I’d been eyeing language learning app, Duolingo (NASDAQ:DUOL) for a while, and finally bit the bullet and bought the stock around $190. I think it was a great opportunity and even though it has since climbed to $205, there is still room for the stock to double in the next 3-4 years on steady revenue growth of 30% and adjusted earnings growth of 98% as operating margins improve and turn the business into an earnings story as well. For now, it generated a strong operating cash flow of $153Mn in 2023 with a margin of 29%, and adjusted EBITDA of $94Mn with a margin of 18%, reaffirming my conviction that the business is strong to generate enough profits down the road as revenue growth slows from the hyper growth of over 50% in the past 4 to a healthy 30% in the next 4.

I will continue to accumulate between $190-210 and hold for the next 3-5 years.

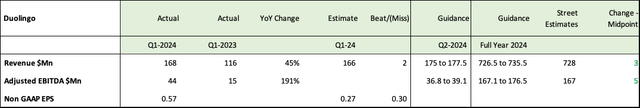

Q1-24 results and guidance confirm progress

For Q1-2024, the fantastic performance continued as Duolingo grew revenues by a whopping 45% YoY and beat revenue estimates by a slight $2Mn, and adjusted EBITDA a massive 191%. It beat non-GAAP EPS by 30 points, clearly demonstrating that operating leverage is flowing through to the bottom line.

Revenue guidance for Q2 was in line with analyst estimates, but higher by $3Mn for the full year, as was adjusted EBITDA, which is now slated at a midpoint of $171.5Mn, another huge increase of 83% over 2023.

Duolingo Q1-2024 (Duolingo, Seeking Alpha)

What’s so special about Duolingo?

Duolingo’s operating metrics tell a compelling story

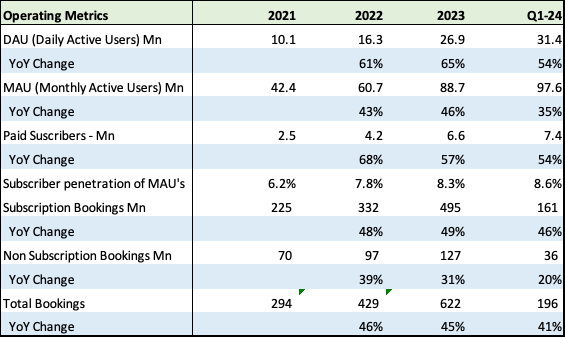

Duolingo makes most of its revenues from paid subscriptions to its language learning apps; Greasing those wheels are the steady increase in daily and monthly active users. Daily Active Users (DAU), which after growing 65% and 61%, in 2023 and 2021, continued to grow 54% in Q1-2024. Similarly, Monthly Active Users (MAU) grew 35% in Q1-2024 after zipping through 2023 and 2022 at 46% and 43%. Paid subscribers, which is Duolingo’s growth and monetization engine didn’t slow down, growing as fast as DAU’s at 54%, a slight drop from last year’s 57%. As we can see from the table below, the penetration of Monthly Active Users, (conversion to paid subscribers) grew to 8.6%, adding to revenue growth. Adding to that was a higher growth in subscription bookings, which grew faster at 46% compared to non-subscription bookings at only 20%. Clearly, this high-quality freemium model works, and works profitably.

Duolingo Operating Metrics (Duolingo)

Duolingo’s Competitive Advantages

A gamified approach

Duolingo is the largest language learning app in the world, with over $37Mn in January 2024 revenues with closest competitor Babbel a distant second with $6.6Mn. It has a unique approach compared to competitors, Rosetta Stone and Babbel, both strong competitors who also have decades of experience in the industry. Duolingo offers a gamified experience, which resonates with its primary user audience and main cohort of younger, Gen Z subscribers, who prefer a lighter, fun experience of learning a new language.

From “The only app that always wins the battle for your attention”

Anyone familiar with Duolingo knows it can feel more like FarmVille than French class. It’s loaded with so many gamification techniques that you might wonder if you’re really learning through bite-sized lessons, odd-looking characters and stories about horses going to the movies.

“From What Makes Duolingo The Most Popular Language App?”

