Stocks traded mixed Monday with time running out on the White House and House Republicans to reach an agreement to raise the U.S. debt ceiling.

These stocks were making moves Monday:

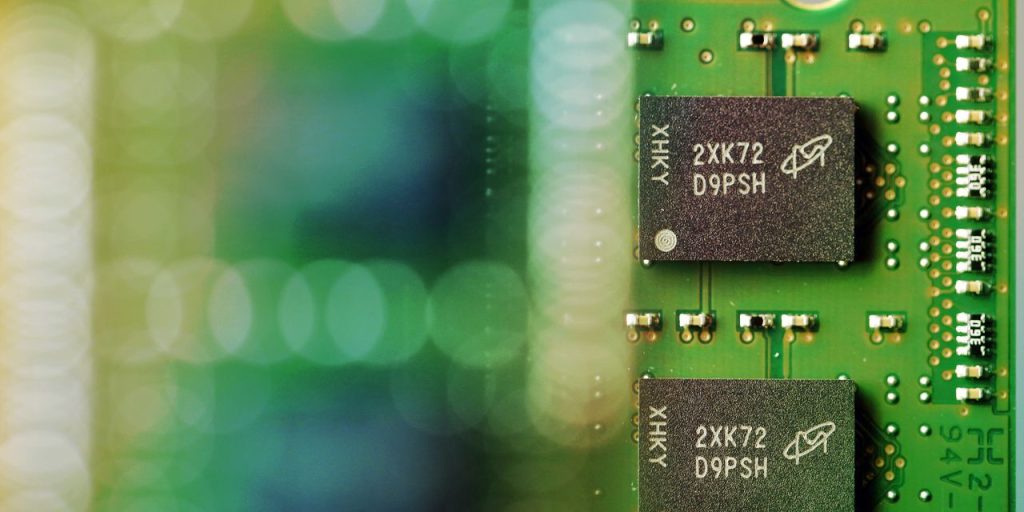

Micron Technology

(ticker: MU) declined 4.2% after Beijing banned companies involved in China’s critical information systems from buying chips from the U.S. chip maker, saying they posed a major national-security risk. China’s investigation into Micron was seen as retaliation for the U.S. reducing China’s access to key technology.

PDC Energy

(PDCE) shares rose 8.2% to $70.46 after it was announced that it would be acquired by

Chevron

(CVX) in an all-stock transaction valued at $6.3 billion, or $72 a share.

Chevron

stock lost 1%.

Meta Platforms

(META) was up 2.7% after the parent of Facebook was fined $1.3 billion by privacy regulators in the European Union for sending user information to the U.S. The fine is a record for the bloc, according to The Wall Street Journal. “We will appeal the ruling, including the unjustified and unnecessary fine, and seek a stay of the orders through the courts,”

Meta

said in a statement.

Swiss Biotech company

VectivBio

(VECT) soared 36% to $16.18. It will be acquired by gastrointestinal drugmaker

Ironwood Pharmaceutical

(IRWD) in an all-cash transaction for $17 a share.

Ironwood

shares shed 4.4%.

Plug Power

(PLUG) gained 7.5% after the hydrogen fuel-cell technology company announced three 5MW electrolyzer projects “for the first-ever use of industrial-scale green hydrogen in glass manufacturing, aluminum recycling, and steel manufacturing processes.”

Apple

(AAPL) lost 0.5% after the tech giant was downgraded to Hold from Buy by analysts at Loop Capital.

PacWest Bancorp

(PACW) shares were rising 9.7% after the regional lender said in a filing Monday it will sell a portfolio of 74 real estate construction loans with a total balance of about $2.6 billion.

DraftKings

(DKNG) was rising 6.4% after shares of the sports-betting company were upgraded to Buy from Neutral at

UBS.

Foot Locker

(FL) declined 4.6% to $28.83. The stock sank more than 27% on Friday after the footwear retailer slashed its earnings and sales guidance for the fiscal year. Williams Trading downgraded the stock to a Sell from Hold with a price target of $25, down from $38, the Fly reported.

Nike

(NKE) also was downgraded to Sell from Hold at Williams Trading. Nike was down 2.6% after tumbling 3.5% on Friday.

Full Truck Alliance

(YMM), the China-based digital freight company, reported fiscal first-quarter earnings and revenue that beat analysts’ estimates. American depositary receipts of

Full Truck Alliance

were falling 1.9%.

Albemarle

(ALB) was up 2.1% after the lithium miner said it would supply more than 100,000 metric tons of battery-grade lithium hydroxide that will be used to make about 3 million electric vehicle batteries for

Ford.

Write to Joe Woelfel at [email protected]

Read the full article here