Telephone and Data Systems, Inc. DEP SR UU PE PFD (NYSE:TDS.PR.U) remains an interesting way to play the company’s deal to sell its wireless operations, offering a better combination of income and value compared to its ordinary shares.

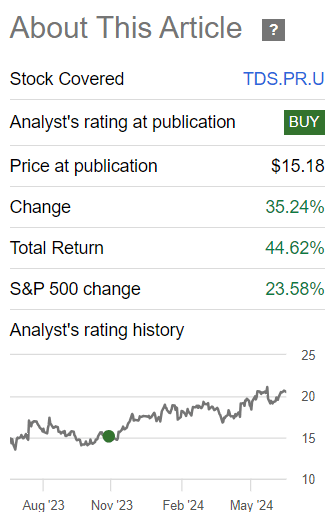

As I’ve covered in a previous article, its preferred shares appeared to be undervalued some months ago, following the company’s announcement of a strategic review of its stake in United States Cellular Corporation (USM). Indeed, since then, its preferred shares are up by more than 44% including dividends, beating the market during the same time frame.

Article performance (Seeking Alpha)

In this article, I update TDS’s most recent financial performance and investment case, to see if the preferred still offers value for long-term investors following its strong rally in recent months.

United States Cellular Deal & Financial Performance

Telephone and Data Systems, Inc. (TDS) is a relatively small telecom operator in the U.S., at least compared to its largest peers AT&T Inc. (T) or Verizon Communications Inc. (VZ), serving about six million customers across several states. Its current market value is about $2.3 billion, being a small company by this measure.

Its most important asset is its stake of around 83% in United States Cellular, which the company put under strategic review in August of last year. After several months of negotiations with Verizon and T-Mobile US, Inc. (TMUS), a deal was announced some weeks ago with T-Mobile to acquire most of United States Cellular’s wireless operations.

This deal is valued at $4.4 billion, including cash and up to $2 billion of debt, allowing TDS to monetize a large part of its stake in United States Cellular. T-Mobile will acquire United States Cellular wireless operations and about 30% of its spectrum, while United States Cellular will retain its owned towers, equity method investments, and the remaining spectrum. Additionally, T-Mobile will also enter into a master license agreement to use about 2,000 towers, of United States Cellular’s total 4,400 owned towers.

While it’s not certain that this deal will get regulatory approval, assuming that eventually the deal goes through, TDS is expected to receive some cash proceeds from United States Cellular, which it intends to use for investments in its fiber network or distribute capital to its shareholders. Regulatory approval should take some time and the deal is expected to be completed by mid-2025, thus for the time being TDS’s business profile is not expected to change much over the coming months.

In the first quarter of 2024, TDS’s operating performance was mixed, as strong competition is leading to some revenue pressure in its wireless segment, while good cost control resulted in higher adjusted profitability.

Indeed, in the wireless segment, which is by far the largest one representing more than 70% of its revenue, its revenues in the first quarter amounted to $950 million, a decline of 4% YoY, due to lower equipment sales (-10% YoY to $196 million) and slightly lower service revenue (-2% YoY to $754 million). While its average revenue per user (ARPU) increased 3% YoY, United States Cellular is reporting net customer losses, which explains lower service revenue in the period. Regarding equipment sales, this is an industry trend, showing that consumers are spending less on smartphones, a sign that the macroeconomic environment is not that strong, plus credit conditions have become less favorable in the current high interest rate environment, a profile that is not expected to change in the next few quarters.

On the other hand, in the towers business, the performance was more stable with quarterly revenues of $25 million being 3% higher than in the same quarter of 2023. About 88% of revenues generated in the tower business comes from the three largest telecom operators, boding well for a recurring revenue stream from this business over the long term.

Regarding its operating expenses, the company’s cost reduction efforts and staff cuts implemented in 2023 are already bearing fruit, with total cash expenses in the wireless segment down by 4% YoY to $729 million in Q1 2024. In equipment, the company ended much of its promotions, resulting in a drop of 14% in the cost of equipment sold, being an important driver of lower costs in the quarter. Its operating margin was 23.3%, an increase of 240 basis points, showing that its cost reduction program was quite successful and has allowed the company to more than offset some revenue weakness.

Regarding capital expenditures in the wireless segment, it amounted to $137 million in Q1 2024, a decline of 37% YoY, but this is mainly due to some timing differences in TDS’s investments, while for the full year, its guidance remains unchanged expecting capex to be between $550-$650 million (vs. $611 million in 2023).

In the wireline business, TDS reported a better performance with revenues up by 5% YoY to $266 million in the quarter, supported by its investments in fiber and expansion of its network. About half of its customers now have access to fiber, while its goal is to serve around 60% of total addresses by fiber. Residential revenue increased by 10% YoY in Q1 2024, clearly outperforming business customers, a trend that is expected to be maintained in the future. Regarding its profitability in the wireline segment, it increased by 38% YoY to $95 million (adjusted EBITDA) in the quarter, due to higher revenues and lower expenses (-6% YoY to $173 million).

Overall, its net income in Q1 2024 was $38 million, compared to just $12 million in Q1 2023, as the company’s cost reduction program was enough to offset revenue weakness and led to higher profitability in the quarter.

Going forward, its guidance has remained unchanged for the full year, with TDS expecting some weakness in the wireless segment due to string competition, while the wireline segment is expected to maintain a positive momentum supported by its fiber rollout program. According to analysts’ estimates, its revenues are expected to be slightly above $5 billion in 2024, a decline of about 2.5% YoY, and its EBITDA is expected to decline by 1.5% to $1.25 billion, which is not an impressive performance.

Despite this somewhat weak background, TDS’s ordinary shares are currently trading at 6.5x EV/EBITDA, at a premium to its historical valuation of about 4.7x EV/EBITDA over the past five years. Compared to U.S. larger players, including AT&T or Verizon, TDS appears to be somewhat overvalued, given that AT&T trades at 6.1x EV/EBITDA and Verizon at 6.6x.

This valuation doesn’t seem to be deserved based on its operating performance in recent quarters, and its premium emerged last year when the company announced a strategic review of its stake in US Cellular, which led to a strong share price rally, thus its current valuation already seems to include a high probability of the deal with T-Mobile being successful.

Therefore, I don’t see TDS’s ordinary shares risk-return profile as being attractive right now, and the preferred shares continue to be a better option for investors. If the deal does not go ahead, its share price is likely to react negatively, while if it’s approved by regulators the upside seems to be limited at this point. Thus, its preferred shares, namely its U series with a 6.625% dividend and a call date for March 2026 seem to be a better option, given that it’s yielding over 8%, and has upside potential to its call price of $25.

Conclusion

Telephone and Data Systems is reporting a relatively muted operating performance making its ordinary shares valuation only justified by its deal to sell US Cellular wireless operations to T-Mobile. Given that there is some risk the deal is not approved by regulators, its preferred shares seem to be a better play, offering a good combination of yield and upside to its call price.

Read the full article here