“ Too much U.S. wealth creation in the technology sector has been in chip design, software and social media. ”

President Joe Biden’s industrial policies aim to make America a world leader in semiconductor manufacturing, but the effort could do more harm than good.

Post-World War II U.S. foreign-trade policies promoted trade based on comparative advantages, but too often America’s trading partners put up import barriers and subsidized domestic industries in areas where the U.S. had technological strength. Examples include commercial aircraft in Europe, solar panels and windmills in China and semiconductors in Taiwan and China.

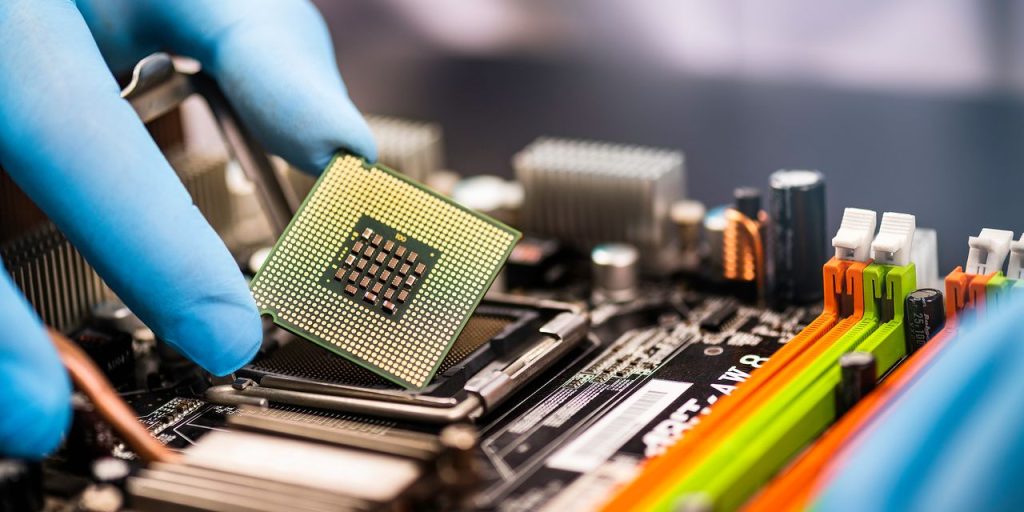

In the 1960s, the United States pioneered the modern semiconductor industry, but now 92% of leading edge chips are made in Taiwan. This creates a critical vulnerability in the event of war with China; semiconductors are an intense focus of President Xi Jinping’s efforts to make China a economic and military superpower.

In recent decades too much U.S. wealth creation in the technology sector has been in chip design, software and social media. Those don’t spawn the kind of broad-based opportunities for ordinary working Americans that actual manufacturing once did in the Midwest.

Chips and dips

The U.S. Chips and Science Act target semiconductor fabrication, EVs and batteries, artificial intelligence and advanced computing and green industries including hydrogen, wind power and solar generation.

The Act seeks to create two geographically compact centers to produce the most-advanced semiconductors, high-demand prior-generation logic chips and DRAMS and the packaging of microprocessors for application in other industries. Firms will be supported through direct subsidies, tax breaks and loans.

Currently, technology hardware attracts just 3% of U.S. venture capital — down from 20% in 2005. The Biden program seeks to reverse that trend and leverage $50 billion in public investments into at least $500 billion in new capital to support semiconductor and related manufacturing and R&D.

“ The hollowing out of U.S. manufacturing has discouraged engineering and plant design skills. ”

It’s a steep climb because the hollowing out of U.S. manufacturing has discouraged engineering and plant design skills. Since the Global Financial Crisis, few manufacturers have built large new factories. Goldman Sachs estimates production costs for a semiconductor fab are 44% percent higher in the U.S. than in Taiwan — about half from higher construction costs and half from operational disadvantages.

The U.S. costs involve myriad environment assessments, permitting procedures, community engagement requirements, mandates to employ union labor, NIMBY abuse of litigation to delay projects and so forth that, for example, make constructing a new subway station in New York City three times as expensive as in Paris.

On top of all these disadvantages, the U.S. Commerce Department will require firms seeking assistance to provide childcare, negotiate project labor agreements, invest in K-12 and higher education, set aside employment and training opportunities for women and minorities and serve other social justice initiatives. State and local governments will have their own social objectives too.

These mandates will also discourage firms from implementing stock buyback programs, even though these are often the principal means high-tech firms reward investors. Moreover, the program requires profit-sharing with the government if projects prove more successful than expected.

Whatever the validity of these goals, these requirements will more likely increase rather than reduce the 44% U.S. cost disadvantage in semiconductor fabrication. Commercial viability without subsidies could become a distant promise.

The attendant compliance bureaucracy will make the building of Manhattan’s Second Avenue Subway look like a cakewalk as compared to erecting a fab under the administrative guidance of the Commerce Department and progressive social engineers.

Federal aid will be awarded to firms through competitive bidding and weight will be assigned to commitments to engage local communities — for example, to provide childcare, improve education at all levels and accomplish the administration’s social just agenda.

Programs that target minorities would leave participating firms vulnerable to federal discrimination law suits, and as with some COVID assistance programs, some businesses that might otherwise consider the program may refuse to participate.

“ The U.S. has competition. The EU is attempting to match the Chips Act. China is spending $150 billion to boost semiconductor production.”

Moreover, the U.S. has competition. Intel

INTC,

has received $7.2 billion from the German government to put up a single fab, and the EU is attempting to match the Chips Act. China is spending $150 billion to boost semiconductor production.

Read: Biden must bring America’s ‘cold war’ with China to an end

House Republicans propose cutting spending on the social initiatives in the infrastructure and industrial policy programs passed by the prior Democratic congress.

Biden would do well to begrudgingly accept those as part of a bargain to raise the debt ceiling. In addition to the money directly saved, this would reduce the vast bureaucratic morass and inefficiencies that stand in the way of the Chips and Science Act achieving its goals.

Peter Morici is an economist and emeritus business professor at the University of Maryland, and a national columnist.

More: Globalization isn’t dead — it’s regrouping to confront threats from China and Russia

Also read: ‘Putting the Treasury on the brink of default is about as dumb as politics gets’

Read the full article here