The oft delayed AR/VR device from Apple Inc. (NASDAQ:AAPL) appears set to finally launch in the next few weeks. The tech giant is expected to finally release the mixed reality headset at the Worldwide Developers Conference (“WWDC”) in a few weeks following a period of apparently limited focus from executives. My investment thesis remains ultra Bearish on Apple stock, priced for perfection while the one product that could justify this current price crawls towards the finish line.

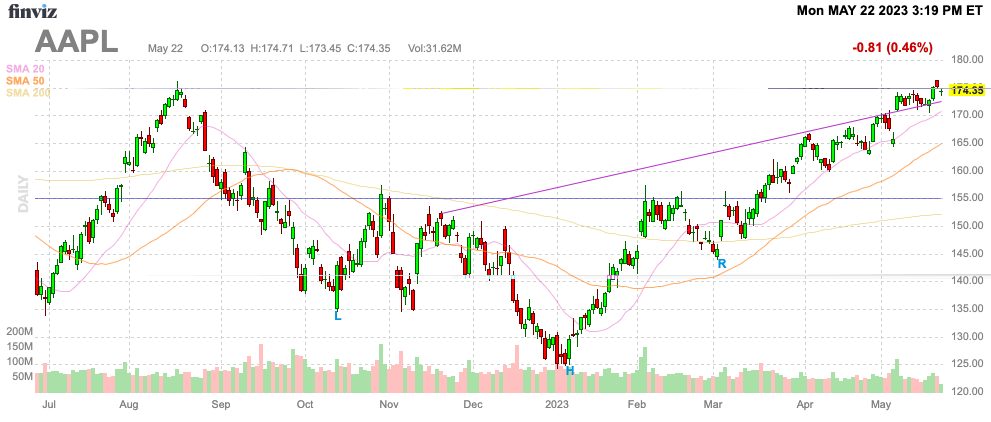

Source: Finviz

Tim Cook’s Legacy Product

Apple CEO Tim Cook turns 63 on November 1. The executive possibly won’t be in charge of the tech giant when the next large product category is released – the potential Apple Car in 2026 or beyond – making the AR/VR device part of his legacy.

The CEO had an initial goal of a smart glasses-type device consumers could wear all day similar to eyeglasses. The device would handle daily functions like emailing, playing games etc., but Bloomberg Tech reported that Tim Cook and other executives have become less involved in the product due to the device shifting more towards AR devices similar to competitors like the Quest Pro from Meta Platforms, Inc. (META).

The product has routinely been delayed over the last few years, with the blame apparently linked to a lack of leadership from Cook and other executives like senior Vice President for hardware technologies Johny Srouji. Mr. Srouji apparently didn’t want to divert high-performing chip development assets away from the iPhone. The AR/VR device has been in development since at least 2015, with an expected announcement of a product that now hardly innovates from current devices on the market.

According to Bloomberg Tech, the headset projections have now scaled back to less than 1 million units, down from an original plan for 3 million units. The ultimate goal is for the AR/VR device to match the iPad and Apple Watch with $25 billion in annual sales, but the estimated $3,000 device now won’t even top $3 billion in sales for FY25.

The device won’t be announced until June 5 at WWDC, at the earliest, with a launch likely at the start of FY25. Our dead money article from March 2022 had forecast how crucial sales of new products would fail to meet aggressive projections and this is playing out right now.

Some of the amazing data points are the plans of Apple to only sell the product at cost, so the tech giant won’t even make a gross profit on these devices. Even worse, the battery pack will apparently reside in a user’s pocket with a power cord attached in a less than appealing design shift from the original concepts of Tim Cook.

Influential Apple analyst Ming-Chi Kuo had already warned of the delay until the WWDC with limited units sold in 2023. The tech giant was wisely pushing back on the product release due to worries over market feedback, considering the Reality device apparently is tethered to a battery pack.

A big problem here is Apple lacking a roadmap to the next device and the eventual smart glasses that fit the original goal of Tim Cook. The clear lack of involvement by executives in the product development of the AR/VR devices appears to be a main contributor in the product delays with the smart glasses development virtually stopped now.

On the flip side, our previous research highlighted the well-outlined device roadmap from Meta Platforms. In addition, CEO Mark Zuckerberg has constantly pushed a Metaverse view, and quarterly investment in the billions while Apple is only purportedly spending $1 billion on the product of the future.

Michael Gartenberg, former Apple marketing executive may have summed up the issue with the product release as follows (emphasis added):

one of the great tech flops of all time… I suspect there’s a lot of internal pressure for the next big thing.

The former executive went on to provide the following expanded view to Insider:

Apple builds devices that can be sold in the millions with a solid profit margin, not high cost ‘experiments’ to be unveiled in public and sold to developers or enthusiasts with deep pockets. This is a doomed model that Google tried with Glass & Microsoft with HoloLens.

All signs are pointing towards Mr. Gartenberg being correct and Apple having to explain why this AR/VR product was even released after so many delays.

Not Priced For Failure

Our negative view on Apple stock has constantly harped on this disconnect with the stock market. Apple is struggling with product development in areas such as AR/VR and the future Apple Car that are needed to drive earnings growth in the years ahead.

Loop Capital just came out with a downgrade of Apple to a Hold based on downside risk on iPhone shipments. The tech giant is already forecast to watch FQ3’23 sales to fall ~2%, and now analyst Ananda Baruah sees risks out for the next couple of quarters.

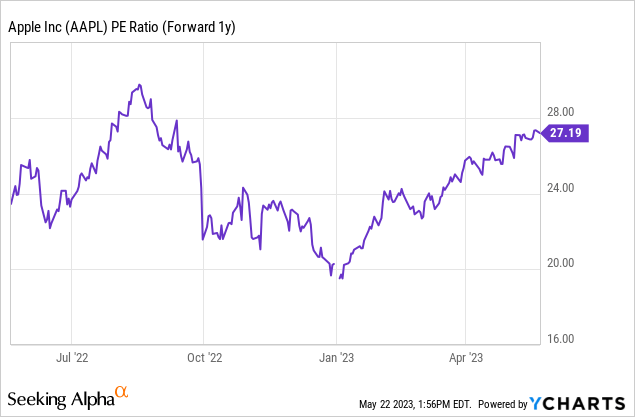

The crazy part is the decision to leave the price target at $180. Apple trades near all-time highs and is valued at 27x forward EPS estimates, which is not a valuation where growth questions should exist.

The analyst community remains content to leave the stock propped up while not actually having bullish views. The average analyst price target is only $179 now, leaving meager upside of just 3%.

Takeaway

The key investor takeaway is that investors really have no reason to be so bullish on Apple Inc. stock. The company could deliver a flop with the launch of an AR/VR device in a few weeks, which could alter the view of AAPL stock going forward.

Apple Inc. investors should use the stock trading at all-time highs as another opportunity to unload the stock.

Read the full article here