My last article on Simon Property Group (NYSE:NYSE:SPG) was issued way back in March, 2020 when the stock had dropped by circa 60% since the start of the year. My thesis was bullish and supported by SPG’s upper investment grade credit rating and access to ample amounts of liquidity, which in my eyes were totally sufficient to cover the costs for couple of years in a row even assuming that majority of its malls will not be open during this period. In other words, the scenario had to be very pessimistic in order to force SPG to file chapter 11 or venture into value-destructive share issuances.

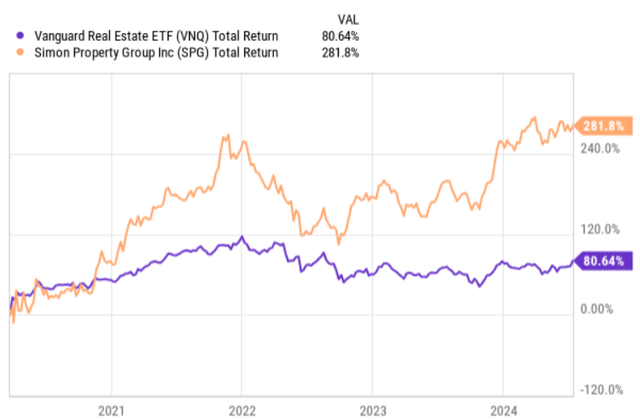

Now, since the publication of my article, the total return performance of SPG has been very strong, outperforming the overall REIT market by a huge margin.

Ycharts

During this period SPG has also almost recovered its dividend level that it had before the pandemic broke out. When the last article was circulated, SPG had communicated a dividend cut from $2.1 per share to $1.3 per share (on a quarterly basis). The quarterly dividend has now increased to $2.0 per share, offering a FWD yield of 5.4%

With all of this being said, while I still own SPG in my portfolio and have no intentions to trim down the position, the fact that SPG’s share price has positively diverged from the overall REIT index in a such a notable manner, makes me a bit cautious about the return prospects going forward.

Thesis review

Currently, SPG trades at a P/FFO of 12.3x, which is a quite high multiple relative to the other retail focused REITs. There are really not many publicly traded mall REITs out there with what we could directly compare SPG, except for the Macerich Company (NYSE:NYSE:MAC). The multiple for MAC is 9.2x (on a FWD basis), but I would argue that it is not a right comparison for SPG considering the multiple idiosyncratic issues that MAC has faced lately (i.e., mostly driven by the excessive leverage in the books).

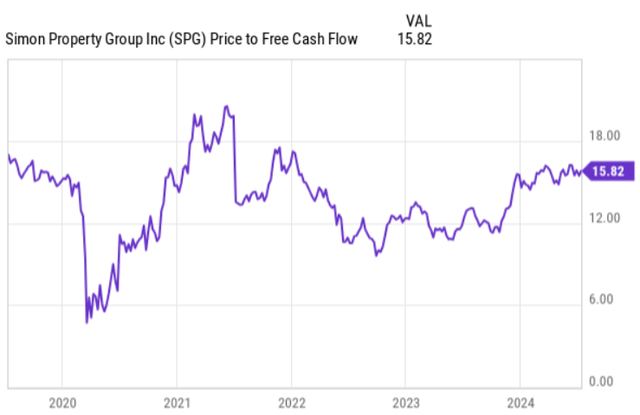

However, if we take at look at SPG’s P/FCF metrics and how it has evolved over the past 5 year period, we will notice that currently the valuation is almost in line with where it was before entering the pandemic period. Similarly, the dividend yield is also in the almost exact same (pre-pandemic) territory.

Ycharts

The key question here is whether this kind of multiple is justified. The answer to this is not that simple.

Against the backdrop of significantly higher interest rates, we should expect some discount to SPG compared to the pre-pandemic period. For SPG as a pure play mall REIT, higher interest rates render (per definition) two negative consequences:

- It pushes down the property valuations and introduces headwinds on FFO generation from rising borrowing costs that in SPG’s case are gradually ticking higher as refinancings take place.

- Higher borrowing costs put a constraint on consumer spending levels or at least make it more difficult to capture increased footwalk in malls.

Granted, the underlying business model and the way how the Management has structured the Company’s balance sheet help mitigate these risks.

For example, almost all of SPG’s malls are classified as trophy-like and located in densely populated and relatively high-income areas. Given this and SPG’s focus on tenant attraction, which cater for the needs of high-income consumers, the business is in a better shape than it would otherwise had been if the strategic bias was directed towards lower income consumer profile.

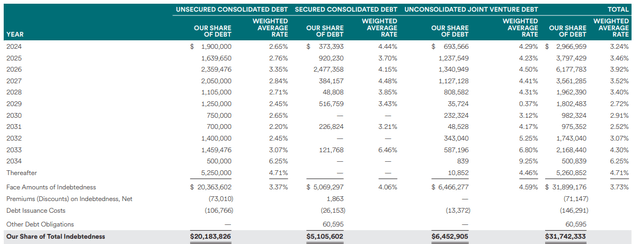

Moreover, almost 97% of SPG’s outstanding borrowings are fixed and backed by a well-laddered maturity profile. As we can see in the table below, SPG is subject to relatively minor debt refinancing each year going forward, which means that the uptick is borrowing costs should not be that quick.

SPG Q1, 2024 earnings supplemental

Nevertheless, I still do not think that SPG trading at almost the same multiple as it had at the start of 2020 before the interest rates were by circa 400 basis points lower is fully justified.

Even taking into account the mitigating factors described above, SPG still remains subject to gradually increasing interest cost base as there are debt maturities of on average $2 billion that come due each year (including this one).

Plus, in terms of the FFO generation, SPG has indeed managed to register ~11% CAGR over the past 3-year period, but calculating this from 2019, SPG’s FFO is almost flat.

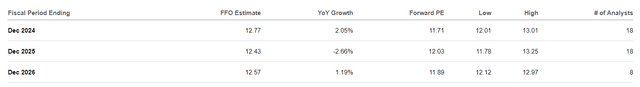

Finally, the analyst consensus estimate on SPG’s FFO for this and 2025 – 2026 years indicate almost no growth.

Seeking Alpha

If we adjust this for the inflation, the level of shareholder wealth created is negative provided that the estimates hold true.

The bottom line

All in all, SPG is a sound business with the right business model to de-risk the underlying cash flows from deteriorating consumer spending levels that are taking place in the low-income bracket. The capital structure is also strong, where the overall level of indebtedness continue to gradually shrink from 2020. In addition, the combination of the lion’s share of borrowing being assumed via fixed rate borrowings and the distant debt maturity profile puts SPG in a solid position to shield its FFO generation from surging interest expense. The TTM FFO payout level of ~ 57% provides also an additional layer of safety in case the business performance deteriorate.

Having said that, while I still continue to hold SPG in my portfolio as a predictable dividend stock, I would certainly not recommend assuming a massive exposure on SPG. The fact that the current multiples are almost at the same level as they were before the outbreak of COVID-19 and also considering the relatively subdued FFO growth projections, I just do not think that SPG will be able to register sound price appreciation returns over the foreseeable future.

As a result of this, my recommendation is to hold Simon Property Group.

Read the full article here