I think the reason it’s been doing so well is it’s very enjoyable – there are a lot of aspects that make it a bit like playing a game – but also effective, There’s an independent study that shows that if you use Duolingo for 34 hours you learn the same as you would in one university semester of language learning.”- The Guardian

Leveraging their mascot as a meme on TikTok

The younger generation, comprised of Gen Z and millennials with their emphasis on travel and new experiences, interacts more frequently across borders and cultures, thus creating the need to learn more than one language. What better than a social media platform like TikTok with a goofy mascot to make learning easy and fun. Besides engaging and growing its key target audience, the TikTok posts reduces expensive advertising and marketing dollars.

Duolingo has more than 6.7Mn followers on TikTok. With 80% of its growth coming from word-of-mouth advertising, engaging followers is often a result of very inventive, and unhinged jokes and posts, such as its mascot owl’s romantic relationships with other brand mascots. And this works according to this Wall Street Journal article..

Our marketing team has really found its stride in terms of…the levers that work and don’t. We’ve just found that we have a brand that is very good for social media. And it’s organic, it’s not paid stuff” says their CEO, Luis von Ahn.

Within its product organization, Duolingo has teams such as the “Virality Team,” which works very closely with marketing to build out the product in a way that lends itself to sharing on social media. For instance, the app encourages users to translate sentences such as “Without a doubt, I want to eat ham” or “Whose robot ate my cake?” or “I do not hear you since I have cinnamon rolls in my ears.” Those sentences are meant to be memorable to those learning a language and lend themselves to users sharing them on social media for comedic value. The company’s marketing also benefits from having become an internet joke. Duolingo is the beneficiary “of essentially having a mascot that has become a meme,” says Chris Ross, a vice president analyst at research firm Gartner.

Duolingo, like many other learning apps, are trials hoping people will like them and the important thing is to keep reinforcing it.

Duolingo believes their platform has become synonymous with language learning, for example, on Google, people search for the term “Duolingo” approximately eighteen times more often than “learn Spanish.”

Duolingo has other attributes to keep growing its user and keeping them loyal and engaged, such as

- A choice of proficiency and pace adapted to each individual’s schedule.

- Allowing users to take charge of their own courses.

- The freemium model for all income and proficiency levels across continents to participate.

- Gamification techniques that reward learners.

Duolingo’s streak strategy

Ben Cohen, a Wall Street Journal, reporter who authored “The Hot Hand” a book on streaks has a very interesting article on Duolingo’s streak strategy and why it is so successful.

The best way to learn a language is getting in the habit of daily practice, and the best way to form that habit is getting a well-timed nudge, which makes streaks and notifications essential to Duolingo’s surprising business success.

I wrote an entire book about the power of streaks, but I’ve never come across an example of streaks as powerful as Duolingo. Duolingo takes our propensity for streaks and turns it into a motivational tactic. It turns out people are willing to do all sorts of peculiar stuff if they have the incentive of a streak-like sneaking out of a bar right before midnight to speak a few minutes of Japanese.

The longest active Duolingo streak is now longer than 4,100 days. The only thing more impressive than a few people using the app every day for more than a decade is that five million people have streaks of a year. In fact, the company says that more than 70% of the product’s more than 30 million daily active users have weeklong streaks.

Duolingo keeps people hooked and engaged by encouraging them to make learning a habit, which has a positive connotation. Research found that simply mentioning the word habit led to a 5% improvement, and from Duolingo’s success, they’re doing this in spades.

Anecdotally, I can vouch for why people get excited about streaks. For example, I will get a nudge from “My Fitness Pal” about my 15-day streak on staying under my calories. Like most people, I like to know how much time I’ve invested in my habit/goal. Duolingo likes to remind you of your investment.

The trend is Duolingo’s friend.

Duolingo seems to be spot on in identifying language learning trends. Reading this, I checked twice to see if this was a promo from Duolingo’s website, the trends were uncannily similar to Duolingo’s product features. It wasn’t – this was an article from Gofluent, a competitor. These were the key trends that Gofluent referred to:

AI Integration – Duolingo is on top of this trend. The streaks and notifications are a result of very precise use of AI, designed to keep their products sticky. Duolingo’s algorithms are a result of decades of AI research.

