Investment Thesis

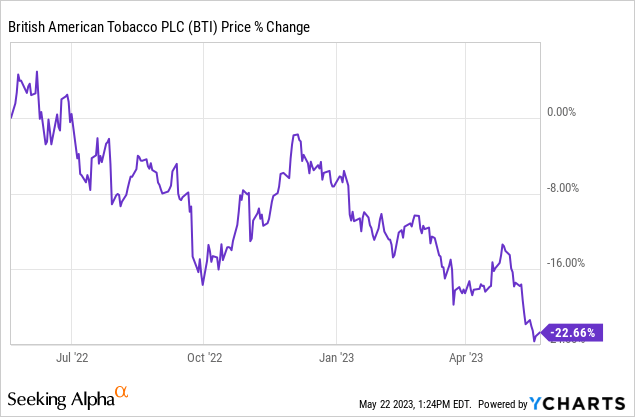

British American Tobacco (NYSE:BTI) has dropped another 16% since my last coverage in January, as investors continue to worry about the declining smoking rates and combustibles volume. While combustible products are expected to be weak, most investors seem to be overlooking the company’s pricing power and its significant progress in the RRP (reduced-risk product) segment.

I believe overall revenue can continue to rise even with the ongoing drop in combustible volume, which I will elaborate more on later. A lot of investors are also unaware of the company’s massive stake in ITC, which could unlock substantial shareholder value moving forward. With such a compressed valuation, I believe BTI stock has meaningful upside potential and I am reiterating my buy rating on the company.

Debunking The Unwarranted Fear Of Declining Combustibles Volume

Most skepticism in regard to British American Tobacco has been about its slowing combustible segment, as volume continues to decline amid tighter regulations across the globe. According to the CDC (Centers for Disease Control and Prevention), the smoking rate in the US recently reached its lowest level in nearly 60 years. There is no denying that the volume of combustible products should continue to slow, but this also does not mean the revenue of British American Tobacco will decline either.

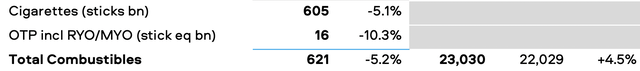

During FY22, combustibles revenue accounted for roughly 85% of total revenue, but this will likely change in the coming years due to the emergence of RRPs. Before I go into RRP, I want to talk a bit more about the resistance of the combustible segment, as I believe a lot of investors are overlooking the pricing power of traditional combustible products. While their volume dropped by 5.2% in FY22, the segment’s revenue actually grew by 4.5%. Given the addictiveness of these products, ongoing price increases should be sustainable and should help offset the weakness in volume.

British American Tobacco

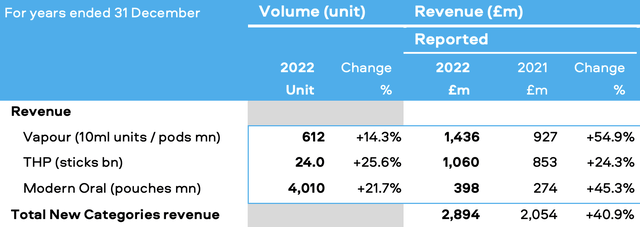

While the non-combustible segment (comprised of traditional oral products and RRPs) only accounts for around 15% of total revenue, I believe it should be the main emphasis of the company moving forward. Altria’s (MO) hefty $2.8 billion acquisition of NJOY in March clearly demonstrates the importance and value of RRPs in the current environment.

For instance, British American Tobacco’s RRP segment grew revenue by 40.9% in FY22, with overall volume up over 20%. As mentioned in my previous article, the market for vapor, heated tobacco, and nicotine pouches is forecasted to grow at a CAGR (compounded annual growth rate) north of 30%. The market expansion should continue to support the exponential growth of the RRP segment.

British American Tobacco

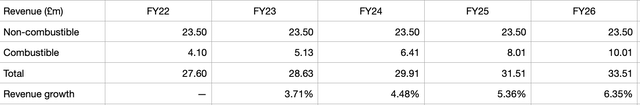

Based on the backdrop discussed above, I made a projection of British American Tobacco’s potential growth trajectory for the coming few years. I expect revenue from the combustible segment to be flat, with consistent price increases (5% to 10% annually) offsetting the ongoing decline in volume (~5% annually). This estimate is pretty conservative as pricing outpaced volume by 970 basis points in FY22, and the company themselves expect global combustible volume to be down only 2% for FY23. I expect the revenue from the non-combustible segment to grow at a CAGR of 25%, which is also very conservative when considering the market’s CAGR north of 30%.

From the chart below, you can see that these assumptions translate to a mid-single-digit revenue CAGR from FY22 to FY26 (on a constant currency basis) even with combustibles volume dropping 5% a year. If the non-combustible segment is able to post a 30% CAGR (the same as the market’s growth), the overall revenue growth rate could increase by another 100-150 basis points each year. The segment should also have a much stronger presence by then, accounting for roughly 31% of total revenue. I understand investors’ worry about the projected decline in combustible volume but I think the recent fear is largely exaggerated.

Author’s Projection

The Massive Stake In ITC Could Unlock Immense Shareholder Value

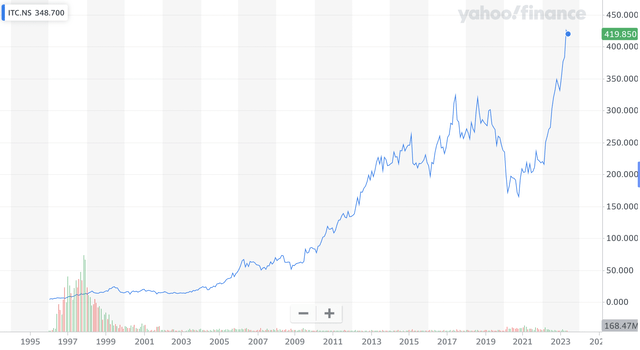

A lot of investors may not be aware, but British American Tobacco actually has a notable 29.1% ownership in ITC Limited, an Indian conglomerate company engaged in packaged food, hotels, and other industries. The stake is now becoming increasingly important as the company’s share price continues to drop while ITC’ continues to grow. The NSE-listed company has been rising steadily in the past decade and its market cap is now standing at RS 5.22 trillion, or $62.9 billion in dollars term. This makes British American Tobacco’s stake worth a massive $18.3 billion, or 22.5% of its current market cap.

I believe this stake could end up being an unprecedented game-changer as it gives the company a lot more financial flexibility. If they sell their whole ownership (which is likely given the attractive incentives), they can use the proceeds to pay down nearly half of their outstanding debt or buy back a quarter of their outstanding shares, which should unlock immense shareholder value given the compressed valuation at the moment.

Share Price Of IDC (Yahoo Finance)

Investors’ Takeaway

While there is a lot of pessimism surrounding British American Tobacco’s future, the facts and numbers are painting another story. Considering the company’s upbeat RRP growth, deleveraged balance sheet, and improved profitability, Fitch Ratings recently revised the company’s outlook to positive with a rating of “BBB”, which further validates its solid fundamentals.

The company’s mid-single-digit revenue CAGR alongside the improving profitability of the RRP segment should translate to a high-single-digit EPS CAGR for the coming few years. This also excludes the impact of any potential share buyback, which could further boost EPS growth especially if they decide to sell their ITC stake. The company’s current FCF yield is roughly 15%, which is the highest in the past decade and this does not even account for the potential return from the expansion in valuation. With an fwd EV/EBITDA of just 7.6x, I believe the current price should present an ample margin of safety with meaningful upside potential.

Read the full article here