo and NGEx, which control the remaining deposits, will end up being consolidated under Lundin Mining. While I remain cautious on copper prices in the near term, I consider Lundin Mining the best way to buy exposure to copper for the long term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here