Using Assessments – As I mentioned earlier, Duolingo will nudge you to death to keep up with your assessments.

Nano Learning – Duolingo’s average lesson is about 7-10 minutes.

Immersive & gaming – Duolingo is a pioneer in both categories with their gamified and social media approaches.

It also made me wonder if Duolingo’s ubiquity and success has actually created these trends, and if so, it has a massive first mover advantage, and a huge brand / product identification with language learning. Maybe “Duolinging” will become a verb for learning a second language, the way Google has become a verb synonymous with search.

Duolingo’s flywheels and why AI is not a threat.

Duolingo has two flywheels, which will allow it to dominate this industry.

The freemium model gives it a lot of scale, and access to a huge amount of learning, by analyzing its users’ data. This is their Learning Flywheel, which in turn allows them to improve engagement and target user needs better, which then allows users to share their experiences and induce new users into the platform – reinforcing the virtuous circle.

Secondly, this also leads to product innovation and enhancements, which Duolingo calls their Investment Flywheel. The conversion to paid subscribers generates more cash to continuing R&D efforts for product enhancement, besides furthering their data moat.

Competitors talk about using AI to teach languages – guess who has the most data to power the algorithms and A/B testing? Duolingo’s millions of learners complete a billion exercises each day, creating and powering on the largest language learning data sets.

Besides the competitive advantages of having two flywheels, Duolingo has tied up with OpenAI for the Duolingo Max, which could add 6-25% to 2025 subscription revenue. AI translations may hinder some progress and fulfill some needs, but it’s unlikely to be as immersive and personal as the human connection of conversing with another human in a different/new language.

Duolingo has several weapons in its arsenal after decades of research, including its bandit algorithm, which it uses to maximum effect in sending those pesky habit forming nudges at the right time. Or, how about their AI model called Birdbrain, which works like a stealth bomber, helping you learn without your realizing it.

Duolingo’s new revenue segments

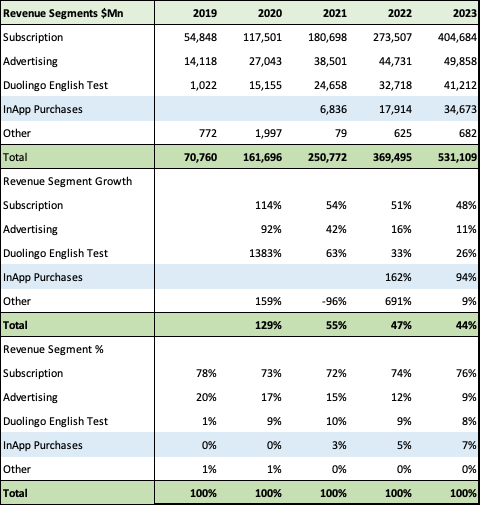

Subscriptions remain at the top with $405Mn, or 76% of the total, growing well at 48%, but In-app purchases have grown the fastest at 94% and now accounts for 7% of revenues in just two years.

English Test revenues also shot up from just $1Mn in 2019 to $41Mn in 2023, and as of last year, over 4,000 higher education programs accepted Duolingo’s test results as proof of proficiency for admissions.

I strongly believe that Duolingo is just getting started and their flywheel, scale and strong user base will open new markets and products. There are a few in process already, such as the app for young children teaching early literacy skills, a Mathematics course and a music course teaching the basics. This product-focused, mobile-first, “learning is fun”, approach to education should easily take them beyond languages and hugely expand their TAM.

Duolingo’s revenue segments (Duolingo, Fountainhead)

Market size and growth

According to the 2024 HolonIQ report, consumer spend on both online and offline language learning is expected to reach about $115 billion by 2025, with online accelerating significantly over the next five years.

Business Research Insights pegs the global language learning application market to grow at a CAGR of 16.4% to reach $16.63Bn by 2031, from just $3.15Bn in 2021.

I do believe that learning via apps will continue to take a larger share of the total language learning pie. The runway for growth is quite long and wide.

