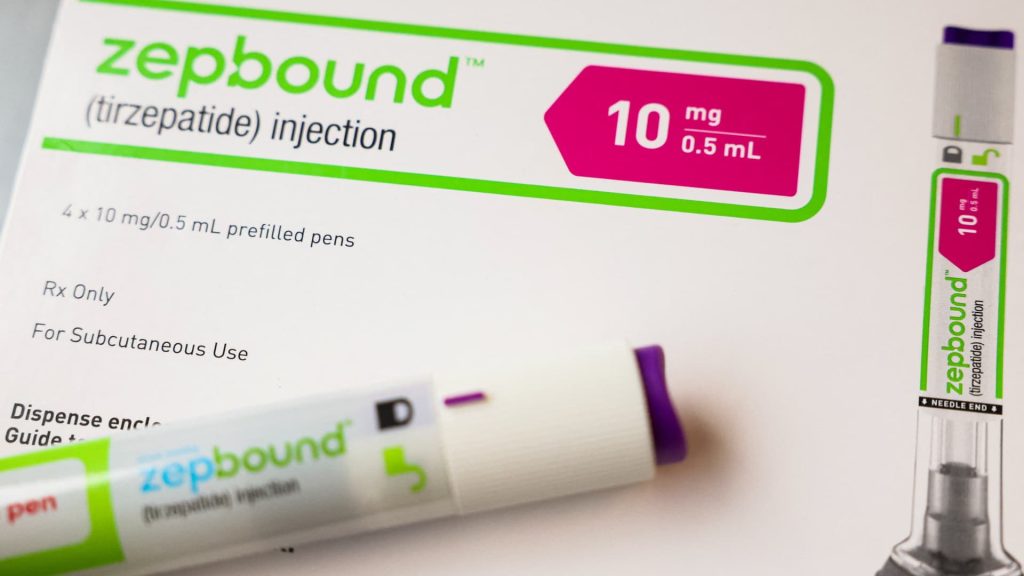

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street. Market check: The S & P 500 is falling for the second session in a row, extending its pullback to 2% from Tuesday’s closing high. The losses in the Nasdaq Composite are a bit worse, with its decline from its most-recent high now totaling slightly more than 4%. Energy and utilities are the only S & P 500 sectors in positive territory Thursday, while health care, information technology and financials lead to the downside. Club holding Nvidia is trying to make a stand here with its first up day of the week, and Meta Platforms is higher after a tough stretch, but the rest of the megacap tech stocks are trading lower. Upgrading Lilly: Shares of Eli Lilly have been hit hard since making a new closing high on Monday. The stock is down nearly 11% over the past three sessions. Some of the decline could be tied to the same profit-taking action in 2024 tech winners. But concerns about competition in the lucrative GLP-1 obesity market also are giving people a reason to sell Eli Lilly, which currently dominates that space alongside Danish rival Novo Nordisk . On Wednesday, Roche provided promising early stage trial results for its oral GLP-1 weight loss pill. The Swiss pharmaceutical firm’s results look pretty good with strong efficacy and tolerability it claims as consistent with other oral GLP-1s. However, we caution about reading too much into the data. Roche’s data is based on a small sample size and encompasses only one month of Phase 1 study. While we don’t want to knock what Roche is doing, there’s just a lot of unknowns so early in the development process. Lilly, on the other hand, has already advanced its oral pill into Phase 3 studies and is investing billions in manufacturing to stay ahead of the competition. Simply put, it’s going to be hard for challengers to knock off Eli Lilly and Novo Nordisk from their leadership positions. Lilly shares may not be cheap on any classical valuation metric, but we think this 10% pullback is the opportunity to do some buying. We are upgrading our rating to 1. Up Next: After the close Thursday, we’ll get earnings reports from Netflix , Intuitive Surgical and PPG Industries . American Express , oil services companies SLB and Halliburton , and a bunch of regional banks report before the opening bell Friday. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street.

Read the full article here