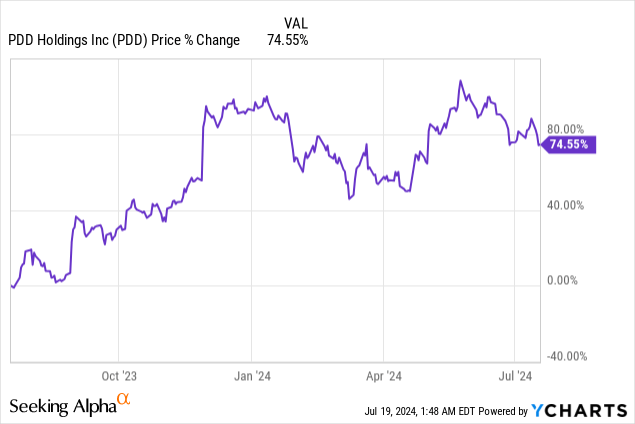

PDD Holdings (NASDAQ:PDD), also known as Pinduoduo, is a leading e-Commerce platform in China and one of the top three Chinese e-Commerce companies, next to Alibaba (BABA) and JD.com (JD), that dominate the market. PDD Holdings offers a variety of e-Commerce and related services such as fulfillment and logistics and Pinduoduo owns the hugely popular, deal-focused e-Commerce platform Temu. PDD Holdings is seeing strong tailwinds for its gross profits and net income and generating a ton of free cash flow. While not as cheap as either Alibaba or JD.com, PDD Holdings is well-positioned to deliver sustainable growth for shareholders and increase its stock buybacks in the future, making it a potential capital return play for investors!

PDD Holdings is a China-based e-Commerce growth play

China has a population of 1.4B and the amount of consumers buying products and services online is growing rapidly. PDD Holdings is well-positioned to benefit from this growth as the company is heavily focused on the Chinese e-Commerce market. PDD Holdings owns Temu.com, a discount- and discovery-focused shopping site that caters mainly to retail buyers, but not only in China. Temu caters to the shopping needs of an international audience and allows Chinese manufacturers to directly sell to their customers. Temu was founded in 2022 and competes directly with Alibaba’s Aliexpress. Temu offers discount deals for kitchen appliances, clothes, shoes, jewelry and beauty products as well as every other category that comes to mind. With its focus on discount deals, PDD has gained a loyal following and is one of the fastest-growing e-Commerce companies in China.

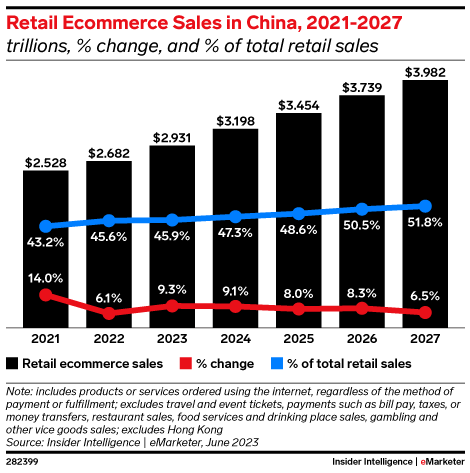

Obviously, with such a big population, China is a solid play for e-Commerce growth investors. In China, according to eMarketer, the market for retail e-Commerce sales is set to grow 8% annually over the next four years which should provide sustained tailwinds for gross profit and EPS growth for PDD Holdings.

eMarketer

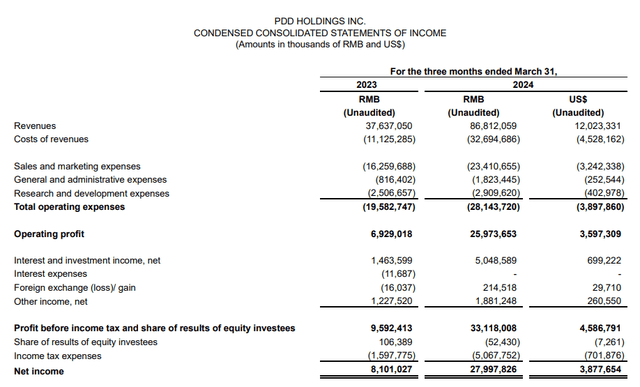

PDD Holdings generated 86.8B Chinese Yuan ($12.0B) in revenues in the first fiscal quarter, showing a year over year increase of 131%. Revenue from online marketing services surged 56% year over year to 42.5B Chinese Yuan ($5.9B) while transaction-related revenue reached 44.4B Chinese Yuan ($6.1B), showing an increase of 327% year over year.

PDD

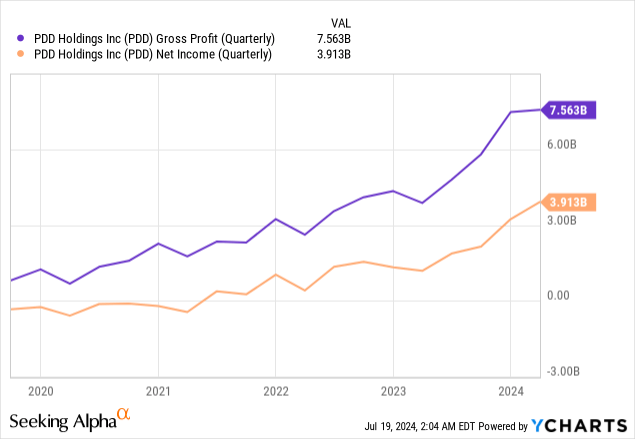

Pinduoduo’s focus on discount deals has allowed the company to build a loyal customer base and the e-Commerce platform has achieved impressive growth in the last several years. PDD Holdings’ gross and net profits are both in a long term uptrend given the company’s continual expansion in the e-Commerce market, innovation and use of artificial intelligence in order to optimize its discovery-based shopping suggestions. The effective use of artificial intelligence, for example in the context of purchase recommendations and tailored shopping feeds, could be conversions drivers for e-Commerce platforms going forward.

