By James Knightley

ISM services index suggests no immediate recession threat

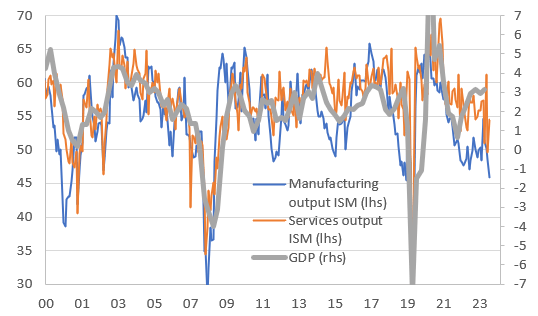

The US ISM non-manufacturing index has risen to 51.4 from 48.8, above the 51.0 consensus. New orders jumped to 52.4 from 47.3 while employment is back in growth territory at 51.1 from 46.1. The activity/production index is particularly strong at 54.5 versus 49.6 while prices paid rose to 57.0 from 56.3. As such this doesn’t fit the impending recession narrative that has gripped markets over the past couple of trading sessions and should go some way to diminishing the pricing of an inter-meeting rate cut. As the chart below shows, the output metrics imply a slowing, but not collapsing economy.

ISM output series point to weaker YoY% GDP growth ahead

Source: Macrobond, ING

Fed to cut rates more swiftly, but market pricing looks aggressive right now

In the wake of the ISM report, we have the market pricing 54bp of rate cuts by the September FOMC meeting, 92bp by November and 123bp by December. This had earlier been up above 60bp priced for September, implying a high chance of an inter-meeting rate cut, with 105bp priced for November and 138bp priced by December, so we have certainly seen some calm return. Chicago Fed President Austan Goolsbee, who is viewed as the most dovish FOMC member yet voted for no change last week, didn’t suggest any urgency to cut rates when he spoke on television earlier this morning and this ISM report also suggests no need for panic action.

After all, the economy grew at nearly an annualised 3% rate in the second quarter, is still adding jobs in July and inflation remains above target. There is the argument that momentum is waning and the Fed is switching from a focus on inflation to a focus on jobs, but unless there is financial system stress we don’t see the need for impending action and the Fed can indeed wait and watch the data flow before deciding what to do at the Septmber FOMC meeting. Equities are down heavily again today, but are still up year-to-date and the Fed will be strongly opposed to be seen to be bailing out risk-takers if there isn’t the pressing economic or financial system need.

We have long been on the more dovish end of forecasters, expecting the Fed to cut rates more quickly and aggressively than the market. Our most recent change in the spring was to scale back our view to a mere 75bp of cuts in the second half of the year given economic resilience, which appears to have been the wrong thing to do. Instead, we can see the Fed acquiescing to some of the market worries and implementing at least one, perhaps two 50bp moves to get them on track to moving policy to a more neutral footing quickly. At the moment, we are leaning in the direction of a 50bp in September followed by a series of 25bp moves that would get us back to a Fed funds rate of around 3% by next summer – broadly in line with the Fed’s “neutral” viewpoint. We will be releasing new updated global macro forecasts later this week.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Read the full article here