Introduction

I have always been interested in the baby bonds of Sachem Capital (NYSE:SACH) as the debt securities offer a very interesting risk/reward ratio. While the total potential for capital gains is relatively limited (and included in the yield-to-maturity calculations of the debt securities), I’d rather be a creditor than a shareholder or even a preferred shareholder of Sachem. As it has been a while since I had a look at Sachem Capital, I wanted to have a closer look at its recent performance to see if I would have to add to my baby bond positions which have been under pressure due to increasing interest rates in the financial markets.

Seeking Alpha

The situation remains under control in the first quarter of the year

In this article I will mainly focus on the company’s recent performance, and for a better understanding of the business model I’d like to refer you to my older articles or this more recent article from Preferred Stock Trader.

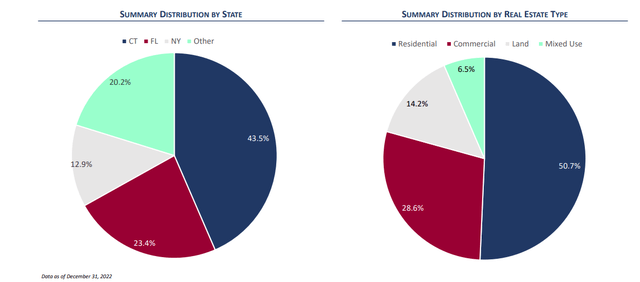

Sachem Investor Relations

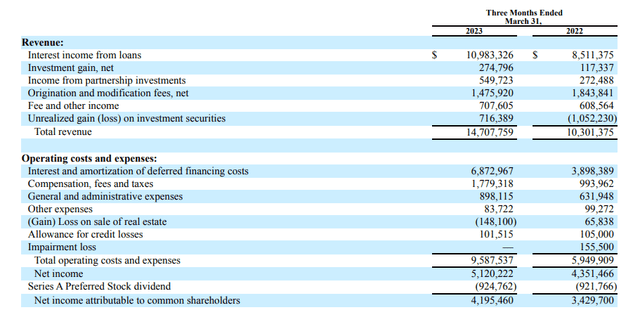

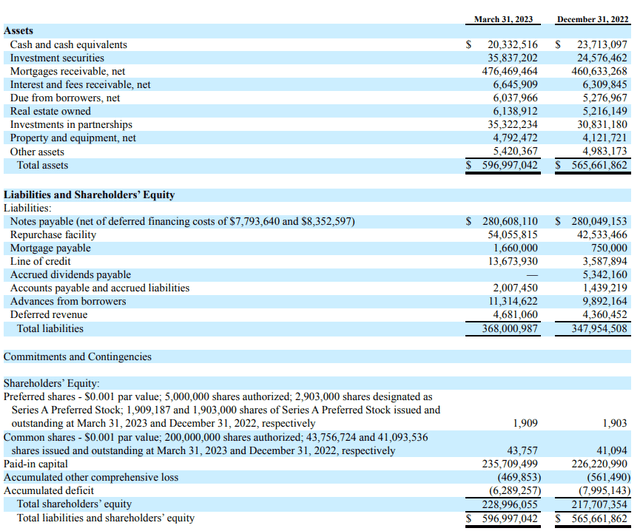

During the first quarter of this year, Sachem reported a total interest income of almost $11M but this was of course entirely mitigated by higher interest expenses as well as the REIT’s balance sheet (Sachem Capital Corp. fulfills the REIT requirements) expanded from $482M in assets as of the end of Q1 2022 and $566M as of the end of FY 2022 to almost $600M as of the end of the first quarter. While the cost of debt on the baby bonds is fixed, Sachem also tapped into its line of credit which has a higher cost of debt these days.

Sachem Investor Relations

The total revenue of the REIT came in at $14.7M while the total operating costs and expenses increased to almost $9.6M despite the $150,000 gain on the sale of real estate and recording just over $100,000 in loan loss provisions. And as you notice above, the vast majority of the operating expenses (in excess of 70%) consist of interest expenses, including the interest payments on the baby bonds.

The REIT reported a net income of $5.1M but still had to pay just over $0.9M in preferred dividends, resulting in a net income of $4.2M attributable to its common shareholders. That’s an EPS of $0.10 which means the current quarterly dividend of $0.13 isn’t covered.