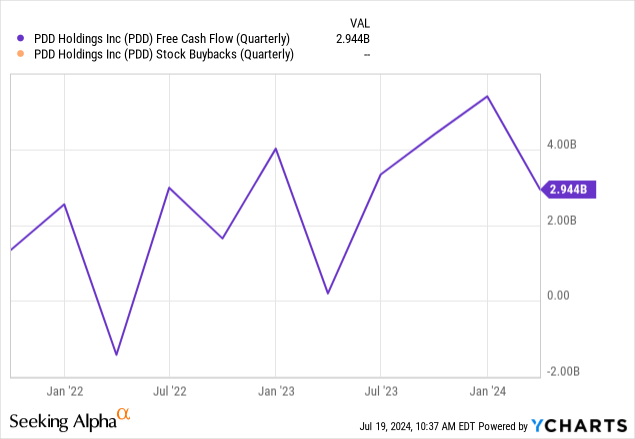

Free cash flow and capital return potential

Pinduoduo generates a lot of excess cash from its e-Commerce operations. Some of this cash is invested in building large language models which will support conversion initiatives on the company’s e-Commerce platforms. However, Pinduoduo is not really buying back any shares which stands in contrast to Alibaba, as an example, which authorized a $25B stock buyback earlier this year. Since Pinduoduo is already profitable in terms of free cash flow, I can definitely see the e-Commerce company follow into the footsteps of Alibaba and initiate stock buybacks in the future, which, given the low P/E shares trade at, would be a good use of cash flow.

Valuation of PDD Holdings

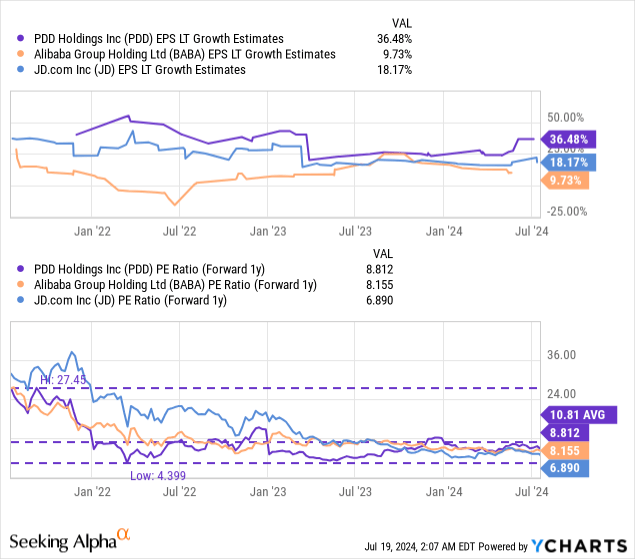

PDD and other Chinese large-cap e-Commerce platform are cheap due to a number of factors including structural issues in China’s economy and increasing competition in the e-Commerce market. China’s GDP only grew 4.7% in the second-quarter, below expectations of 5.1%, due to slowing consumer spending and a troubled property sector that has suffered due to excessive speculation in recent years.

Additionally, U.S. investors are scared to touch Chinese large-cap companies, in large part because Beijing has a history of involving itself in corporate affairs. Questions about the rule of law and corporate governance have overly negatively affected investor attitudes towards Chinese companies.

While those risks are not totally unjustified, e-Commerce growth in China is very cheap. China has the second-largest market by population size (after India) which obviously makes it an attractive long term e-Commerce growth play.

PDD Holdings is currently valued, despite a projected long term EPS growth rate of 36%, at a P/E ratio of only 8.8X… which is about 19% below the company’s longer term valuation average. I believe that Chinese e-Commerce platforms could at least trade at 10X FY 2025 earnings given their growth potential and generally positive gross profit momentum.

A 10X P/E ratio is likely a low estimate for PDD, given its stronger than average EPS growth. A 10X earnings multiplier also implies only 14% upside revaluation potential and a fair value of $150. In the longer term, I can see Pinduoduo revalue to a 12-13X P/E ratio — comparable to what I believe is reasonable for Alibaba, also because of its strong free cash flow — which implies a much higher fair value of $180-195.

Risks with PDD Holdings

The biggest risk for PDD Holdings is a sluggish recovery in China’s economy which may weigh on consumer spending and therefore on e-Commerce sales. This risk is partially offset by what I expect to be an aggressive roll-out of AI products that could help drive conversions and average order values. What would change my mind about Pinduoduo is if the e-Commerce company were to see negative gross profit momentum or declining free cash flow.

Final thoughts

There are lots of things to like about Pinduoduo, the owner of the widely popular Temu e-Commerce website. The company is generating very strong top line growth as its focus on discount and discovery-based shopping deals is paying off. Pinduoduo is also seeing positive gross profit momentum and could follow into the footsteps of Alibaba which is more heavily focused now on returning free cash flow to shareholders, mainly through its stock buyback plan. What I like most about Pinduoduo is that the e-Commerce company’s shares trade at a huge discount to fair value while PDD is expected to maintain considerable EPS growth momentum going forward. With a P/E ratio of 8.8X, stock buybacks would also make a ton of sense!

Read the full article here