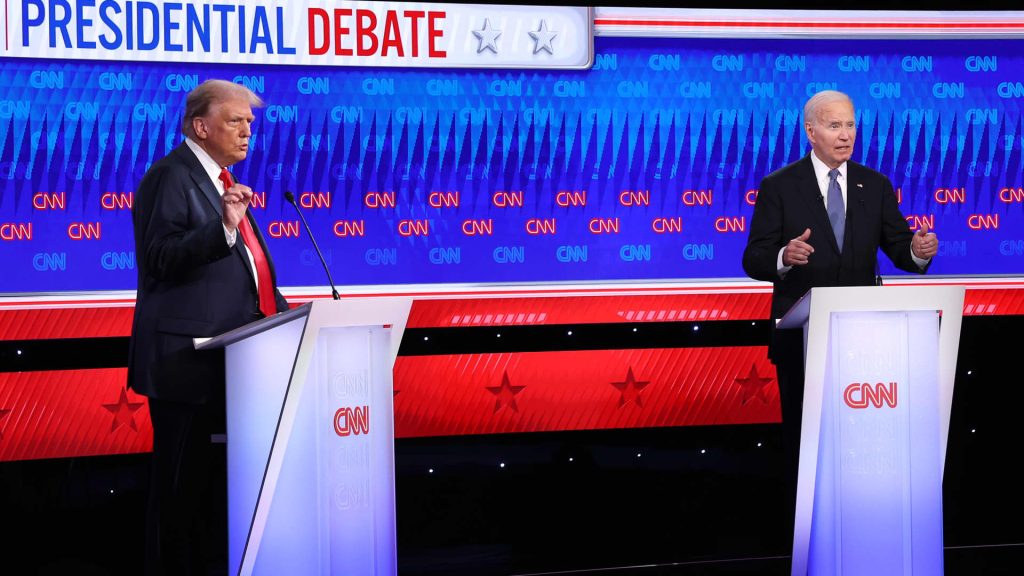

Financial markets are slowly starting to absorb the possibility that what was once a toss-up presidential election campaign has taken a notable turn. While it may yet become an overstatement to call the June 27 debate between President Joe Biden and former President Donald Trump a watershed moment, the incumbent’s halting and mumbling performance has changed views about where the race is headed. In both polling data and the predictions market, the Republican challenger has become a solid favorite, up mid-single digits in several recent polls, with the specter lingering that Biden won’t even be his party’s nominee come November. That has put investors in a quandary of how to handicap what a Trump presidency would look like from an economic and market standpoint. “As Trump’s numbers rose earlier [last] week, people started to speculate that a Trump win would mean a little bit more mid- to long-term inflation, potentially slower economy, which is why the yield curve steepened a little bit, and which is why longer-term bonds got a little pressure earlier in the week,” said Mark Malek, chief investment officer at Siebert AdvisorNXT. “We’re going to watch that, because there’s no definitive sort of direction yet, but we feel that the market is starting to try to figure that stuff out,” he added. Stock market reaction has been fairly benign so far: The S & P 500 has continued to scale record heights, albeit gradually, and is up about 1.5% since the last close before the debate. .SPX mountain 2024-06-28 S & P 500 performance since the debate However, the bond market has had a bit more of a reaction. The benchmark 10-year Treasury yield has gradually declined and, perhaps more importantly, has moved further below the 2-year note. The phenomenon, known as an inverted yield curve, has been a nearly infallible predictor of recessions, though the current inversion started in July 2022 and there has not been an official recession since. The inversion has steepened in the past several days as Trump has shown a post-debate polling bounce, indicating misgivings about the economy’s prospects. Handicapping a second Trump presidency Other market reaction regarding a potential Trump victory, as measured by Bank of America’s chief investment strategist, Michael Hartnett: winners were rates volatility, bets that benefit as the yield curve steepens, banks and technology. Losers have featured longer-dated bonds, homebuilders, renewable energy stocks and emerging market currencies. Hartnett also noted that the odds of a Trump-led Republican sweep of the White House and both chambers in Congress have swelled to 36%. Reading the tea leaves, though, has been difficult. The first Trump presidency and some of his campaign rhetoric nevertheless has led to guesswork about what could be ahead. “The extension of the 2017 tax cuts and potential deregulatory agenda of former President Trump are starting to get priced into the market,” Ed Mills, Washington policy analyst for Raymond James, said in a note. “This particularly favors financials and there will be an expectation of more M & A approval in a Trump presidency. A potential for more inflationary policies should also be closely monitored.” ‘Reverse Goldilocks’ reaction Inflation has been a major problem for Biden as the consumer price index has risen more than 19% on his watch, compared with less than 8% during Trump’s time in office. But it was the president’s stumbling debate performance that brought out the knives, with some congressional Democrats and mainstream media outlets such as The New York Times calling for him to step aside. PredictIt, a widely watched though thinly traded predictions market, put Trump’s chances of victory around 59% as of Monday afternoon. However, in a switch, Biden’s defiant statements that he would stay in the race caused a swing on the betting site, giving him a 29% chance of victory compared with 15% for Vice President Kamala Harris. In recent days, there had been heavy speculation that Harris could step in for Biden on the ballot, and she had overtaken his chances of being the nominee before that changed Monday. PredictIt, though, now gives Biden a 56% chance of being the Democrat nominee, with Harris falling 12 points to just 31%. Chris Krueger, Washington strategist for TD Cowen, called this week “Biden’s Gauntlet” as it will be crucial to his viability as a candidate. “Biden remains the presumptive nominee…for [the] time being,” Krueger wrote, adding that Biden’s interview Friday with ABC’s George Stephanopoulos was “a bit of a reverse Goldilocks: just good enough to stay in the race, but not good enough to alleviate concerns about acuity.” — CNBC’s Sarah Min contributed to this article. Correction: Mark Malek is chief investment officer at Siebert AdvisorNXT. An earlier version misstated the name of the firm.

Read the full article here