I still prefer to be a creditor than a shareholder

That’s too bad for the common shareholders although a cut to a quarterly dividend of, say, $0.08, would still result in a 10% yield, but the payments on all securities senior to the common shares are well covered. The preferred dividends also are still well covered as the REIT needs to spend less than 20% of its net income on covering the preferred dividends. Those preferred shares, trading with (NYSE:SACH.PA) as ticker symbol closed at $19.30 last Friday resulting in a dividend yield of 10%.

While that does sound appealing, I’m not sure why I would want to choose being a preferred shareholder rather than being a creditor (unless, of course, you’d want to bet on the preferred shares being called in 2026).

I own several series of the baby bonds, and my largest position is the 8% note due in 2027 trading with (NYSE:SCCG) as its ticker symbol. This was a relatively small issue ($40.25M) and mature on Sept. 30, 2027, (so in four years and four months from now). This issue was trading at $21.18 at the closing bell last Friday, resulting in a yield to maturity of just over 12.5%. And that’s why I’m not interested in buying a 10% yielding preferred security if I can buy a four-year bond – which per definition is a safer security as it ranks senior to any equity, including preferred equity – with a YTM of 12.5%. Even the SACC baby bond with a coupon of 6.875% and maturing in December 2024 currently offers a yield to maturity of in excess of 11%. So, I agree with the thesis of Preferred Stock Trader. It makes sense to rotate from the preferred shares to the baby bonds.

The income statement made it very clear the interest expenses were well-covered, and looking at the balance sheet, I like the $229M in equity on the balance sheet, which ranks junior to any debt.

As you can see below, Sachem has about $20.3M in cash and $36M in investment securities and that $56M would be sufficient to cover almost all of the non-baby bond debt (the credit facility and mortgage will rank senior to the baby bonds).

Sachem Investor Relations

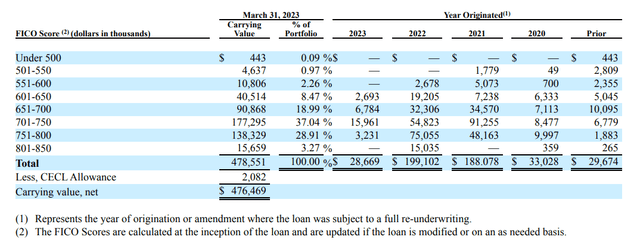

Of course the main question in Sachem’s case is being sure that the $476M in mortgages receivable are in good standing, or have plenty of collateral against it. At the end of March, Sachem had 406 mortgage loans and approximately 128 of them for a total of $81.4M have matured but have not been repaid in full. Those loans are in the process of being modified and will likely be re-underwritten based on new terms. In total, 52 loans soured and Sachem initiated foreclosure proceedings and the company made it clear it believes the value of the collateral exceeds the outstanding balance on the loan. That’s reassuring, and while it will take time to dispose of the assets, it does indicate the total value of the mortgages receivable appears to be reliable.

Also keep in mind Sachem has been trying to reduce the risk as much as possible by requiring personal guarantees and the loans are typically cross-collateralized. Sachem now also disclosed the FICO scores of the borrowers and almost 70% of the loans were issued to borrowers with a FICO score of in excess of 700.

Sachem Investor Relations

Investment thesis

On the conference call, Sachem’s management indicated it was focusing on quality when it underwrites new loans and most originations during the first quarter carried gross returns of in excess of 15% so we should see an uptick in the interest income in the second quarter of this year. Additionally, Sachem will continue to focus on residential and multi-family loans.

It does look like the average loan term will become longer as Sachem’s fix-and-flip lending usually saw the borrowers refinance the loans using mortgages provided by banks within about a year, but as banks are getting more strict with underwriting requirements, the rotation within the portfolio will likely be slower this year.

The next few quarters will be very interesting and I think a dividend cut may be unavoidable on the common shares (unless the interest income picks up faster than expected), but I’m not worried about the baby bonds. The preferred equity also is in a good shape but the returns are higher on the baby bonds – which also are safer as they are obviously senior to preferred equity. Additionally, Sachem has been using its ATM facility and has been selling new common shares on the open market. Adding more common equity to the balance sheet is positive for both the baby bonds as well as the preferred shares.

That being said, even the common shares of Sachem Capital could become interesting down here (as the book value per share exceeded $4 as of the end of Q1), as long as investors are aware a dividend cut is likely. I currently have no position in Sachem’s common shares and only own some baby bonds, of which SCCG is my largest position.

Read the full article here