Learning English is going to be one of the larger, faster growing and more profitable segments of this market. As we saw from Duolingo’s revenue segments they have a strong presence in English, especially in English test revenue, which started with just $1Mn in 2019, and grew to $42Mn last year.

Challenges and weaknesses

The biggest criticism, and perhaps a very valid one seems to be the lack of depth in its courses. While this article was positive on Duolingo’s unique approach to language learning, with the author clearly liking Duolingo, several readers commented that they didn’t learn enough, and that Duolingo wasn’t serious enough for them.

Critics claim that there’s not enough emphasis on grammar, but it isn’t stopping users from trying out their product.

There has been some criticism that AI may also be a risk, but as I stated earlier, Duolingo has its own AI strengths and more importantly, the right data that others don’t.

The stock is expensive at 12x, 2024 sales and while the company throws up gobs of cash it doesn’t have GAAP operating profits yet, which could affect its valuation. The stock did crater after Q1 earnings, just because the beat and guidance were insufficient for heightened expectations. Currently it’s about 17% below its 52-week high of $251.

Valuation and investment case

Duolingo’s excellent financials

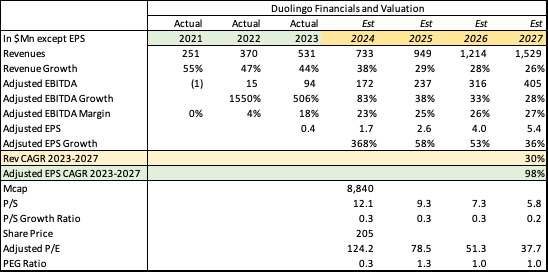

Duolingo Valuation (Duolingo, Seeking Alpha, Fountainhead)

While Duolingo’s revenues grew at a frenetic pace of 65% between 2019 and 2023, they’re forecasted to grow at a still excellent pace of 30% from 2023 to 2027, in range with average analyst estimates. What is even more impressive is the adjusted EBITDA and earnings growth. Adjusted EBITDA grew at a whopping 506% in 2023, and Duolingo has guided to 83% growth in 2024.

With excellent operating leverage and reining in marketing and sales costs, earnings should grow at a much faster pace at a CAGR of 98% between 2023 and 2027.

Is the stock expensive – Yes, at 12x sales and 125x earnings, but these pale to insignificance in the next two years with strong growth. Duolingo’s P/S ratio drops to 7x 2026 sales and its P/E drops to 51x 2026 earnings. The PEG ratio is low at 1 for a such a fast grower.

Duolingo Margins (Duolingo, Seeking Alpha)

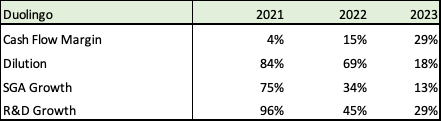

I have a high amount of conviction in Duolingo’s business model and management. Duolingo displayed strength and acumen in growing revenues at an exceptional CAGR of 65 % between 2019 and 2023, while keeping a lid on operating expenses. Duolingo was cash-flow positive as early as 2019, as we can see from the table above; operating cash flow, which was a paltry 4% in 2021, ballooned to 29% in 2023. Key to that was a slowdown in SG & A growth, especially fiscal discipline in marketing and selling expenses. Normally, sales and marketing are heavy for a consumer product platform needing to acquire subscribers/users. SG&A expenses grew only 34% and just 13% in 2022, and 2023, much slower than revenue growth of 47% and 44% respectively. Instead of wasting money on heavy advertising and sales, Duolingo spent the money on TikTok memes, as I wrote in the section earlier.

They also made the intelligent move of not reducing R&D expenses, which is the prime reason for its popularity and product excellence. Duolingo is one the more user friendly and addictive apps, which is purely because of the depth of product and user knowledge that has gone into making it.

I’m also impressed that dilution reduced to 18% in 2023 and expect this to continue dropping.

To summarize, this is an excellent company for its

- Impressive Learning and Investment flywheels.

- Unique gamified and social media strategies.

- Strong AI and data analytics.

- Market leadership.

- Excellent operating metrics.

- Growth prospects beyond languages.

I recommend a buy.

Read the full article here